Commodities ETF Forms Wedge Pattern, Big Move Coming?

Commodities came into March like a lion and went out like a lamb.

Even so, the price of several commodities remains elevated and pressuring an...

If Australian Dollar Breaks Out, Commodities May Scream Higher!

Over the past 11 years, the Australian Dollar has been in a downtrend. Today's chart highlights its falling channel marked by each (1).

Could we...

What To Make Of Commodities Reversals

Tuesday, many commodity ETFs gapped lower while the major indices gapped up.

Additionally, the Russell 2000 (IWM) finally cleared its pivotal price level at $209.

However,...

Is Crude Oil Creating Historic Bearish Price Reversal?

The Ides of March are in full effect. Investors have been rocked by war, inflation, and financial markets volatility.

At the center of all of...

Crude Oil Price Peak? Elliott Wave Points To Correction

What can you do when the market goes hard against the trade you just entered? Here we revisit our February post about crude oil futures (symbol...

Is Copper Repeating Historic Double Top Price Pattern?

Copper is among several commodities with elevated prices right now.

It has also formed an important price pattern that may send one of the strongest...

Crude Oil Likely To Hit $127 After A Brief Pause

After a steep pullback, crude oil prices have reversed higher. I highlighted this bullish reversal in a research note here on See It Market...

US Dollar Rally Reaches Pivotal Long-Term Resistance!

Six years ago, the Economist magazine illustrated the mighty US Dollar. And that marked a peak that has since been tested but not broken out...

Are Steel Prices On Cusp of a Major Breakout?

Over the past several months, we've shared a lot of commodities charts and highlighted the economic theme of inflation.

Well, inflation is here. Now...

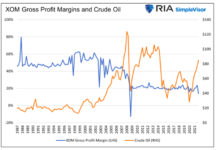

Big Oil and The Fallacy of a Windfall Profits Tax

Higher energy prices worrying you? Be afraid because Congress is coming to the rescue. Legislators are introducing a new bill called the “Big Oil...