I have created another video recap for today’s Daily. The link to watch is below.

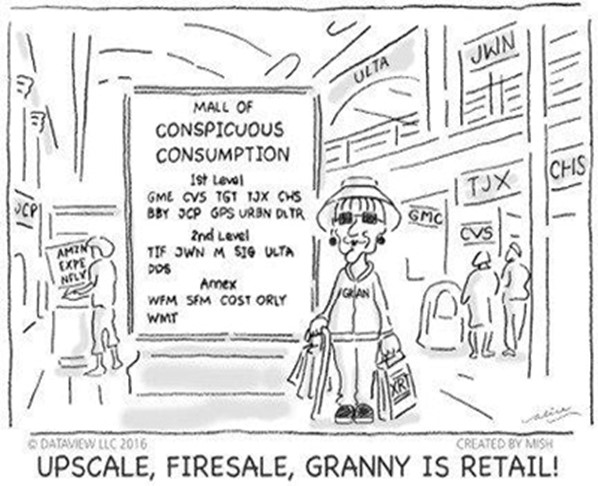

The focus is on our Grandma of the Economic Modern Family-Granny Retail. I use the Retail ETF $XRT as the benchmark.

XRT is the largest retail ETF but by all means, not the only one. IBUY is another one to look at for more e-commerce names. IBUY htough includes companies around the world while XRT is 100% United States.

Hence, XRT is Granny’s monkier as it also offers exposure to many sub-industries with the retail industry, including apparel, drug retailers, departments stores and computer and electronics retailers.

It’s important to remember that the US consumer makes up approximately 70% of the our economy.

Without Granny Retail’s shopping and consumerism, our ecomomy would not the largest in the world.

Click here to access the video of Mish, Granny Retail and chart analysis

Granny Retail, SPDR S&P RETAIL ETF (XRT)

Fund Type: Consumer Discretionary ETF

Benchmark Index: S&P RETAIL SELECT

Date of Inception: 06/19/2006 AUM $256.96M

Number of retail holdings in the ETF: 89

Expense Ratio 0.35% Dividend Yield 1.64%

Top 10 Retail Sector Holdings

Chewy Inc.

Grocery Outlet Holding Corp.

Ollie’s Bargain Outlet Holdings Inc

Rite Aid Corporation

Dollar General Corporation

AutoZone Inc.

O’Reilly Automotive Inc.

Costco Wholesal

National Vision Holdings Inc.

Doorash Inc.

Reach out via chat, phone, email, or book a call with our Chief Strategy Consultant, Rob Quinn by clicking here for more information.

Mish in the Media

Business First AM 08-24-22

Stock Market ETFs Trading Analysis and Summary:

S&P 500 (SPY) 410 pivotal support 397 major support 423 resistance.

Russell 2000 (IWM) 190 pivotal support, 180 major support, 199 resistance.

Dow Jones Industrials (DIA) 339 resistance with 319 major support.

Nasdaq (QQQ) 312.50 pivotal support, 301 major support and 325 resistance.

KRE (Regional Banks) 64.00 support 68 resistance.

SMH (Semiconductors) 222 the 50-DMA support and over 240 better.

IYT (Transportation) Through 243 better and must hold 225.

IBB (Biotechnology) 123 the 50-DMA support to hold 128 resistance.

XRT (Retail) 67.20 must hold on a weekly close. If not, looking at 66 then 65.00 next.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.