Will Nasdaq 100 Equal Weight Index Continue Under-Performing?

When analyzing the stock market's health & balance, investors have several unique indicators at their disposal. One indicator that I like to look at...

Inflation, Soft Landing, January Trends Working Out (Trading Update)

Bank stocks announced strong earnings yet again, sending the Financial Sector ETF (NYSEARCA: XLF) and the Regional Banking ETF (NYSEARCA: KRE) higher on Wednesday....

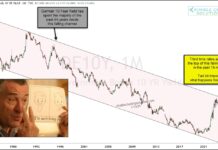

Are German Government Bond Yields Changing 44 Year Trend?

Interest rates continue to dominate our recent research. And rightfully so. Big swings in interest rates have ramifications for the domestic and global economy.

Whether...

30-Year Treasury Bond Yields Targeting 6.5% or Higher?

In just 4 years, the trend (and investment theme) of low interest rates has been turned on its head.

During this time, home and auto...

NASDAQ Joins Stock Indices in Confirmed Caution Phase

What is a confirmed Caution Phase?

Some of you might know it as a warning phase.

Simply put, it is when the 50-DMA remains above the...

Chinese Bond Yields Collapse; U.S., German Yields Breaking Out?

There are a lot of moving parts across the global economy.

From commodity prices to employment data to bond yields, investors pay attention.

Today we look...

Key Stock Market ETFs Start 2025 With Cautious Patterns

I hope everyone had a wonderful holiday and has a very happy and successful New Year.

I spent time with my family and of course...

Russell 2000 At Important Risk-On vs Risk-Off Crossroads!

The stock market has been charging higher into year end. Then came the FED interest rate decision and comments.

But a even a couple weeks...

Will the Nasdaq 100 (QQQ) Sell Off in January 2025?

In today’s video, we explore potential scenarios for the Nasdaq 100 ETF (NASDAQ:QQQ) through January 2025. While seasonal strength often boosts year-end performance, results...

Will 2025 Be Bullish For International Equities?

International equities have posted some excellent returns in 2024. But with such U.S. dominance, do many people know?

The allocation decision for many investors to...