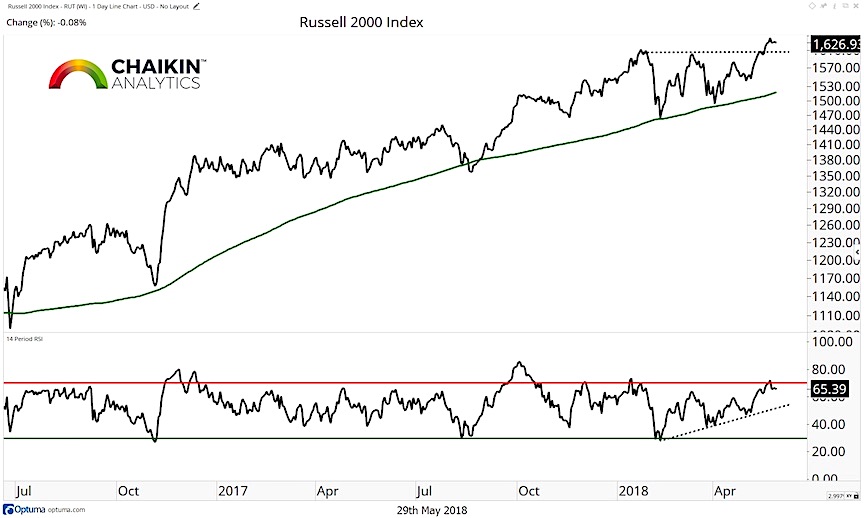

Macro Technical Trends & Insights: Small Cap Leadership

The 24-7 news cycle adds an additional layer of noise to what's happening in the marketplace.

Though it's good to be up on news and...

10-Year Treasury Yield Driving Broad Stock Market Indices

Heading into this week, it was seen as "more" probable that strength in Technology and Industrial stocks would carry stocks higher despite the increasing...

Consumer Staples Sector Update: Will The Free-Fall Continue?

Note that this post with written with my friend Arun Chopra of Fusion Point Capital.

Last Halloween we shared some spooky charts.

On the top...

Treasury Bonds Top Heavy, But Sliding Into Support Area

Almost two years ago, we focused on a measured move target and the 145 area as potentially strong resistance and topping points for Treasury...

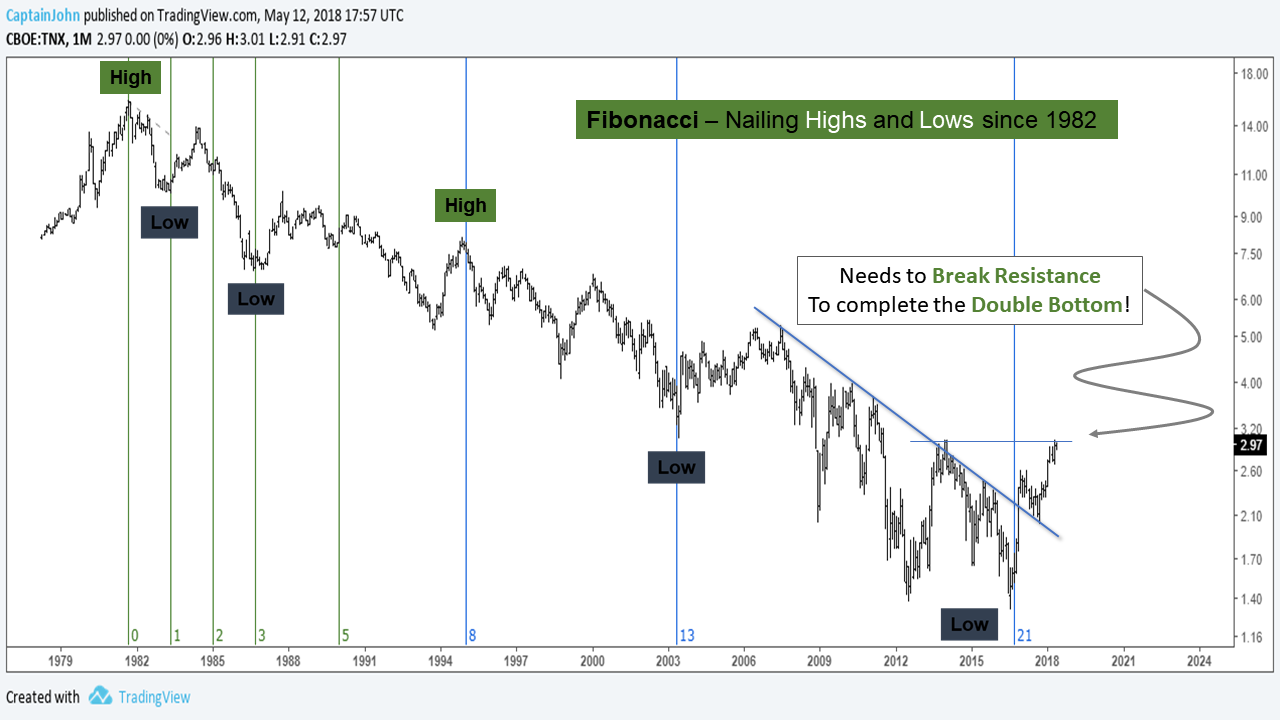

10 Year Treasury Yield Long-Term Outlook: Charts Point Higher

The 10 Year US Treasury Yield is getting the attention of investors here around 3 percent.

Well, it looks to be headed higher yet in...

S&P 500 Technical Trading Outlook: False Moves

Like I have been saying in recent editions of my "On The Mark" newsletter, there will likely be a lot of false breakouts and...

Slippery Signs Coming from the Junk Bond Market

High yield bonds can often serve as a leading indicator for the equity markets. And although indexes which track high yield returns have not...

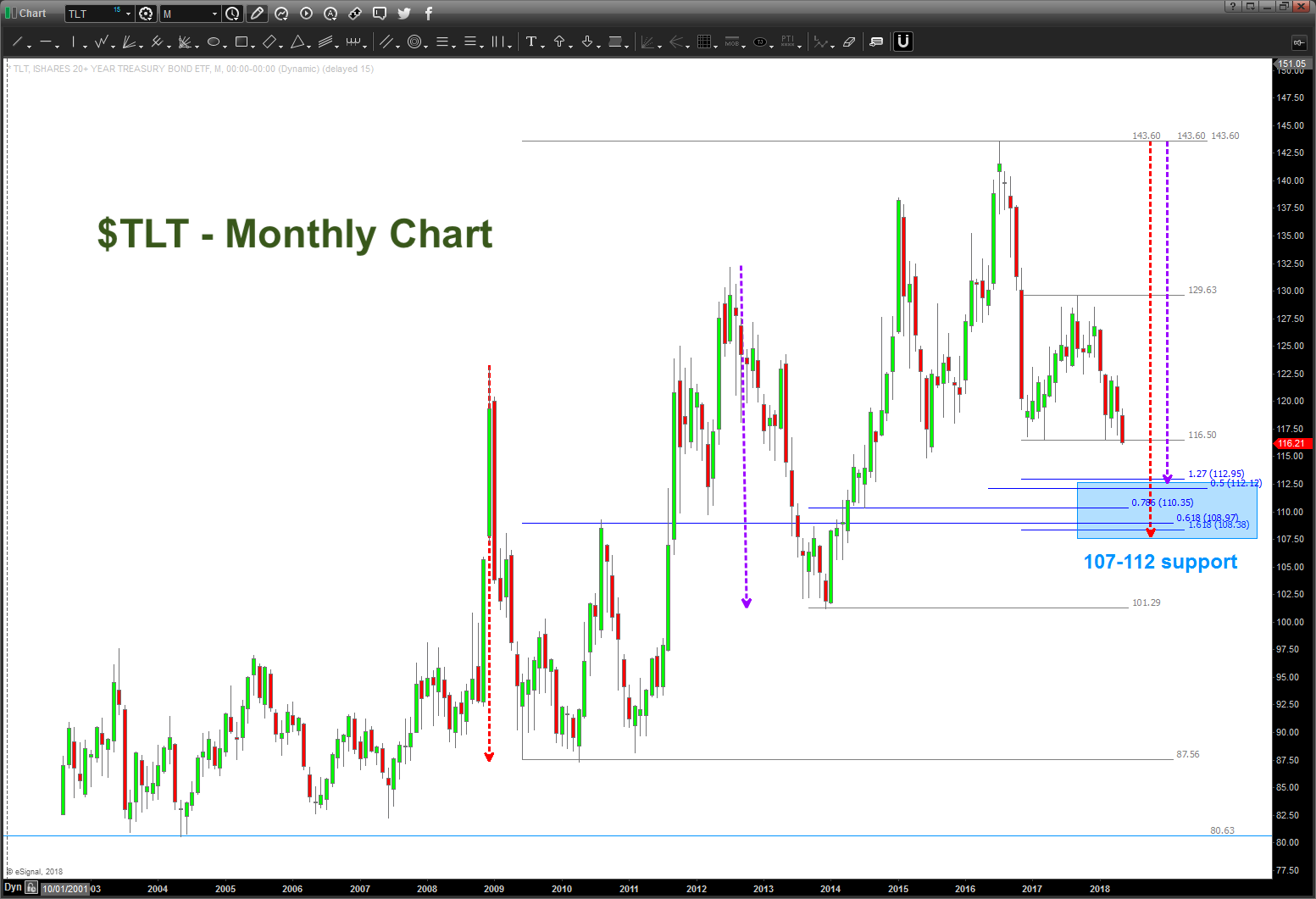

Treasury Bonds ETF (TLT): Near-Term Bounce, Long-Term Top?

Treasury bonds have gotten out of favor as investors continue to price in rising interest rates. This has the Treasury Bonds ETF (TLT) testing key...

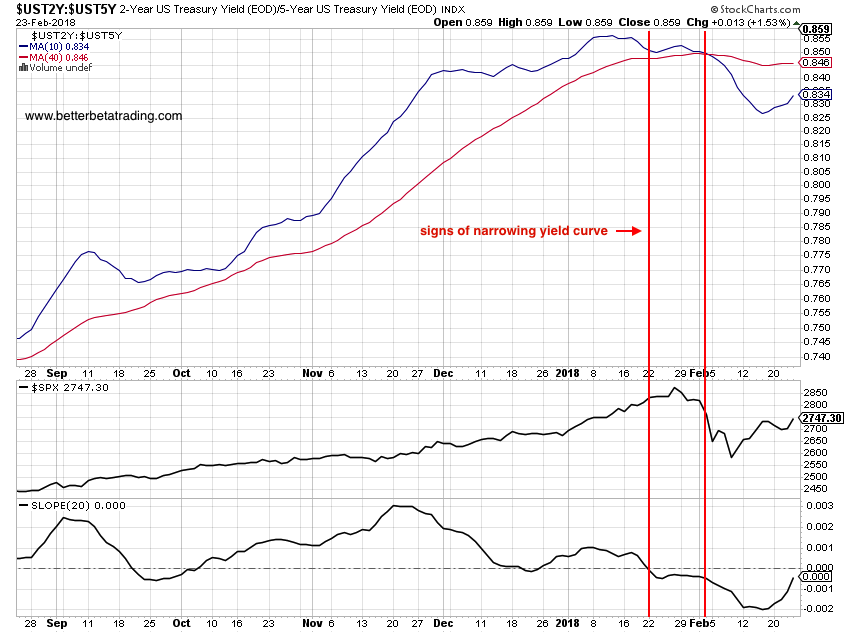

How To Use The Yield Curve As An Equities Risk On/Off Indicator

The drop in equity markets and subsequent V-shaped rebound has left many traders wondering: "Is it safe to increase long equity exposure?"

With pundits on...

Market Outlook: Stocks Set To Continue Bounce, Then Fail

The S&P 500 reversed course on Friday and rallied back to new 3-week closing highs.

Look for stocks to extend gains into this week before...