Investing In Commodities and Stores of Value

For today, I used ChatGPT to ask which companies store raw materials.

After all, you cannot have capital investing in infrastructure without raw materials.

You cannot...

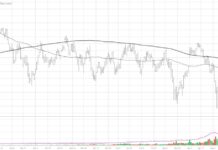

US Dollar Deja Vu? Repeating Bearish Pattern In Play!

Recent weakness in the US Dollar has helped to propel commodities such as Gold and Silver higher.

Today's analysis showing a potential repeating pattern that...

Is Inflation Permanently “Dissed”?

I wish I could say that the clearly impressive trend from peak until now in CPI and PPI is sustainable.

However, I am more inclined...

US Dollar To See Further Weakness? Gold Bulls Hope So!

After peaking in 2022, the US Dollar Index has spent nearly a year in decline.

But it may be set to fall even further. And...

Gold Miners ETF Breaking Out of Bullish Falling Wedge Pattern!

The precious metals complex may be ending a 2 month pullback / consolidation pattern.

And perhaps in grand fashion!

With Gold and Silver prices bouncing off...

$WEAT Wheat ETF (and inflation) Down But Not Out As Ukraine War Escalates

Investors and economists are getting awfully complacent about inflation, in my opinion. They seem to think that an escalating international war that we are...

U.S. Oil Reserves Drop to 40 Year Lows

On June 12th, Goldman Sachs came out stating how bearish they are on oil.

I wrote a Daily about it on June 20th:

Bearish at the Bottom-Institutions...

What A Healthy Correction in Energy Stocks Looks Like

An interesting article based on cycles and commodities versus stocks suggests that over the past 90 years, stocks have outperformed commodities by 4 to...

Gold Trading “Refresh” Nearing The Buy Zone?

Gold prices took a 3rd run at new highs and fizzled out again. Looks like it may take a 4th attempt.

Earlier this month, I...

Bearish at the Bottom: Why Institutions Are Wrong On Crude Oil

Crude Oil Futures

On June 12th, Goldman Sachs came out with this:

Goldman Sachs has slashed its forecast for oil prices by nearly 10%, citing weak demand in...