Long-Dated Treasury Bonds Nearing A Rally?

Among the throngs of headlines on X, this one came out today

PRESIDENT DONALD TRUMP JUST SAID: - ANNOUNCED THE TARIFF PAUSE BECAUSE PEOPLE GETTING...

Is It Time to Look at Fixed Income and Inflation Protection?

Recently, I was asked on CNBC Asia what I thought about fixed income at the present time.

My answer was that I thought having cash...

Treasury Bonds (TLT) Rally Nears Important Resistance

Treasury bond yields have turned lower over the past 6 weeks. And that means treasury bonds and the popular treasury bonds etf (TLT) have...

Long Treasury Bonds Indicator Says Risk OFF, But With a Twist

Turnaround Tuesday brought some interesting charts. What bulls do not want to see, is when long-dated treasury bonds (which have turned around) outperform both...

Post Federal Reserve: Treasury Bonds (TLT) Outlook and The Year of the Snake

First, I would like to express to my colleagues, friends and followers:

May the Year of the Snake guide your endeavors to great heights. Gong...

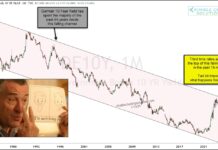

Historical Deja Vu: Will 30-Year Treasury Bond Yields Repeat 2007?

We have repeated several times the importance and implications of rising/falling interest rates.

And today we come back to this theme while discussing long-term US...

Are German Government Bond Yields Changing 44 Year Trend?

Interest rates continue to dominate our recent research. And rightfully so. Big swings in interest rates have ramifications for the domestic and global economy.

Whether...

30-Year Treasury Bond Yields Targeting 6.5% or Higher?

In just 4 years, the trend (and investment theme) of low interest rates has been turned on its head.

During this time, home and auto...

Chinese Bond Yields Collapse; U.S., German Yields Breaking Out?

There are a lot of moving parts across the global economy.

From commodity prices to employment data to bond yields, investors pay attention.

Today we look...

Bond Yields Oversold; Will Interest Rates Rise Again?

The Federal Reserve is talking dovish and finally the bond market is listening...

but this may be a trap.

With inflation looking sticky and bond yields...