Here’s Why Commodities Are Ready For A Big Move

The commodity complex has been caught in a decline for the past several years.

Now that doesn't mean that there haven't been trading opportunities in...

Stock Market Today: Bears Kick Up Some Dust

Stock market volatility is picking up as we head deeper into the month of May.

A few twists and turns have arisen with the US-China...

Gold Investors Reach Crossroads Into Federal Reserve Statement

Gold began 2019 with a head of steam.

Gold investors had hopes of tailwinds coming from a soft US Dollar and potential rising rates environment...

Gold Bulls Don’t Want To See Australian Dollar (AUDUSD) Break-Down

When the Australian Dollar (AUDUSD) heads higher, it is good for gold bulls, precious metals investors, and commodities in general.

Unfortunately, the Australian Dollar -...

U.S. Stocks Hit Record Highs As Market Trend Remains Bullish

The S&P 500 (NYSEARCA: SPY) finished higher by 0.88% and achieved an all-time closing high.

All major U.S. equity indices have strongly bullish intermediate postures...

What Is Silver to Gold Ratio Saying About Precious Metals and Inflation?

Before we get into the chart and subject of today’s column, the silver to gold ratio, let’s do a quick recap of the financial...

Is Silver / Gold Price Ratio Creating Historic Bullish Reversal?

For most investors familiar with precious metals, it's a great sign when silver out-performs gold.

It's kind of like the old market analogy that it's...

Stock Market Futures Update: Bull-Bear Battle at Resistance

Buyers and sellers are doing battle at key stock market resistance price areas.

This comes as S&P 500 futures (ES_F), Dow Jones futures (YM_F) and...

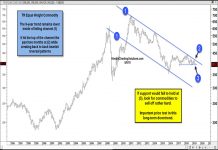

Silver Bear Market Faces Big Price Support Test!

When silver, gold, and the precious metals industry were on red-hot bullish in the 2000's, investors could do no wrong.

You could buy silver at...

S&P 500 Trading Outlook: Bearish, But Look For Buying Opportunities

S&P 500 Index Trading Outlook (3-5 Days): Bearish

Reversal happened on cue- Stocks likely begin 3-5 day pullback. Maximum weakness down to 2785-2800 in all likelihood.

S&P...