The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- Q3 featured just a modest increase in global share repurchase announcements, and the fourth quarter is off to a sluggish start

- A trio of consumer companies crossed our radar with encouraging buyback plans despite generally tightening financial conditions

- As earnings season progresses, watching repurchase program trends could offer insights into the 2024 economic landscape

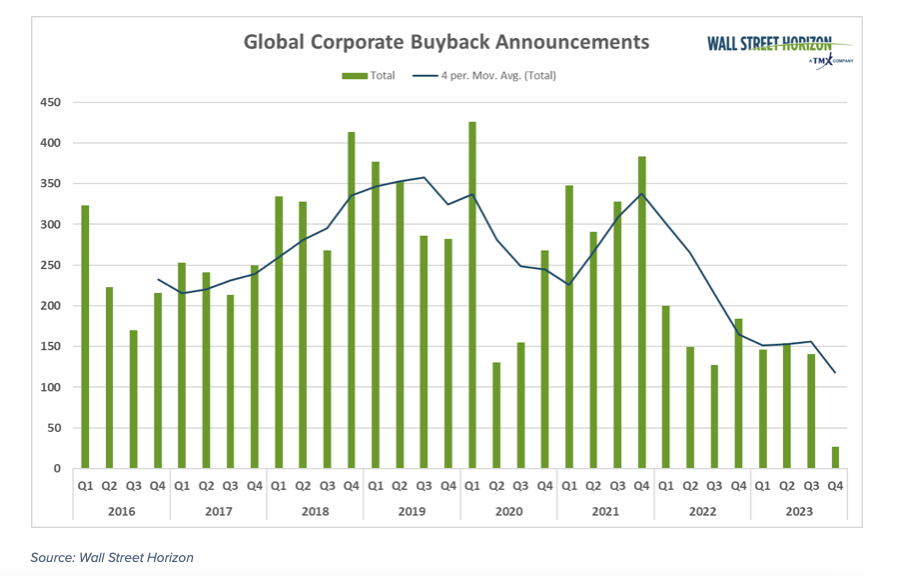

Corporate buybacks turned higher in Q3 on a trailing four-quarter basis. Temper your excitement, however, as the uptick barely registered on the long-term buyback announcement chart.

Executives continue to approach capital allocation decisions with trepidation amid steeply rising costs of capital and ongoing bouts of volatility. This earnings season will shed light on where CEOs and CIOs see economic conditions headed in 2024. As it stands, Wall Street Horizon’s data show relatively few new share repurchase announcements, though many companies have yet to report third-quarter results.

Buyback Announcements Remain Few, Reflecting Heightened Uncertainty

The dearth of stock buyback announcements is not surprising as, according to a recent BofA survey, investors increasingly prefer that firms shore up their balance sheets rather than embark on potentially risky capital expenditure projects or use cash for shareholder accretive activities.1 Thus, it’s reasonable to assert that cash may continue to become an even more valuable asset until definitive signs of easing financial conditions become apparent.

Good News is Bad News?

While economic surprises have generally been solid lately, per the Citigroup Economic Surprise Index, anxiety in the C-suite may still be high.2 Strong data means the Federal Reserve must keep its foot on the economic brake pedal, possibly resulting in a 2024 recession. Just this month, we have seen a hot jobs report and surging retail sales, yet an 18th straight monthly decline in the Leading Economic Index (LEI).3 All these crosscurrents no doubt leave investors and corporate managers looking forward to year-end – and maybe a few drinks!

Our team spotted three stocks that recently announced new buyback initiatives.

Order Up

First on the list is Restaurant Brands International (QSR), an international fast-food chain operator. The Ontario-based $29 billion market cap Consumer Discretionary sector company is among several restaurant stocks that have come under steep selling pressure as GLP-1 weight-loss drugs continue to show significant efficacy. QSR, the operator of Tim Hortons, Burger King, Popeyes Louisiana Kitchen, and Firehouse Subs, is expected to grow earnings at an accelerating pace over the next two years4, but shares endured a 20% decline from July through early October.

In late August, the quick service restaurant company announced a $1 billion buyback plan that extends through September 2025. The stock rallied after the news hit the tape, but sellers regained control in short order. It wasn’t a groundbreaking announcement since the plan’s approval followed the expiration of a previous 2-year repurchase authorization.

QSR: One of Many Discretionary Stocks Feeling the Selling Heat Since July

It’s Time for a Drink (Or Three)

If a burger and fries doesn’t hit the spot, maybe a tall cold one will ease your market anxiety. Molson Coors (TAP) is another major consumer company authorizing a share repurchase plan. The Consumer Staples stock has, like QSR, perhaps felt the brunt of the weight-loss drug impact. Shares are down more than 15% from a peak notched in early Q3 despite its debt being upgraded to BBB by S&P Global® earlier this month.6 New growth plans detailed at its Investor Day back on October 3rd included a $2 billion buyback program as part of a “balanced and cohesive” approach to capital allocation.

The stock held its own before capitulating to selling pressure in the sessions after the Investor Day. Looking ahead, TAP has a confirmed Q3 2023 earnings date of Thursday, November 2 BMO with a conference call later that morning. CEO Gavin Hattersley has an expansion focus right now, so be on the lookout for any new strategies for 2024, building on its low-single-digit annual sales growth outlook provided earlier this month.

TAP: Encouraging Investor Day Comments Not Enough to Buck the Trend

Seeking a Winning Hand

Fast food and an adult beverage are not bad for a Friday night, but how about an extended getaway? Las Vegas Sands (LVS) is the latest high-profile firm to roll the dice with a new repurchase initiative. Luck has been with the bears since May, however. Indeed, the last five months have been a major flop for shareholders with LVS plunging from near $65 to the mid-$40s. Tepid growth out of China is the obvious culprit (since LVS no longer has significant assets in Las Vegas), and recent travel warnings associated with rising geopolitical tensions do the resort operator no favors.

On Wednesday October 18, LVS reported in-line earnings of $0.55 per share. Sales rose 177% from year-ago levels, slightly beating analysts’ expectations.8 What drove shares higher in after-hours trading, though, was the authorization of the company’s first buyback program since 2020, an upbeat sign after many quarters of pandemic-induced turmoil. LVS held those gains the following session, helping lift other casinos and gaming industry stocks.

LVS: China Weakness, Waning Travel Demand Weigh

The Bottom Line

The buyback bear market presses on. We continue to see significantly fewer corporations issuing repurchase announcements as macro conditions remain unnerving. Investors may look for a broadening of large-company buyback plans beyond just a few consumer names.

Sources:

1BofA Global Fund Manager Survey, BofA Global Research, October 17, 2023,https://rsch.baml.com

2US Economic Indicators: Citigroup Economic Surprise Index, Yardeni Research, Inc., October 19, 2023,https://www.yardeni.com

3LEI for the U.S. Continues to Fall in September, The Conference Board, October 19, 2023,https://www.conference-board.org

42Q Earnings: SSSG improves helped by industry tailwinds; investments to ramp, BofA Global Research, Sara Senatore,https://rsch.baml.com

5Restaurant Brands International Inc., StockCharts, October 20, 2023,https://stockcharts.com

6Molson Coors upgraded to BBB at S&P Global, Seeking Alpha, Jonathan Block, October 5, 2023,https://seekingalpha.com

7Molson Coors Co., StockCharts, October 20, 2023,https://stockcharts.com

8Las Vegas Sands Non-GAAP EPS of $0.55 in-line, revenue of $2.8B beats by $80M, Seeking Alpha, Gaurav Batavia, October 18, 2023.https://seekingalpha.com

9Las Vegas Sands Corp., StockCharts, October 20, 2023,https://stockcharts.com

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.