Is German 10-Year Bond Yield Nearing Historic Breakout?

Government bond yields and interest rates have been rising all around the world. And investors aren't quite sure what to make of it.

Perhaps there...

Why Active Investors Should Follow Junk Bonds

Bonds issued by companies with a credit rating of BB or lower by S&P or Fitch, or Ba or lower by Moody's, are considered junk...

Treasury Bonds Nearing “Bounce” Buying Opportunity (Elliott Wave)

If you made use of the Elliott wave support area we identified in our October post, then you probably caught a good trade in treasury...

Is Largest Rally In 10 Year US Treasury Bond Yield History Nearing End?

US Treasury bond yields have been moving higher for the past 4 years.

Furthermore, the rally marks the largest 200 week rally in 10-year yield...

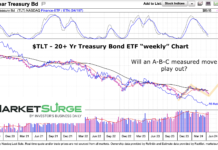

Are Treasury Bonds Ready To Follow A-B-C Correction Pattern?

The treasury bond market continues to captivate the minds of active investors as the focus on interest rates (and the Federal Reserve) continues.

If bonds...

Treasury Bond Yields: Breakout May Test 5% Again

Many investors seem to think that inflation is under control and interest rates are set to decline.

While this may be the longer term play,...

Bond Yields and US Dollar Head Higher, Junk Bonds Tumble

As we start a new month, quarter, and week, I want to remind you how I concluded the weekend Daily:

“Narratives are not very meaningful...

Ahead of Federal Reserve Meeting, Investors Eye Long Bonds (TLT)

Over the weekend Geoff Bysshe wrote an Market Outlook wherein he highlighted some “Long-Term Interest Rate Tipping Points.

While most investors consider the level of interest...

10 Year Bond Yield Testing Key Resistance This Month!

The 10-year treasury bond yield is very closely watched by banks, consumers, and active investors. It is used as a measuring stick for interest...

Long-Dated Bonds Could Be Telling HODLers a Story

I follow long bonds very closely as they play a role in assessing risk within our various market indicators. I do this by using...