Many seem to be talking about the growth/reflation theme that has taken place post election. Did this theme really start improving post election?

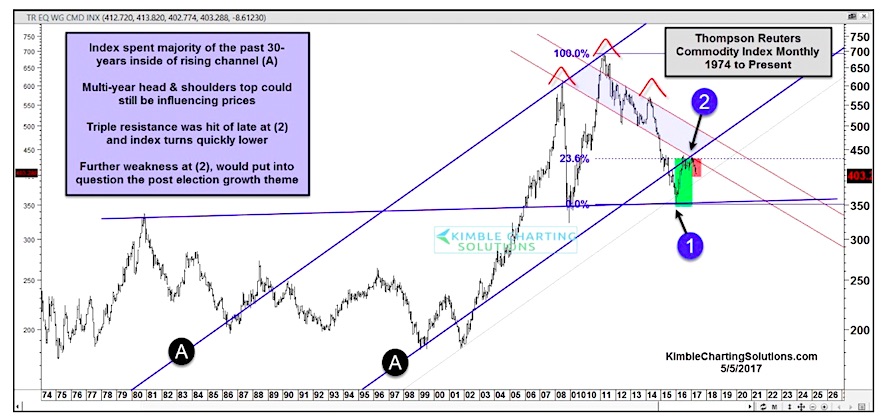

The chart below would put a little question into the date. Below looks at the TR Commodity index over the past 40-years.

The index hit support at (1) and started to moving higher. When did the index hit a low last year on a monthly closing basis? The monthly low took place at the end of February 2016, 9-months “before” the election.

The index remains in a bearish downtrend since the highs back in 2011, which looks to have formed the head, of a multi-year head & shoulder topping pattern. The swift decline that started in July of 2014, took it down to support at (1). This is where a counter trend rally started, that many call the reflation/growth rally. Regardless of what label one wants to put on the rally, the index did hit triple resistance in a downtrend at (2) and has turned south of late.

The growth/reflation theme would be put into question, if neckline support at (1), would happen to give way! A support break at (1), would suggest that dis-inflation or de-flation is in play.

So far weakness in the index since the highs back in 2011, has not impacted stocks in a negative way at all. Stocks and this index did bottom together at (1) and both have struggled a little, as resistance was hit at (2) in the chart above.

Thanks for reading.

ALSO READ: Gold Miners ETF (GDX) At Critical Juncture

This post originally appeared on Kimble Charting.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.