Several key bank stocks came out of earnings season with some renewed energy. The recent rally has helped the broader stock market push to new all-time highs. At the same time, the sector is nearing an important point for investors.

Can the banks lead the stock market higher yet? Or will the rally falter?

JP Morgan Chase (JPM) and Goldman Sachs (GS) have been recent leaders amongst the money center banks. But even laggards like Citigroup (C) and Bank of America (BAC) have fared well of late. Here’s a look how several key bank stocks have performed in 2015, along with the Bank Index (BKX):

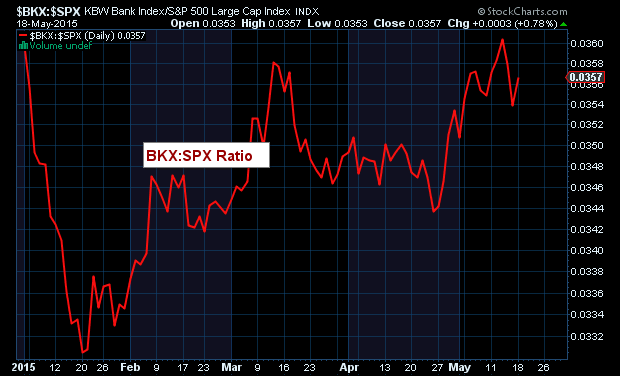

As you can see, BKX is now up over 2 percent on the year. This is quite a turn around, considering it’s January slide that put it in the hole 10 percent. The next chart shows how the banks have fought back relative to the broader market- the S&P 500 Index. As you can see, the relative strength ratio shows the banks outperforming since February, mostly in two spurts (February into March and late April into May.

BKX:SPX Relative Strength Chart

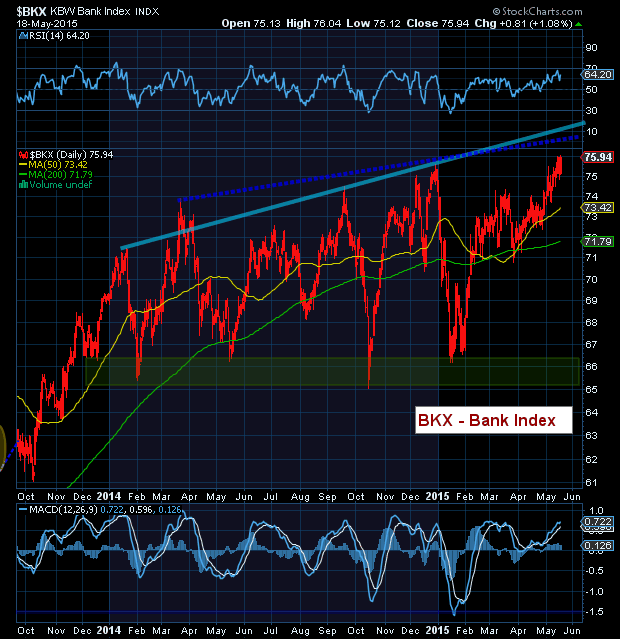

When we look at the Bank Index (BKX) chart and focus solely on the price action, we can see that although the Index is reaching up into new highs (bullish), it is running into a couple of potential resistance zones. There will likely be more volatility in the sector if the banks cannot take out one or both of these resistance lines. So keep an eye on BKX as it nears the 77-78 level.

Although the Bank Index could grind higher along one of these trend lines, a clear breakout above would be the most bullish scenario for the sector (and the broader stock market). Note that the 50 day and 200 day moving averages are both moving higher. And the Relative Strength Index (RSI) recently touched up near 70.

Bank Index (BKX) Daily Chart

Like them or not, the banks are an important part of the equation. Thanks for reading.

Twitter: @andrewnyquist

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.