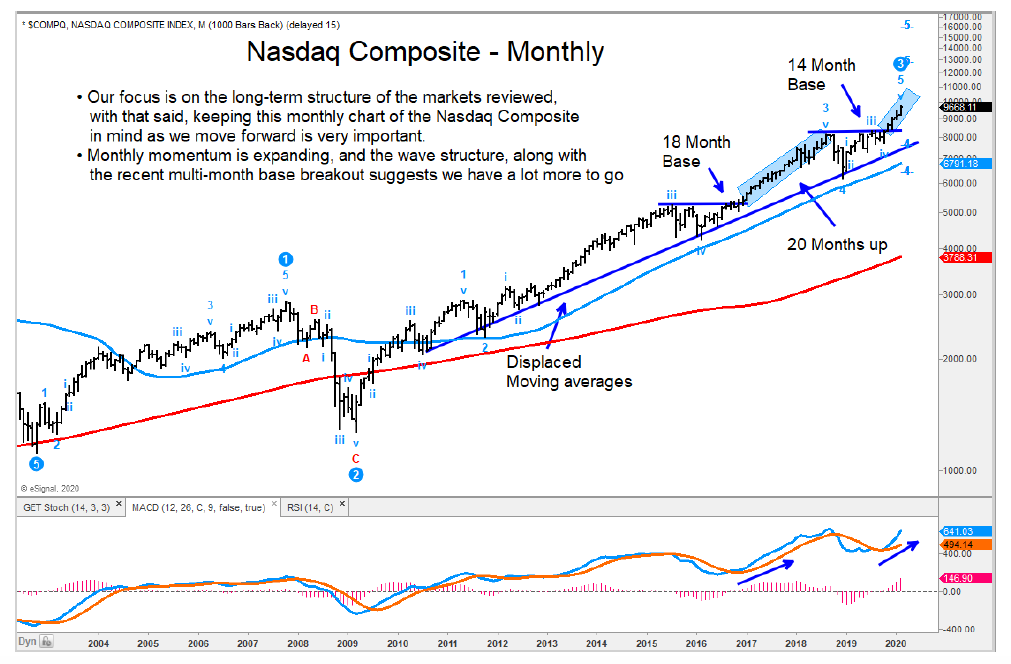

Upside momentum for the S&P 500 Index and Nasdaq Composite remains very robust.

Both the Russell 2000 Index and Mid-Cap ETF (MDY) have turned up from price support and buy zones

The iShares Software Sector ETF (IGV) is very close to our price target area where we would look for a pause.

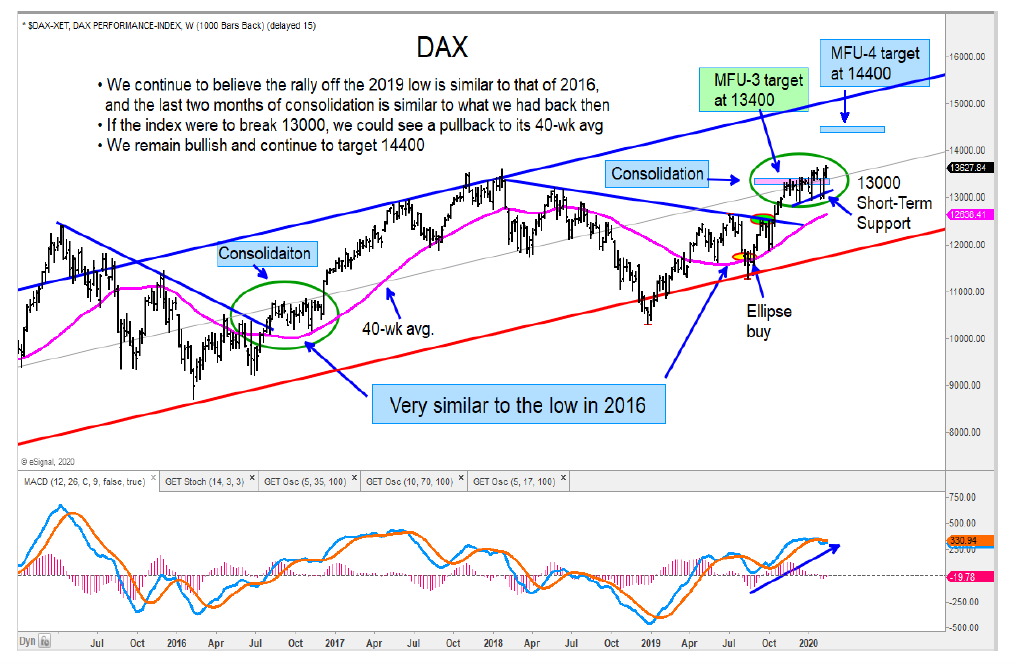

European indices remain bullish – see German Dax Index chart below. I would be adding to Italy’s FTSE MIB Index.

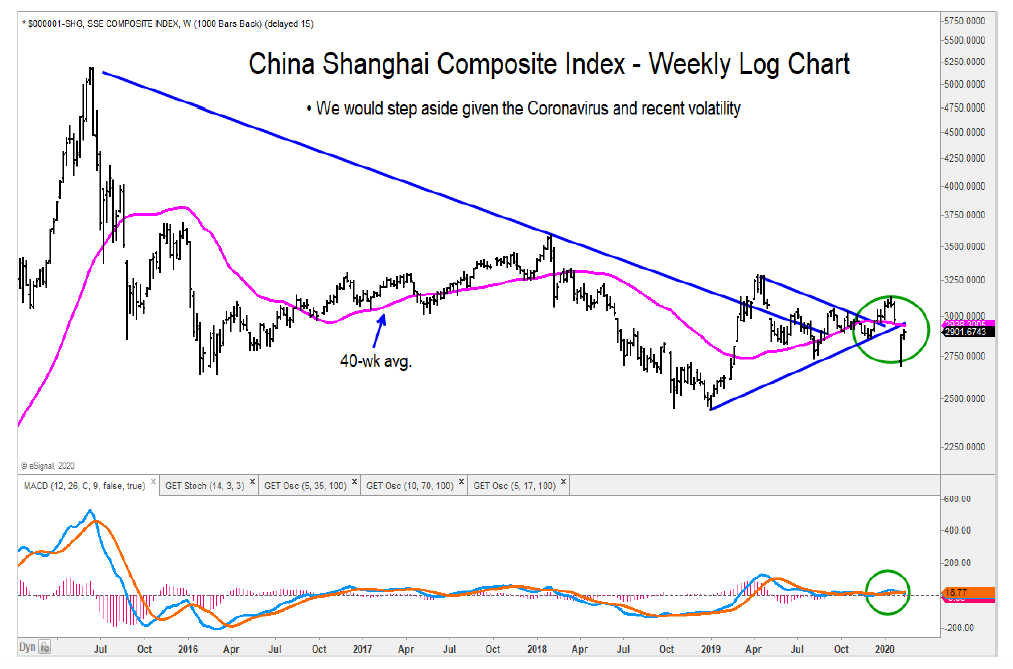

I am on the sidelines for China’s Shanghai Composite after a reversal lower and coronavirus concerns.

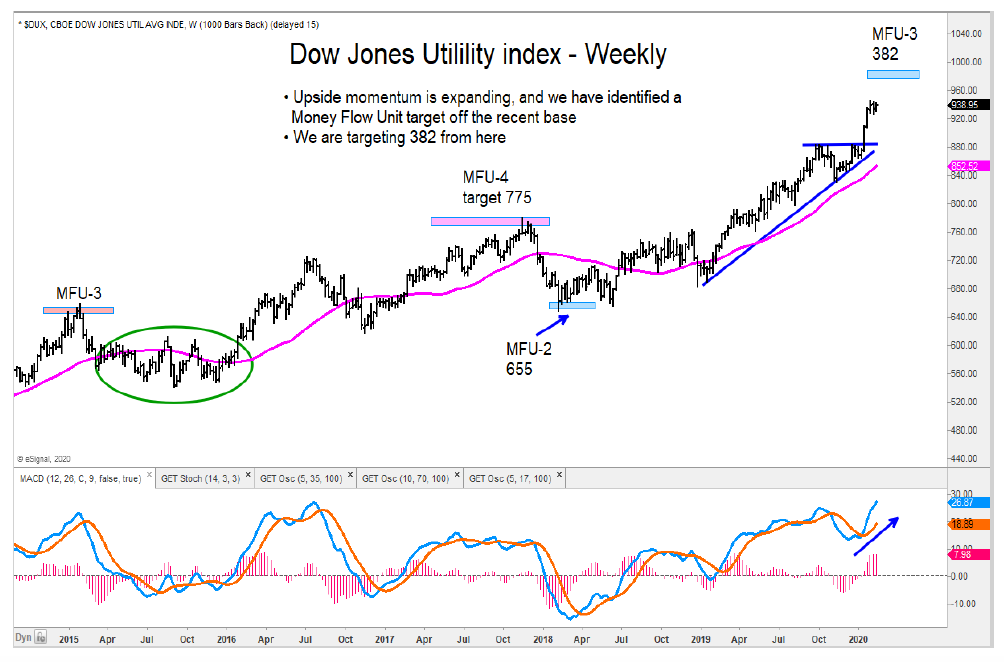

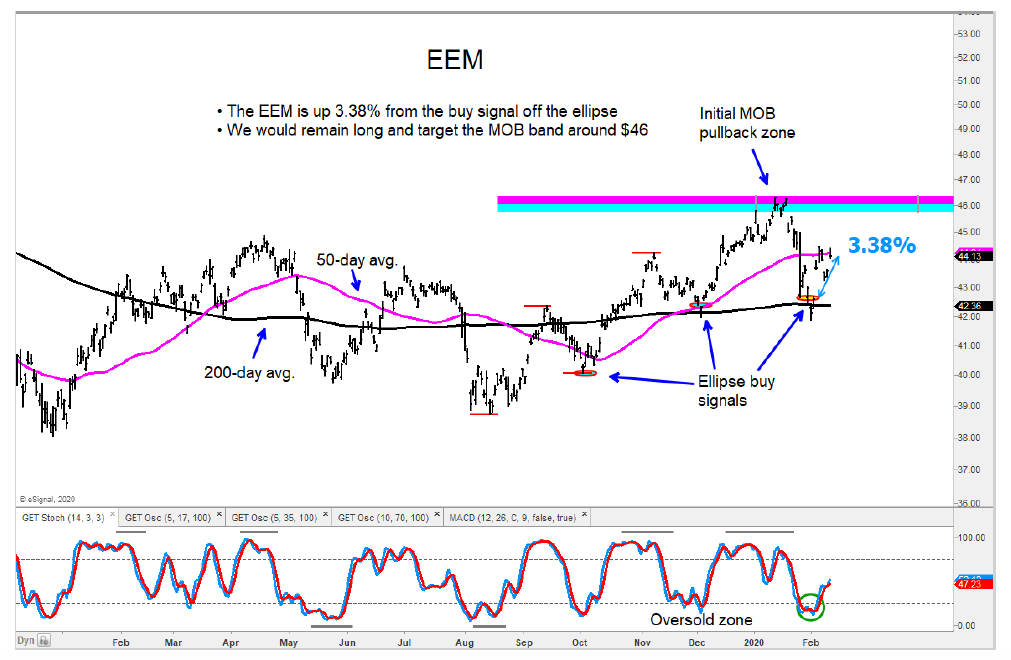

See detailed comments on annotated stock market charts below.

The author may hold positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.