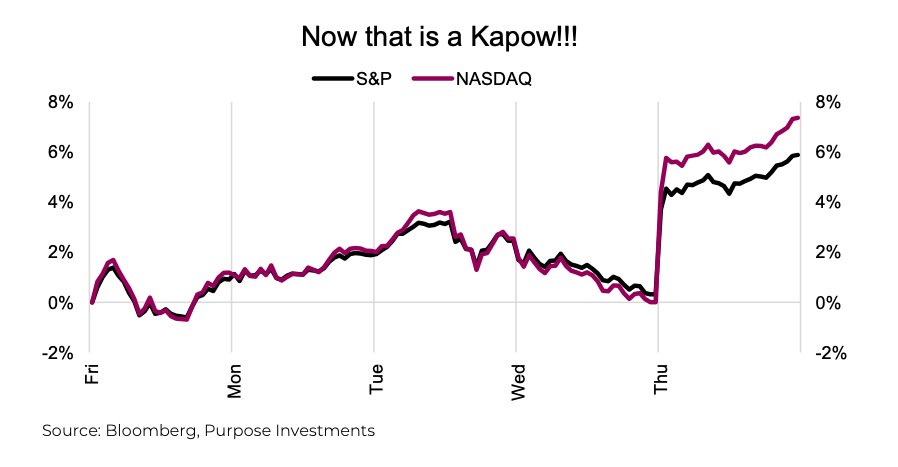

Wow, that was an explosive post-CPI (Consumer Price Index) rally!

A better-than-expected U.S. CPI (inflation) print kicked off the largest one-day rally the market has seen since the 2020 pandemic bear. S&P 500 +5.5%, NASDAQ +7.3%, TSX +3.3% … hell, even bonds +2.9%.

For the S&P 500, this was the 15th biggest one-day gain measuring back to 1950. What makes it more impressive is most big days for the market come right after a terribly painful few days. For instance, in October ’87, there was a +9% day, but the market was down 21% over the previous few days, which was kind of bittersweet. The list of these kinds of bounces is long. Yesterday, the market was down over the previous few sessions but only a bit. Anyhoo, it was a great day to be an investor in the markets and not in cash or GICs.

At the root of this bear market is inflation, so finally, a sign of improving inflation has a very strong market response. Especially given the preponderance of negative news over the past few months, the market is kind of like a spring sometimes. Inflation starting to come down was always a ‘when,’ not an ‘if,’ and that CPI report did carry a lot of good news. Food inflation came down, which is nice.

Core inflation, ex food & energy, was 0.3% for the month, which was below the 0.5% expected and below the 0.6% from last month. There was a decent amount of good news – rent inflation slowed, while outright price drops were evident in clothes, car prices, airfares and durable goods in general. Lodging away from home (aka hotels) was up a lot. Overall, a good report.

Holy market bounce Batman!

So, was it an overreaction? For sure – looking at the one-day move, it was a 5-sigma event. For those lovers of normal distributions, that really shouldn’t happen. But the market is not normal. It reacts to news, and the reaction is also driven by the starting point. Lots of bad news from inflation, recession fear, war, and central banks’ hawkishness; the list is long and has been enduring for much of 2022. This primes the market for a bounce, with the trigger being a change in the news flow. And the news has gotten better beyond just inflation data.

Inflation – has shown signs of slowing.

Midterms – we don’t focus on politics much as guessing the direction is hard and how the market may respond even harder. But without the red wave that was expected, U.S. politics may be back to a lame-duck period, unable to implement much on the policy side. This reduces policy uncertainty which markets like.

China – it may prove premature, but there is an optimistic tone in the market on the potential relaxing of zero- covid policies in China. This policy has suppressed the world’s second-largest economy, and relaxing would have a meaningful impact on global economic growth. Previous periods of optimism fizzled, so hard to say. But Hong Kong has popped 18% so far this month, and global cyclicals have rallied as well.

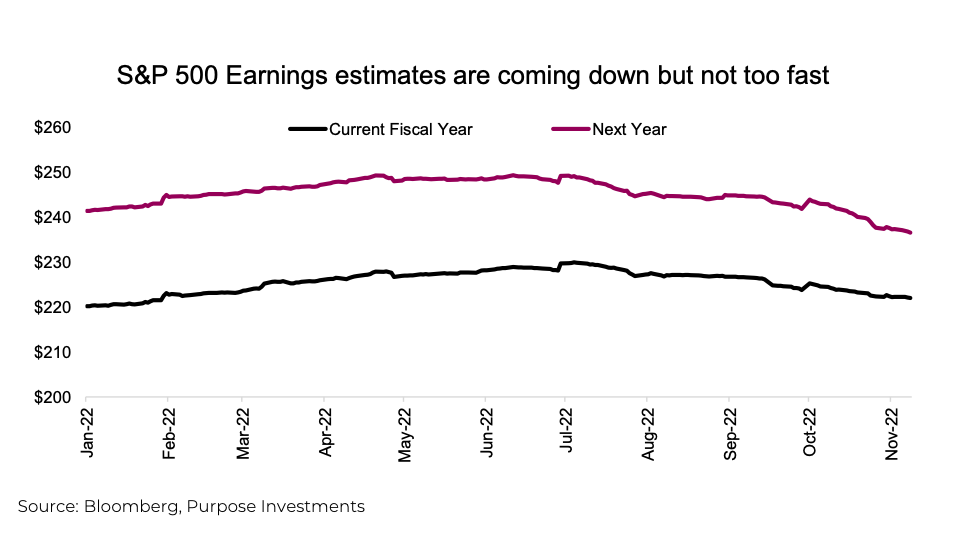

Earnings – not saying the Q3 earnings season was a home run, but it wasn’t bad, either. The frequency of positive earnings and sales surprises was within historical norms. The magnitude of the surprises was lower, and growth has been slowing. Still, things didn’t fall off a cliff, and forward estimates may be falling but only marginally so far.

No news is good news

The other good news is there shouldn’t be much news ahead. Past CPI, labor report, Fed, earnings, election, etc. In a world that does tend to have more bad news than good, a light news period is a welcome development. We have been saying for a while that when inflation rolls over, this market will bounce, and that bounce appears to be in motion. If you are an optimist, perhaps call it a Santa Claus rally. If not as optimistic, maybe a U.S. gobble gobble rally.

Impact on portfolios

This rally could have some legs, much like the one in the summer that was kick-started by optimism around inflation and a better-than-expected earnings season. Markets have been oversold, and a light news period may help. Of course, the million-dollar question is whether the bear is over, which we do not believe to be the case. The higher and faster this market ascends, the less financial conditions tighten, which could elicit less of a pivot from central banks. Plus, valuations become a headwind when combined with negative earnings revisions.Of course, when the bear does end, everyone will doubt the rally as it will be built on more hope than anything fundamental. We remain market-weight equities as the downside vs upside risks appear balanced … for the time being. Now back to enjoying the markets; it is a welcome change

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.