Capri Holdings NYSE: CPRI Weekly Chart

This morning Capri Holdings (CPRI), the parent company of Michael Kors, released a business update regarding their response to the COVID-19 outbreak.

The company announced they are furloughing 7,000 store employees, reducing CAPEX, suspending their share buyback, cutting executive compensation among other actions.

Let’s see what the stock chart tells us.

askSlim Technical Briefing:

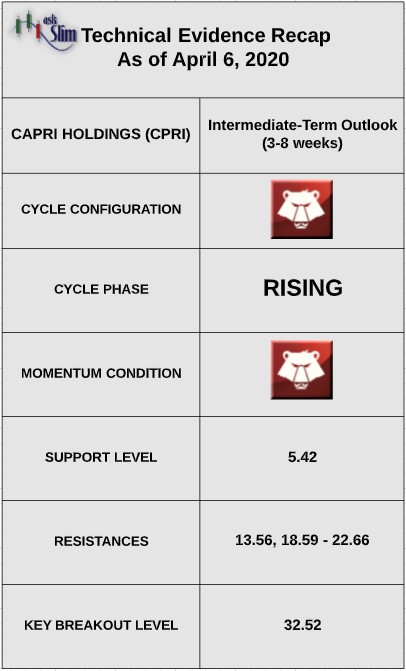

The weekly cycle analysis suggests that CPRI is in a very negative pattern. The next projected intermediate-term low is due in November of this year. Weekly momentum remains negative.

On the upside, there is an intermediate-term resistance at 13.56 followed by a zone of resistance from 18.59 – 22.66. On the downside, the only visible support is the prior weekly cycle low at 5.42.

Our analysis suggests that for the bulls to regain control of the intermediate-term, we would need to see a close above 32.52 to repair some of the damage done to this stock

askSlim Sum of the Evidence:

CPRI is in a very negative weekly pattern with negative momentum. Given these conditions, we would expect any upside to be limited to the intermediate resistances beginning at 13.56. We would expect this rally to fail at resistance and get more selling pressure below 5.42 by November.

Interested in askSlim?

At askSlim.com we use technical analysis to evaluate price charts of stocks, futures, and ETF’s. We use a combination of cycle, trend and momentum chart studies, on multiple timeframes, to present a “sum of the evidence” directional outlook in time and price.

Get professional grade technical analysis, trader education and trade planning tools at askSlim.com. Write to matt@askslim.com and mention See It Market in your email for special askSlim membership trial offers!

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.