Monday after the close, some warnings signs from our risk gauges popped up.

These are especially interesting given the number of bulls and the amount of money coming into the market.

Technically, we still have the resistance that has not cleared in small caps, retail, or transportation.

And this with a declining dollar, bullish gold, plus renewed buying in agricultural commodities.

Could these warnings reverse?

Yes, but this is the most risk off we have seen as far as the gauges since April.

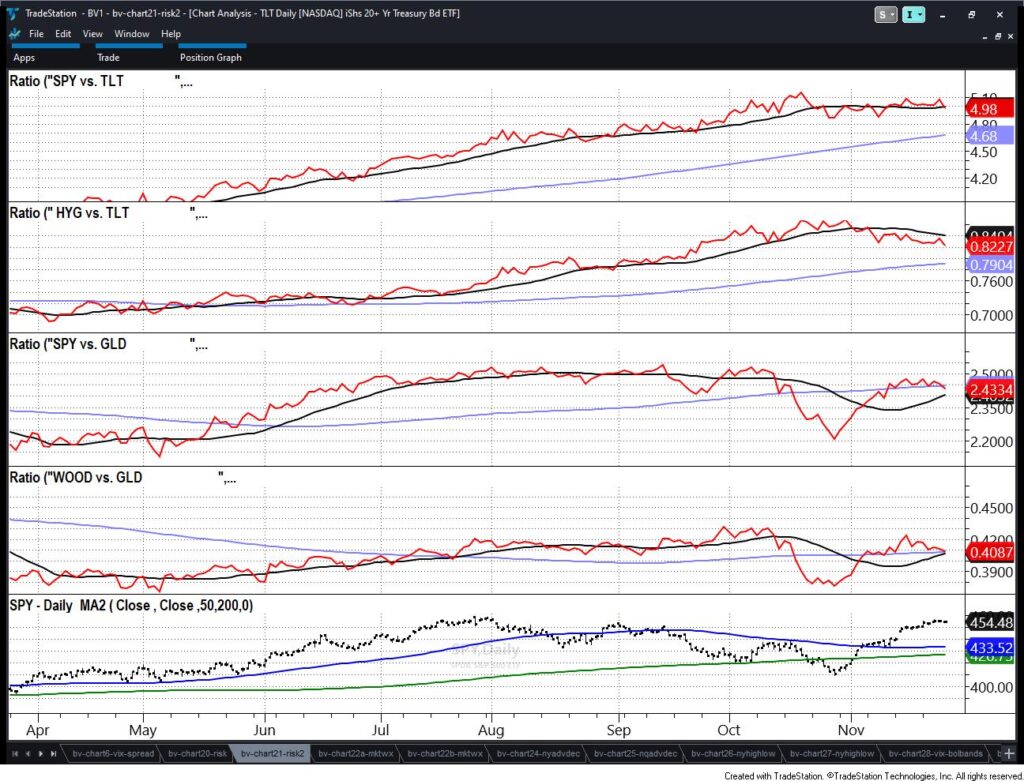

Risk Gauges: WARNINGS:

SPY (S&P 500) now on par with TLT (long bonds)-you don’t want TLT to outperform-risk off.

HYG (junk bonds) underperforming TLT risk off.

SPY is now underperforming GLD (gold)-risk off.

WOOD underperforming GLD-risk off.

Risk off means just that-so -pay attention-these gauges are incredible.

On another note, check out Your Daily Five with 6 picks and setups I did for StockchartsTV.com today, which should be on YouTube later.

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) 450 support 465 resistance

Russell 2000 (IWM) 181 resistance 174 support

Dow (DIA) 360 resistance 346 support

Nasdaq (QQQ) 388 now pivotal support

Regional banks (KRE) 45 big resistance

Semiconductors (SMH) 160-161 pivotal support

Transportation (IYT) 235 support

Biotechnology (IBB) 120 pivotal

Retail (XRT) 65 resistance and 60 pivotal support

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.