Employment is a more positive story at the moment.

It is a natural progression that when growth slows, companies start to cut back.

Often this 1.50 is seen in programs to reduce costs, like switching from ‘Makers’ (or your 1.00 equivalent upscale eatery) to Dominos for the monthly team lunch.

Usually the last place to feel the cost-cutting pinch is in hiring/layoffs. This is because it is expensive to find, hire and train people.

So far, the slower growth has not shown up in most of the labor data. The U.S. employs 152 million people, more than it ever has before. And this has increased by over 22 million over the past decade.

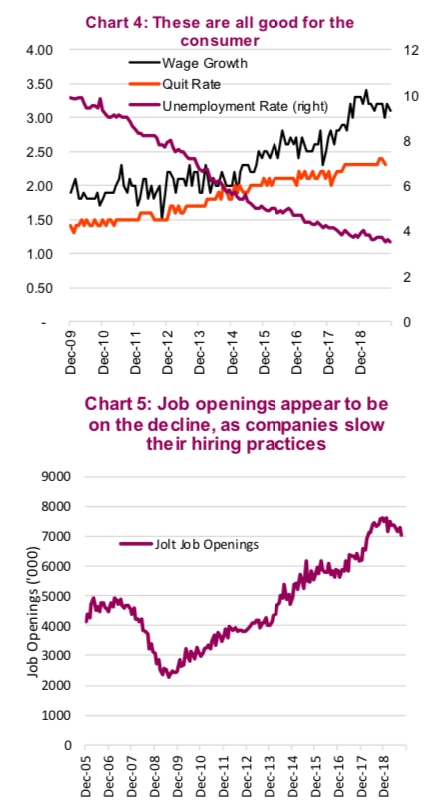

The unemployment rate is 3.5%, the quit rate is over 2% and wages are rising over 3% (Chart 4). The quit rate is important as it also captures people’s confidence. If you’re willing to quit to take on something new, you’re typically not worried as much about job security.

It isn’t all roses though. Sometimes, changing hiring practices show up in other data points. Another early warning may be evident via the U.S Labor Department’s Job Openings and Labor Turnover Survey, or JOLTS. After all, before any company starts to cut labor, they will stop or slow hiring. This survey captures the number of job openings available in the economy and while it isn’t falling dramatically, it has started to roll over.

Overall, the U.S. consumer remains in good shape and at this point appears to be holding the line. That is encouraging for the global economy. The same cannot be said about the Canadian consumer.

Canadian Consumer Not Nearly As Encouraging

The jobs market in Canada has gone form good to terrible rather quickly. Canada posted its largest monthly job loss since the financial crisis, shedding 71,200 jobs in November. The unemployment rate rose to 5.9% compared to 5.5% in October. The losses were split between part time and full time, with Quebec taking the brunt of the hit, losing 45,100 jobs in November. The worsening employment outlook for Canadians comes at a time when elevated household debt has stretched Canadian household balance sheets to extreme levels. Chart 6 shows that the current levels are high even compared with the U.S. debt situation prior to the financial crisis. While the calculations differ from one country to the next, the degree of different remains material. Consumer insolvencies have risen by a fairly large degree in 2019, up 9.2% year over year as of October. Granted this is from a low base, but with the employment situation having deteriorated rather materially, this could lead to a sharper increase.

For some on the ground insight into the Canadian consumer and economy, let’s look at the Canadians banks, which have recently reported Q4 results. They have had a tough week falling 2.6%, with TD and CIBC falling by over 4%. The drop relative to the TSX Index is the worst weekly performance for the banks in five years. It appears that Canada’s banks are well aware of the challenging credit conditions, with provisions for credit losses rising across all banks in the latest quarter as seen in Chart 7. The sharp increase in loan loss provisions is most notable for CIBC, TD and Royal Bank. The economic mood in Canada has soured recently, and the increasingly defensive posturing by local banks has us believing that the trend heading into 2020 will be towards tighter lending standards, which could further constrain the consumer.

Investment Conclusion

The good news is that while the Canadian consumer is at risk, it’s the U.S. consumer that matters most for the global economy. And so far they are holding the line. The next few months will be key so added emphasis on labor/hiring/spending data is warranted.

Charts are sourced to Bloomberg or Richardson GMP unless otherwise stated.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.