March corn futures closed last week at $3.87 ¼ per bushel.

Price weakness on Friday resulted in a lower weekly close with March corn futures finishing down 2-cents per bushel week-on-week.

On Thursday, March corn futures traded up to their highest level since November 5, 2019, making a day high of $3.94. However, after failing to push above that level again on Friday, selling pressure quickly ensued.

Market observers have tried to link corn’s recent price resilience and ability to avoid deeper downward corrections below $3.80 per bushel to a slight improvement in U.S. corn export sales.

Friday’s weekly Export Sales report showed corn sales of 39.6 million bushels for the week ending 1/16/2020 (Japan and Mexico primary buyers).

And although this total was 92% higher than the prior 4-week average, crop year-to-date corn export sales remain 37% behind a year ago (-471.6 million bushels).

Thursday’s weekly EIA report showed U.S. ethanol stocks surging back over 24.0 million barrels and up to their highest level since July 26, 2019.

Since ethanol stocks dipped to approximately a 3-year low of 20.277 million barrels on November 22, inventories have rebounded by +3.75 million barrels in just 8-weeks. Not surprisingly the rapid ascent in stocks has been preceded by U.S. ethanol production returning to near maximum capacity. Industry “average” ethanol margins have again turned negative with spot Chi Platts ethanol values down 26 ¾-cents per gallon (high-to-low) since November 26.

My market opinion on March corn futures remains the same: Range bound price action is to be expected in the absence of a sustained improvement in U.S. corn demand ($3.95 by $3.70 per bushel).

With 2019/20 U.S. corn ending stocks projected at 1.892 billion bushels, 2020/21 U.S. corn carryin stocks should be more than adequate. Furthermore even after applying IEG Vantage’s recently revised 2020/21 U.S. corn planted acreage forecast of 93.44 million acres (slightly below their December estimate, as well as, the USDA’s Baseline estimate of 94.5 million), 2020/21 U.S. corn production is still expected to approach 15.3 billion bushels (current record high = 15.148 billion bushels in 2016/17).

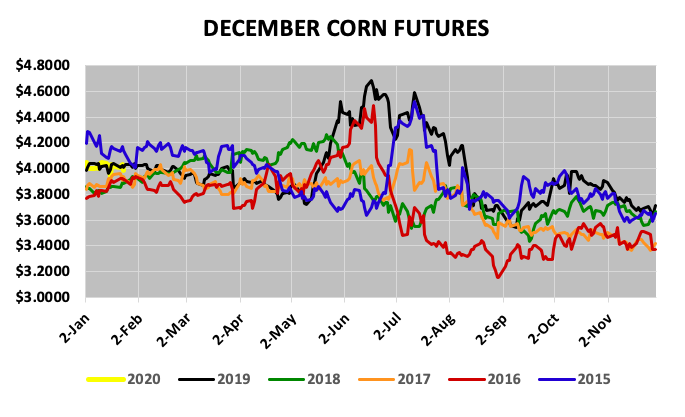

This is predicated on a U.S. corn yield ranging from 178 to 178.5 bpa. These types of supply-side forecasts should limit corn’s ability to sustain futures rallies during Feb/Mar/Apr above $4.00 in CH20 and CK20 ($4.05 to $4.10 CZ20).

Other Pricing Considerations:

- Corn Basis: I would expect Midwest basis levels to remain historically firm, as long as ethanol plants remain cash positive EBITDA (location specific influenced by FOB ethanol netbacks and plant efficiencies). The Dec 1 corn stocks estimate of 11.4 billion bushels was down nearly 550 million bushels versus 2018 (-5%) with farmers holding approximately 63% of those stocks on-farm. Therefore I’m assuming farmers will be extremely selective in moving bushels leveraging their space versus the consistent need for bushels from End-Users and their own internal space limitations.

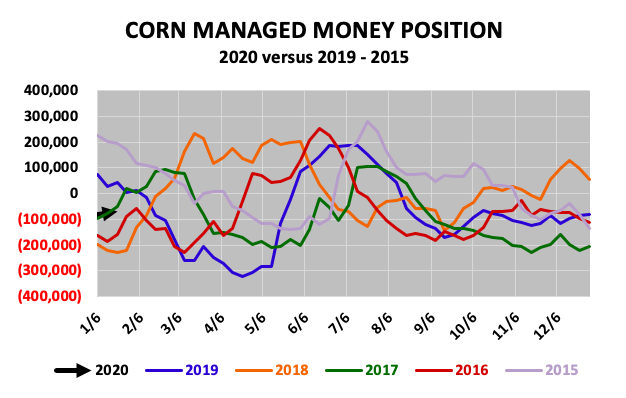

- Managed Money Position: Friday’s Commitment of Traders report showed Money Managers trimming their net short corn position to just -67,804 contracts. This is down from -114,801 contracts in early December. There is however no strong seasonal tendency for Money Managers to be long or short in January. For example, versus the same week a year ago Money Managers were carrying a net long in corn of approximately +44k. Conversely in 2018 Money Managers were riding a net short in corn over -220k contracts. Therefore its difficult to project how they will adjust going forward.

ONE FINAL NOTE: The highest December corn has traded during Feb/Mar the past 5-years is $4.21 ¾ on 2/9/2015.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.