Since 2010, QE saved the markets and the economy, which in turn led to big tech as the 10-year bull market savior.

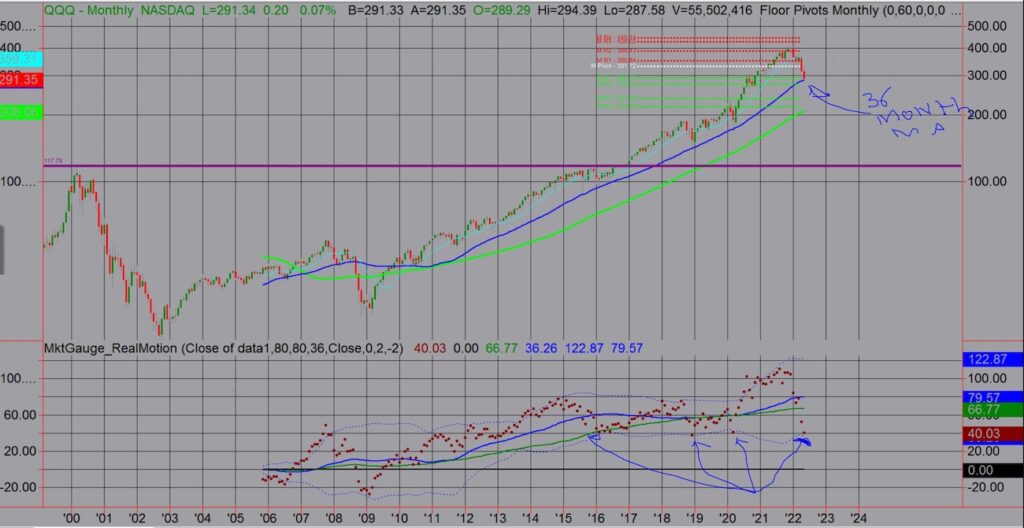

The monthly chart of QQQs, which goes back from the dot com bubble, highlights the run that began in 2010.

Yet it also shows that it took another six-years (2016) until the peak of the dot com bubble was taken out.

The first sentence might be the most important. It begins with “QE saved…”

Nasdaq 100 peaked again in November 2021. Since then, the letters QE are now replaced with QT.

In fact, June officially begins the Fed’s shrinking of an $8.5 trillion bond portfolio.

Some say its already priced into the bond market. Others say we have not seen anything yet as far as collateral damage from rising yields.

What is the chart telling us?

NASDAQ spent most of the day green, only to close down .18% in the last few minutes of the session.

The chart does not illustrate the classic reversal bottom as many hope for.

We did have a new 60+ day low on May 2oth. However, it was followed by an inside day, which was then followed by a red day.

In fact, the high from the candle on May 20th did not clear until last Thursday-and on low volume. Last Friday, the volume was lower still.

Now technically, we do not need to see a clean reversal bottom or one where a new low is made and then the high of that day clears within one to two days max.

But we like it when it happens.

So now, this points more to a bear market rally with new lows most likely on the horizon. Especially is QQQs fail 295 again.

Could more upsides be in store?

Maybe. A chance QQQS could run to 318-but why?

Call me a skeptic, but back to the monthly chart-that run was with QE and it still took from 2000 until 2016 for the peak highs to clear- 16 years!

Now we have QT-duh-big red truck!

Stock Market ETFs Trading Summary:

S&P 500 (SPY) 400 major support 425resistance

Russell 2000 (IWM) 180 support 192 resistance

Dow Jones Industrials (DIA) 320 support 336 resistance

Nasdaq (QQQ) 295 support 327 resistance

KRE (Regional Banks) Rally to resistance and not interesting unless it clears 66

SMH (Semiconductors) 247 resistance with 228 nearest support

IYT (Transportation) Weaker sector with 227 some support to hold

IBB (Biotechnology) 117 pivotal and under 110 support trouble

XRT (Retail) Oversold otherwise, 64 support and maybe new life over 73.00

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.