Are The BRIC countries Working On A Break Out? Emerging Minds Want To Know

The BRIC acronym was developed to denote top emerging market nations with excess growth potential. The countries denoted in this basket include: Brazil, Russia, India, and China. While you can invest directly in any one of these nations, there are also more diversified ETFs that group all four together.

Over the last several years, we have seen this group of countries malignantly underperform U.S.-focused investments. Nevertheless, a trend change may be stoking the fires for a return of strength in the BRIC theme. Let’s examine some of the top ETF players in this field.

KNOW WHAT YOU OWN: BRIC ETFs

Reviewing The Playing Field – David Fabian

The number one fund by asset size is the iShares MSCI BRIC ETF (BKF), which has $178 million in total assets. This portfolio owns 305 stocks of the aforementioned countries through a market cap weighted structure. The end result is a significant weighting towards Chinese stocks with over 55% of the portfolio, followed by India (19%), Brazil (16%), and Russia (9%).

The BKF portfolio is primarily concentrated in financial, technology, and energy companies. Brazil and Russia especially are known for their heavy reliance on the energy space to drive their economy, while China focuses heavily on technology and finance.

While not as diverse as the 800+ stocks in the broad iShares MSCI Emerging Markets ETF (EEM), BKF can provide a more specialized regional play for those who want to focus on a more niche theme.

Another variant fund in this space is the SPDR S&P BRIC 40 ETF (BIK). This ETF takes a more concentrated approach by investing in just 40 of the largest stocks in the BRIC nations. This magnifies the effect of the outsized China weighting with 72% of the total portfolio allocated to that country.

BIK has $75 million in total assets and charges an expense ratio of 0.49%. Investors considering this fund should carefully evaluate the smaller number of holdings and overall country allocation versus BKF to determine if it suits their goals.

Lastly, the Guggenheim BRIC ETF (EEB) is another option with a unique portfolio of 109 emerging market stocks. This ETF promotes greater emphasis on Russia, India, and Brazil within its index and has technology listed as the top sector allocation. EEB also has $75 million in total assets and charges a net expense ratio of 0.69%.

Technical Review – Aaron Jackson

Whenever we have funds made up of main components, it’s helpful to break them down and view performance and relative performance.

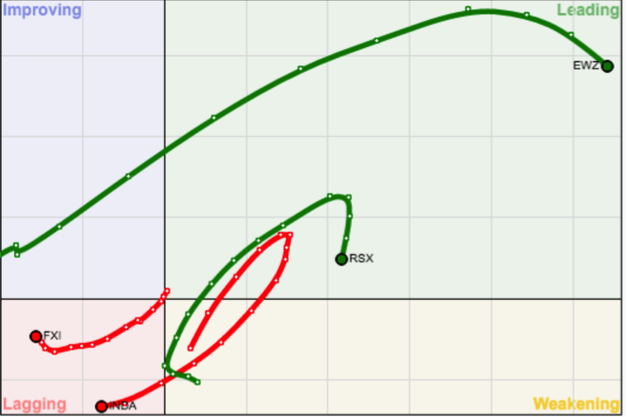

We see the BRIC rally has largely been led by Brazil and Russia. Naturally, the fund with the most balanced exposure is leading the pack performance wise.

One interesting trend is that the volume in BRIC ETFs has fallen ever since the BRIC mantra became popular in the mid 2000’s.

Readers of this series know that many ETFs are just made to be sold to you. BRIC was hot theme of a decade ago, so the street started selling.

We’ve seen a 30% rally in EBB in two months and the interest still wanes. Nobody cares about the group. Nobody wants to sell it, nobody wants to buy it. That’s just what happens when an old stock market gets old and dies.

Conclusions

- The best pure BRIC play, based on an evenly distributed allocation, is EEB.

- The vast array of ETF products allows investors to finely tune their allocations

- Volume in BRIC ETFs is at an all time low. These low volumes don’t suggest a lack of price discovery as they still track the underlying assets. They just lack interest.

Thanks for reading!

This article is part of a series co-authored by David Fabian (fmdcapital.com) and Aaron Jackson (northstarta.com). Each week we will be unlocking the secrets to some of the most talked-about exchange-traded funds in the market. The goal is to better understand what you own or elevate new ideas to the forefront of your watch list.

Twitter: @fabiancapital @ATMCharts

Neither author holds a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of each other or any other person or entity.