Last week the major indices made a successful rally back into a short-term support area.

However, many see the price move as a rally back into a volatile resistance zone leading people to believe we could again see the market break lower.

While this could be the case as the S&P 500 (SPY), Dow Jones (DIA), and the Nasdaq 100 (QQQ) are looking heavy and have been trending lower, the Russell 2000 (IWM) is holding the middle of its current range and could make a push towards its next resistance level near $209.

It should also be noted that IWM made a double bottom chart pattern from its gap down last Thursday.

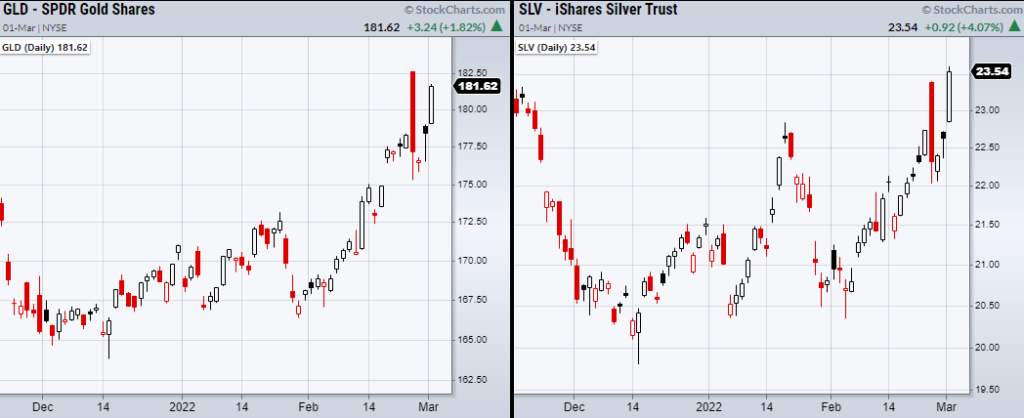

With that said, even with gold (GLD) and silver (SLV) rallying, the equities market is attempting to hold together for the moment.

Historically precious metals have risen when a market takes a downturn as people become more defensive with their money.

From the gold and silver perspective, this looks to be the case as we can see their strong upward movement in the daily charts.

Though we have taken profits in precious metals, we have also been holding soft commodities.

One that looks to be reaching a pivotal point is the Sugar ETF (CANE).

Flirting with its 50- and 200-day moving average, CANE should be watched closely if it can clear and stay over these price levels.

50-day moving average = 9.00

200-day moving average = 9.03

Additionally, CANE could be setting up on the weekly chart if it can build support over $9.06 or hold over its 50-week moving average.

With that said, while we are trading precious metals and looking for more entries into soft commodities, we are still watching for the equities market to hold for the moment.

Especially if IWM can stay above its double bottom near $188.

Listen to Mish talk about the market, Federal Reserve, and the Russia—Ukraine war on “Live the Money Life” with Chuck Jaffe.

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) 427 is a support area.

Russell 2000 (IWM) 208-209 is resistance.

Dow Jones Industrials (DIA) 331 is support.

Nasdaq (QQQ) 344 is pivotal.

KRE (Regional Banks) Could not clear resistance. Now watching to hold 200-DMA at 69.25

SMH (Semiconductors) 272 to clear.

IYT (Transportation) 250 is pivotal.

IBB (Biotechnology) Flirting with the 10-day moving average at 125.89

XRT (Retail) Could not hold over the 10-day moving average at 77.24

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.