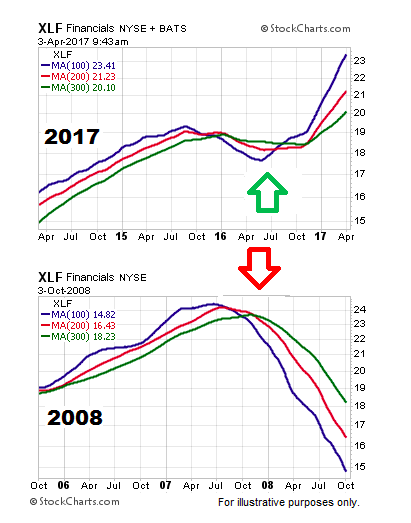

Financial Stocks

In early October 2007, just as the S&P 500 was peaking, financial stocks’ (XLF) 100-day moving average (blue) dropped below both the 200-day (red) and 300-day (green), telling us the odds of bad things happening had increased relative to the odds of good things happening.

How close is the 2017 100-day to dropping below the 200 and 300-day? The answer tells us something about the strength of the long-term trends in 2017.

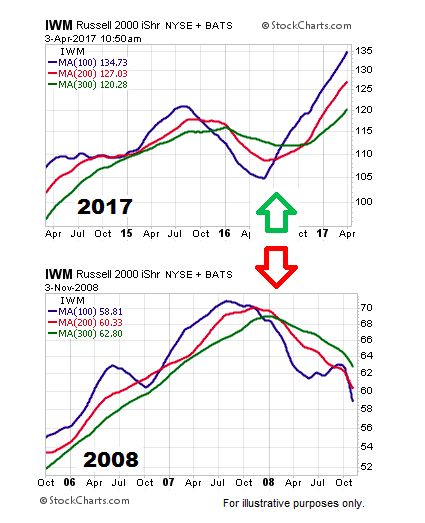

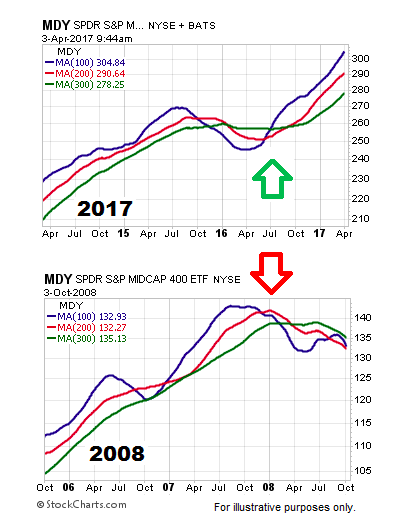

Small-Caps

When we take a longer-term view, the trends in small-caps (NYSEARCA:IWM) and mid-caps (MDY) remain in the favorable camp.

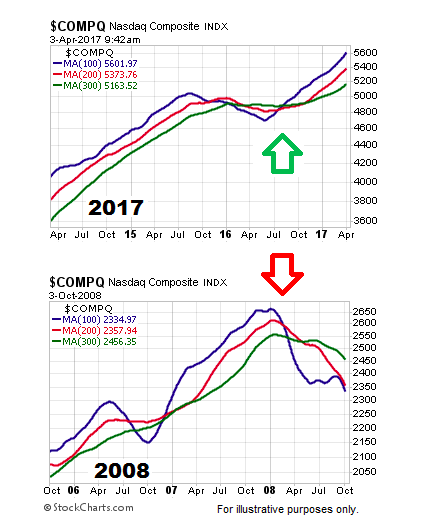

The NASDAQ

The same concepts apply to the April 2017 version of the NASDAQ’s daily chart (INDEXNASDAQ:.IXIC).

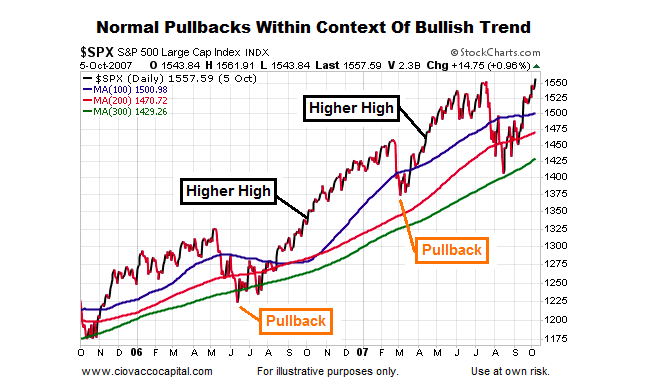

Bullish Trends Make Higher Highs

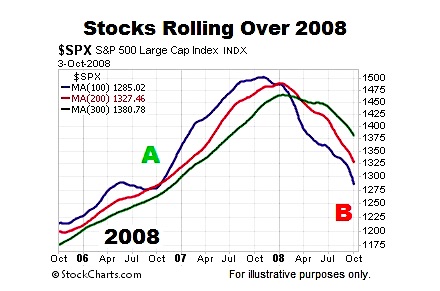

By definition, a bullish trend makes a series of higher highs and higher lows. Therefore, if the trends shown above remain in place, the S&P 500, Dow, XLF, IWM, MDY, and the NASDAQ will eventually make higher highs after the current pullback. To illustrate the concept of higher highs and higher lows, we will focus in on the left side of the chart below, during the bullish phase.

The chart below shows only the bullish phase (2005-2007). Notice how the pullbacks are followed by higher highs. Compare the look of the moving averages during the bullish trend below to their look in April 2017.

A quote from the book Market Wizards provides some additional insight:

“Investors tend to confuse short-term volatility with long-term risk. The longer the time period, the lower the risk of holding equities. People focus too much on the short term, week-to-week and month-to-month price changes, and don’t pay enough attention to the long-term potential.”

Richard Driehaus

The 2017 moving averages below help us stay focused on the long-term potential.

Is it possible the trends flip over in a bearish manner? Yes, it is very possible. However, the evidence we have in hand today (see charts above) does not support an imminent trend reversal. If the evidence shifts, bearish odds will begin to increase. That may happen, but it has not happened yet.

Thanks for reading.

Read more from Chris over on CCM.

Twitter: @CiovaccoCapital

The author or his clients may hold positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.