I went into a friend’s guestroom to grab my purse and saw this on the shelf – see image below.

In my constant search for photos to use as stock market metaphors, Mr. Potato Head’s Star Trek featuring Captain Kirk and Klingon Kor seemed deliciously apropos.

This reminds me of one of my favorite jokes: What does toilet paper and Star Trek have in common?

The answer is a bit indelicate so I will save it for the very end…

The point is, Kirk sought to destroy Klingons.

In the stock market, Kirk is the captain of the Economic Modern Family today or the Russell 2000 ETF (IWM).

The Modern Family has yet to “boldly go where no man has gone before,” as they are way off from all-time highs.

Nevertheless, Captain Kirk, or the Russell 2000, held onto recent gains.

If the small caps are Captain Kirk, that makes Klingon Kor is the news.

The S&P 500 (SPY) and Nasdaq 100 (QQQ) turned red after the British Parliament delayed the Brexit vote.

As we have repeatedly seen, the news can either cause the market Klingon-type issues (Brexit) or drive it to rally at warp speed (Trade War progress).

The potatoes remind us to try not to take the constant bombardment of news, fake or real, too seriously.

Just follow price.

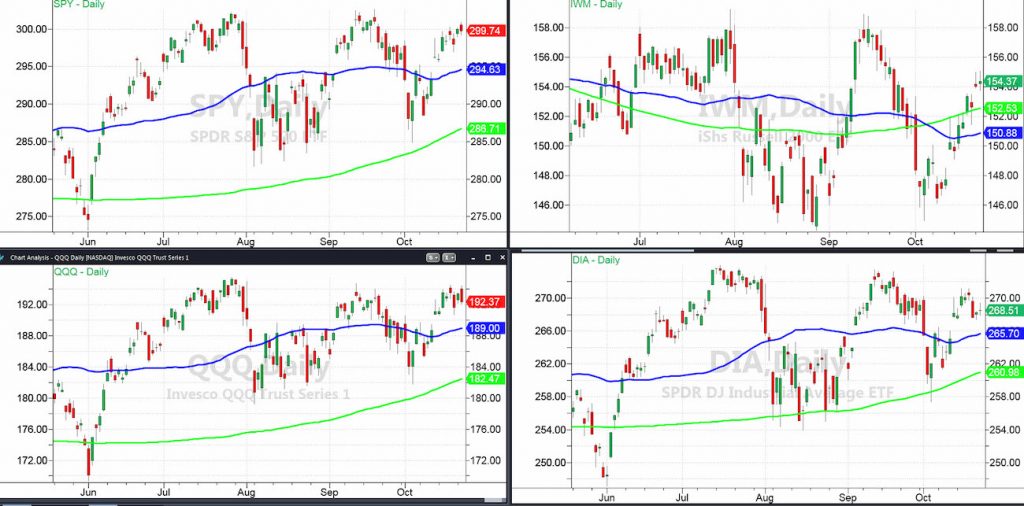

Last night I posted weekly charts of the four indices.

Today, here are the Daily charts.

Except for IWM, all are in strong bullish phases.

IWM is in an accumulation phase.

SPY, QQQs and DIA show how they have climbed near the top of the recent trading range highs. IWM has quite a distance to go.

The question right now is who leads and who lags?

IWM is trying to catch up because like Kirk, who never lost his optimism, the small caps hope for better news with China. And if not, they bank on a cooperative Federal Reserve.

SPY and QQQs fell partly because of Brexit, but also because of some softer earnings potentially on tap.

Should IWM and IYT continue their lead, warp speed.

Should they fall victim to the Klingons, we will need an emergency transport (or a beam me up to higher prices Scotty!).

Some facts about Mr. Potato Head.

In the spirit of keeping it light, the answer to the joke: They both travel around Uranus in search of Klingons.

S&P 500 (SPY) 296 is pivotal price support, 300 is pivotal resistance.

Russell 2000 (IWM) 153.50 is pivotal price support, 156 resistance.

Dow Jones Industrials (DIA) 270 is pivotal price resistance.

Nasdaq (QQQ) 193.50 is price resistance to watch, 190.45 is key support.

KRE (Regional Banks) 53.65 is price support, 55.00 resistance.

SMH (Semiconductors) 120 is key price support – eyeing Texas Instrument weak earnings.

IYT (Transportation) 190 is price support, 195 is resistance.

IBB (Biotechnology) 105 pivotal price support, 108 is resistance.

XRT (Retail) 43-44 price resistance, 41.50 is support.

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.