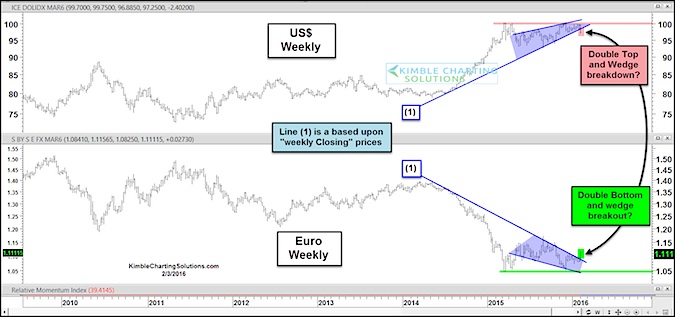

Euro Currency Breakout Has Major Implications For Markets

For much of the past several months, the Euro has been trading in the gutter. It was written off for dead and King Dollar...

Cocoa Futures Setting Up For A Tactical Bounce Higher

If you're on the sidelines in the equity market, or don't necessarily have much conviction long or short at current levels, Cocoa futures may...

Crude Oil Futures Rally After Rout; S&P 500 Futures Struggle

Steep reversals yesterday and a test of lower support levels on the S&P 500 futures charts leave stocks somewhat vulnerable to selling this morning....

Where Is The Crude Oil Rally Headed Next?

Crude oil futures are volatile enough on a normal day, but with rumors of a Russia/OPEC February meeting to discuss production cuts, it’s really volatile...

Have Gasoline Prices Bottomed? Watch This Chart Pattern

Over the past 18 months or so, investors have seen the energy market implode. Gasoline futures have correlated pretty well with Crude Oil in...

Copper Chart: A Critical Test Is At Hand For Dr. Copper!

Dr. Copper has often been pointed to as a barometer of global economic activity. If that's the case, then investors are right to be...

A Bottom In Oil Prices But Perhaps Not “The” Bottom

With oil prices bouncing nearly 20% off of last Wednesday's lows, many are once again asking whether or not the bottom in Oil is...

Following The Energy Sector (XLE) With Ratio Analysis

I want to take a moment to share a few charts that followed the Energy Sector's ($XLE) decline and seemed to highlight where the...

Crude Oil Declines Into Major Fibonacci Price Target, Rallies

Crude oil futures prices dipped below $27 per barrel last week before recovering with a late week rally that recaptured the psychological level of $30.

That...

Crude Oil Prices Reverse Course: Is A Bottom Taking Shape?

The waterfall in crude oil prices has been relentless. Oil prices have declined by the largest amount over an 18 month period ever. Wow,...