The equity markets broke a two-week winning streak last week with the S&P 500 and Dow Industrial indices falling more than 1.00%.

And the futures markets are suggesting a sharp decline on Monday.

Expectations for growth in the worldwide economy are coming down a bit due to the coronavirus scare.

Investors are not anticipating a global pandemic but have become more aware of the disruptions that are occurring in China and spilling over into the U.S. economy. Apple lowered its revenue guidance as it closed most of its 42 stores in China, which account for one-fifth of its total sales. We can expect to see more profit revisions from other companies.

Additionally, the Markit Services Purchasing Managers’ Index which is based on data from over 400 private sector companies, unexpectedly came in below 50 indicating economic contraction. Activity in the manufacturing sectors also weakened. This may have been linked to the coronavirus.

The economic data along with some revisions in earnings estimates will likely create stock market volatility in the coming months.

The disruption in China’s economy is sending investors to seek out the safe havens of gold and Treasuries, driving the dollar higher and the yield on the 30-year U.S. Treasury bond to an all-time low.

The yield on the benchmark ten-year Treasury note fell below the 3-month Treasury yield creating an inverted yield curve which is considered to be a recession indicator. I currently do not see any additional indicators that suggest a recession is on the horizon.

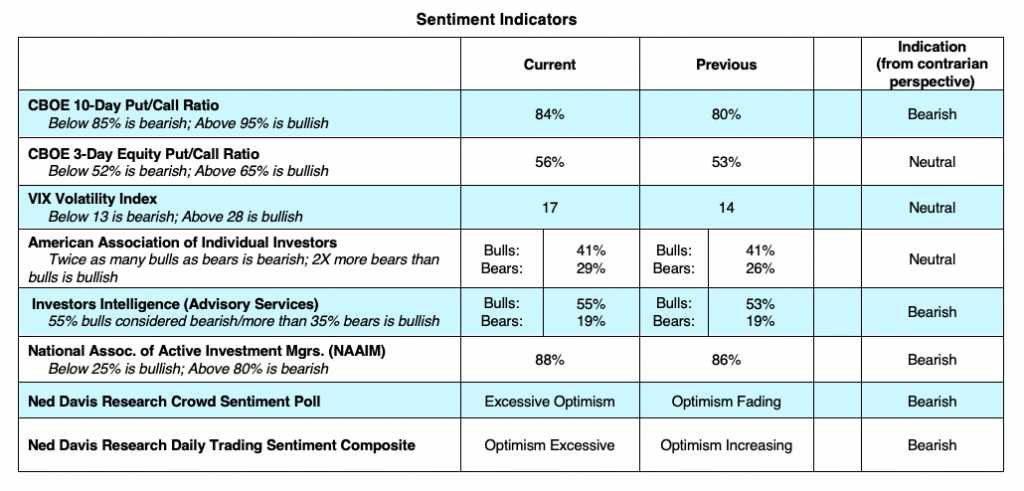

Last week we cautioned that should optimism turn more aggressive we would expect to see a pullback in the market. Most of the sentiment indicators we follow currently show a higher level of complacency.

The Investors Intelligence Advisory Services (a contrarian indicator) shows twice as many are bullish as are bearish. We are seeing other evidence of excessive investor optimism in the put/call ratios and the Ned Davis Research sentiment polls. Investors remain surprisingly bullish in the face of the coronavirus, lukewarm economic news, and earnings downgrades.

Since there is so much uncertainty surrounding the coronavirus impact on the global economy, the optimism seems to have gotten ahead of itself leaving the markets vulnerable should the virus news worsen or global economic conditions deteriorate further.

History shows that epidemic threats do not cause sustainable damage to the world economy and that the global economic rebound will likely be delayed but not derailed. This year we will begin to see the impact of the United States Mexico Canada Trade Agreement which will be a boom for agriculture, technology and manufacturing. A middle-income tax cut 2.0 is on the table for year-end which should be a huge stimulus for the U.S. economy.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.