3rd Worst Santa Claus Rally Since 1950: Reason For Concern?

With the markets posting another year of solid gains, many investors relaxed heading into December. After all, the setup for December seemed to be 'piece of...

Will The Gold To Silver Ratio Peak In 2015?

Both Gold and Silver have been under selling pressure for a majority of the past few years. However, last year silver prices were hit...

German DAX: Index At Critical Technical Resistance

European equities underperformed US equities in 2014. And much of that had to do with economic woes and deflation concerns. Will this continue into...

Bank Stocks: Near ‘Make It Or Break It’ Point In 2015

It’s a known saying around Wall Street that “as the banks goes, so does the market.” The banks/financials lead the market up when it...

Apple Stock Pullback: Price Targets And Levels To Watch

The two day selloff has put several stocks on notice. Right now, active investors should be doing two things: managing risk and preparing for...

USDJPY: Will This Reversal Pattern Trigger A Pullback?

The USDJPY currency pair has been a great momentum play for currency traders over the past 2 years, as it has risen from the...

Gauging The Stock Market Into 2015: A Look At The Technicals

Since Q1 2009 the stock market has, to say the least, been on an absolute rip higher! Will this continue into 2015? Personally, I...

Nikkei 225: Is The Hottest Equity Market About To Cool Off?

The past 2 years have been red-hot for Japanese equities. The best gauge of the Japanese stock market is the Nikkei 225 Index. And...

Why IBM Stock May Reverse Higher In 2015

It's been a tough couple of years for International Business Machines (IBM) investors, as the stock has struggled to find a bottom. And it's...

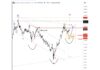

Gold Futures Update: Choppy With 1033.40 Target Still Valid

The past two months have seen Gold prices trade in a range of $1130-$1230. And after slipping a bit this morning on a Greek...