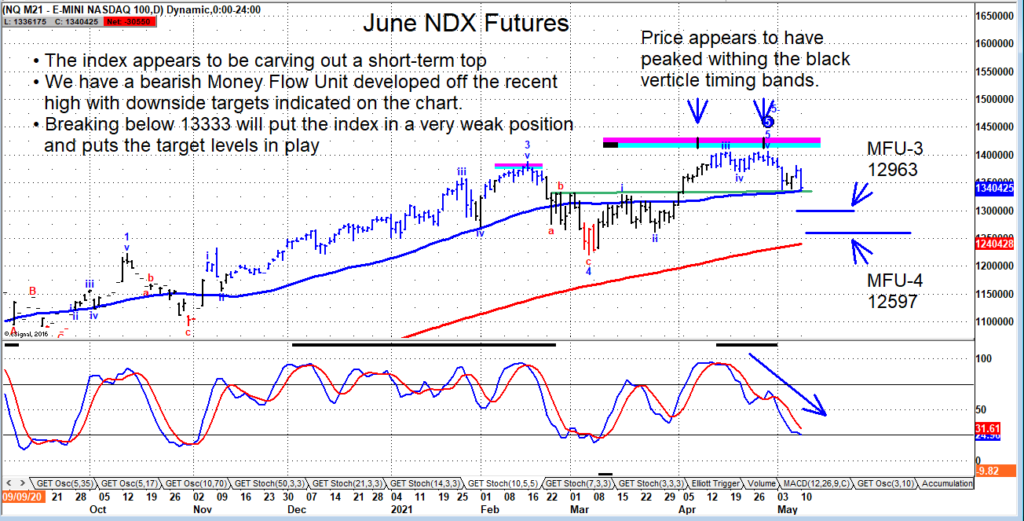

The Nasdaq 100 (NDX) rally came within 7 points of my 1390 target before quickly reversing lower. As we noted on our May 6th note, “the inability of the index to move up from trend support for a short-term pop is telling,” and the fact that the “pop” was so short-lived is very telling.

It shows that selling pressure is increasing, and the index is at risk of breaking support at 13333.

That said, we need to hold tight and wait for that confirmation before turning outright bearish.

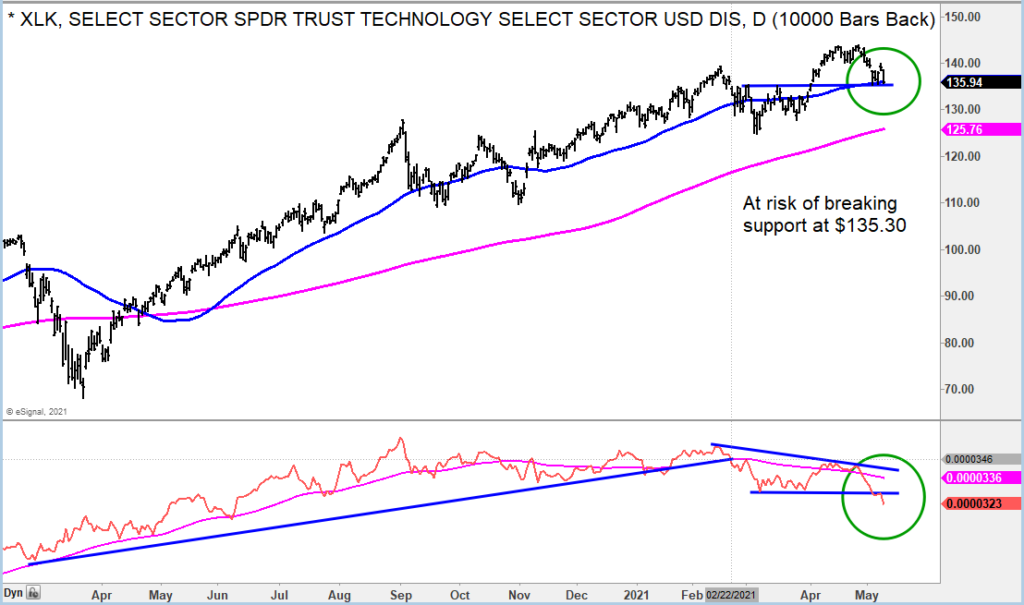

I also have been pointing out that our multi-factor technical model is picking up on some deterioration in both the absolute and relative performance in the Technology Sector (XLK). XLK has key price support at 135.30, and a break below could potentially lead to a decline towards the March low. That said, it is right to be patient and wait for outright sell signals. The up-trend has been relentless and has found reversals at key support all the way up.

Charts of the NDX and XLK below.

The author or his firm have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.