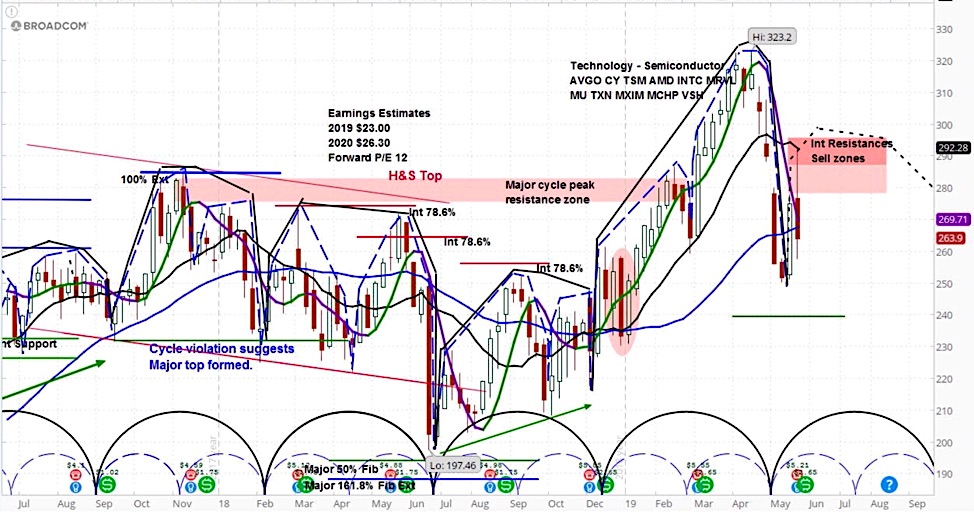

Broadcom (NASDAQ: AVGO) Stock Daily Chart

Amongst the individual stocks that moved significantly last week was Broadcom (AVGO), which fell sharply on Friday after the company’s earnings failed to impress investors.

Broadcom reported earnings per share of $5.21 and revenue of $5.5 billion, compared to analyst estimates of $5.19 and $5.7 billion. Management also lowered its guidance for the fiscal year to $22.5 billion, which was below the $24.3 consensus.

CEO Hock Tan explained that, “We currently see a broad-based slowdown in demand, which we believe is driven by continued geopolitical uncertainties, as well as the effects of export restrictions on one of our largest customers.” That of course is Chinese telecom, Huawei.

Based on the market cycles for Broadcom’s stock AVGO, we believe it may be entering the declining phase of its current cycle. After all, it hit our intermediate resistance zone and failed.

While it is relatively early in this stock cycle, we believe this is a bearish indicator and are watching closely to see if it breaks the cycle low at $250, which is the point from which it started the rising phase of this cycle.

While the stock may hold up for a few weeks, this overall trading pattern suggests that breakdown may not be far off.

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.