Bearish at the Bottom: Why Institutions Are Wrong On Crude Oil

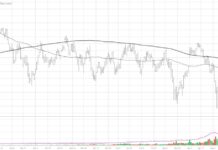

Crude Oil Futures

On June 12th, Goldman Sachs came out with this:

Goldman Sachs has slashed its forecast for oil prices by nearly 10%, citing weak demand in...

US Oil Fund ETF (USO): Technical and Fundamental Analysis

USO, US Oil Fund the ETF, invests primarily in futures contracts for light, sweet crude oil, other types of crude oil, diesel-heating oil, gasoline,...

Is Crude Oil About To Send An Important Global Message?

The past 12 years have seen some really big swings in the price of crude oil. And the latest swing higher into 2022 played...

Another Market Collapsing

The real reaction to Wednesday’s Federal Reserve meeting is likely to happen Thursday.

All eyes and ears were on Chairman Jerome Powell today. Most notable...

Crude Oil At Crossroads, Next Move To Impact Inflation

Inflation concerns peaked last year when agriculture and oil prices peaked.

This year has seen inflation fears subside as key price inputs fall.

BUT investors should...

New Treasury Bonds Bull Market? Don’t Bet On It

Persistent inflation has dogged the Federal Reserve for the past 12-18 months, leading to higher interest rates.

But rates have fallen more recently as investors...

Energy Sector Gathers Tailwinds, Looks Ready To Rally

Crude oil in the $60s looks like a gift. War abroad, OPEC talking tough, summer driving season approaching.

Oil prices are turning higher and, IF...

Natural Gas Price Bottom? Let’s Review The Measured Move Setup

Recently I posted the “measured move” on the Continuous Contract for Natural Gas Futures from a monthly scale. Here is the link.

In my opinion, Measured...

What’s Up With Oil and Energy? (Sector and Stocks Update)

After the CORE PCE numbers came out on Friday, the market had the expected reaction of selling off in anticipation of a more aggressive...

Is Inflation Cooling, or Set to Reignite?

This past week, I got to talk a lot about inflation, something many have thrown in the towel about. But not us!

I sat down...