“You got to know when to hold ’em

Know when to fold ’em

Know when to walk away

And know when to run”Kenny Rogers- The Gambler

So how do we know when to hold or fold ’em bonds?

If you ask bond traders, you are likely to get many different answers. Some will say it depends on future inflation rates. Over the last ten years, the Fed has become a popular response. Economic growth rates, demographics, and the dollar are also likely replies.

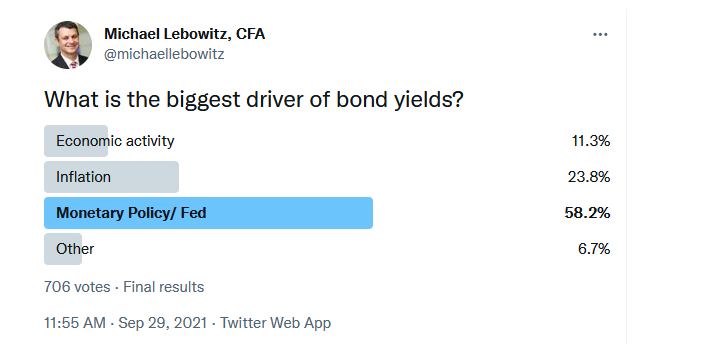

According to my Twitter followers, over half think the Fed is the most significant determinant of bond yields.

In this article, I explore a few essential factors that tend to dictate bond yields. I aim to assess whether the recent increase in yields is a buying opportunity or foreshadows even higher rates.

This article is not just for bond investors. Given the importance of low yields to justify extreme equity valuations, rising yields will not only dampen earnings multiples but weigh on earnings.

Federal Reserve Monetary Policy

The Fed is the runaway winner in our Twitter Poll. It is not surprising, given it purchases $120 billion per month of U.S. Treasuries (UST) and MBS (mortgage-backed securities). These outsized purchases directly impact treasury and mortgage yields. Other assets also benefit from the excess liquidity and lower rates, such as equities, crypto, and some commodities.

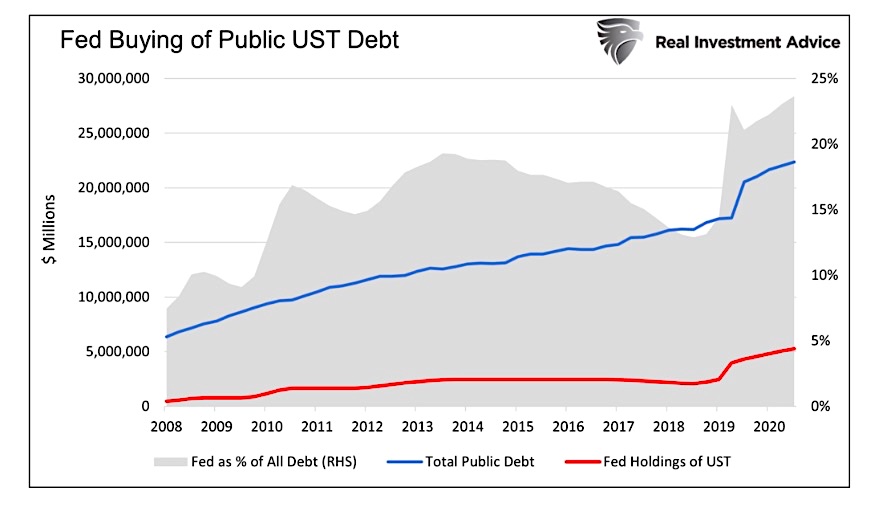

The Fed now owns nearly 25% of all public U.S. Treasury debt outstanding, as shown below. Since 2020, the Fed has bought more than half of the debt issued by the Treasury. Further, the Fed owns another $3.25 trillion of mortgages and other assets that also influence yields.

The Fed is the dominant “investor” and marginal price setter of Treasury yields. Their role is even more prominent considering a good percentage of Treasury debt is “put away.” These are bonds held to maturity that will likely never be sold. Foreign nations, pension funds, insurance companies, and other investors are such holders. As a result, the float, or amount of bonds available for purchase, is well less than the total supply.

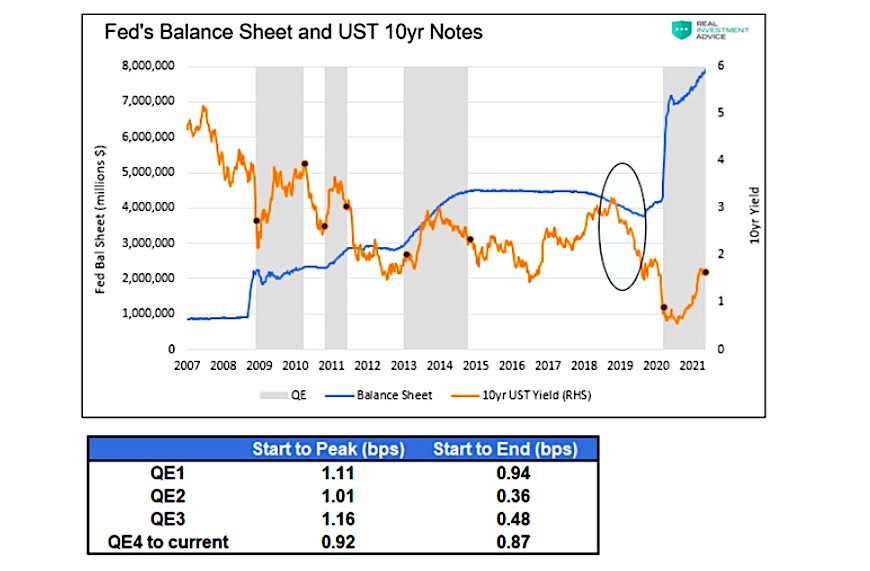

Given the Fed’s enormous footprint, how does QE influence bond yields? In Taper Is Coming Got Bonds? we compare bond yield changes to the size of the Fed’s balance sheet.

The article’s results are not intuitive. One would think yields would fall as the Fed buys bonds and vice versa. Quite the opposite occurs. To wit: “Ten-year yields tend to rise about 1% from the start of QE to peak yield levels during QE. Equally important, yields tend to fall toward the end of QE.”

As shown in the graph and table below, yields rise during QE. Equally important, yields decline after periods of QE.

With the Fed set to taper in November and finish in the second quarter, this metric argues for lower yields.

Economic Activity and Inflation

Bond traders, old enough to remember a time before 2008 when the Fed was not the dominant price setter of U.S. obligations, may claim economic activity and inflation matter most for bond yields.

Economic Activity

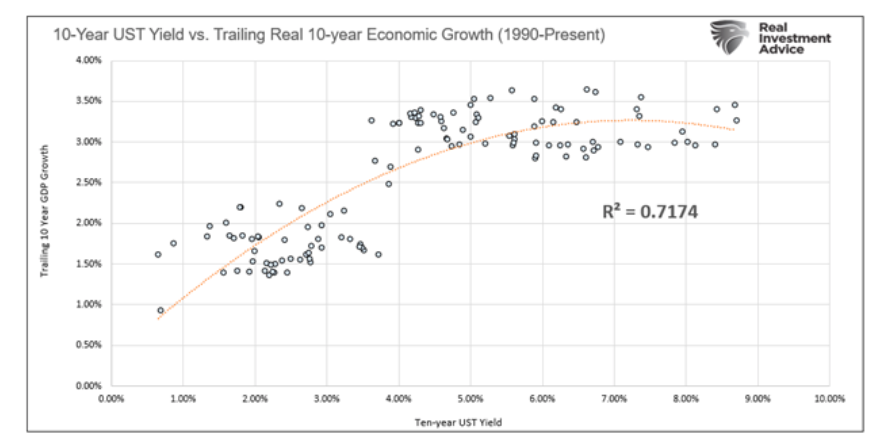

The chart below compares quarterly instances of real ten-year trailing economic growth rates versus the yield on the 10-year UST. The correlation is statistically significant at .71.

Given the strong correlation, we can confidently form a reliable forecast for ten-year yields if we can reasonably forecast future economic growth.

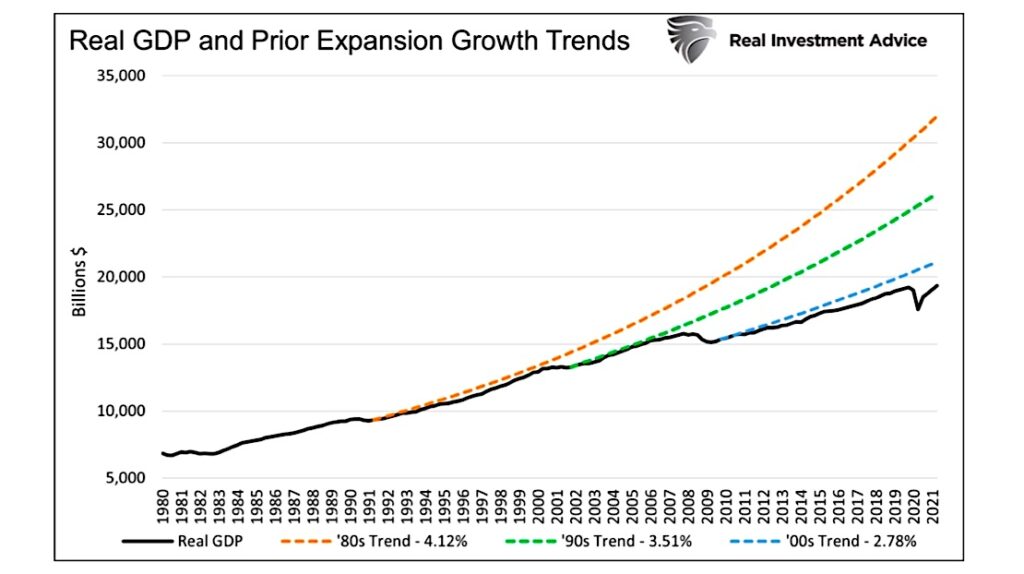

The graph below helps us. Following each of the last three recessions, the trend real growth rate declines. This is a consequence of increasingly larger amounts of unproductive government spending during and after each recession. Given the massive amount of unproductive debt issued over the last year and a half, we suspect another step down in the growth rate is coming.

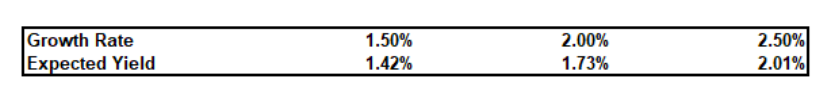

I forecast real economic growth to average between 1.50% and 2.50% over the next ten years. The Fed’s “longer run” projection of 1.90% falls right in the middle of this range. The table below uses the scatter plot to determine where 10-year UST yields should be in three growth scenarios. Based on the current yield of 1.50, yields seem fair given growth forecasts.

Inflation and Inflation Expectations

In theory, investors should demand a yield greater to or equal to the expected inflation rate and credit losses. Such a sufficient yield ensures purchasing power is, at a minimum, preserved by the investment. Treasuries are supposedly risk-free; therefore, UST yields should equal or exceed expected inflation.

Theory and reality are often two different things, as is the case today. The expected rate of five-year inflation is approximately 2.50%. The current 10-year bond yield is almost half of that. There are many reasons for such inefficiency. Chief among them is the Fed’s large footprint and strong demand for high-grade collateral to back derivatives. The Fed’s now trillion dollars plus reverse repurchase program is evidence of collateral needs. More on that in another article.

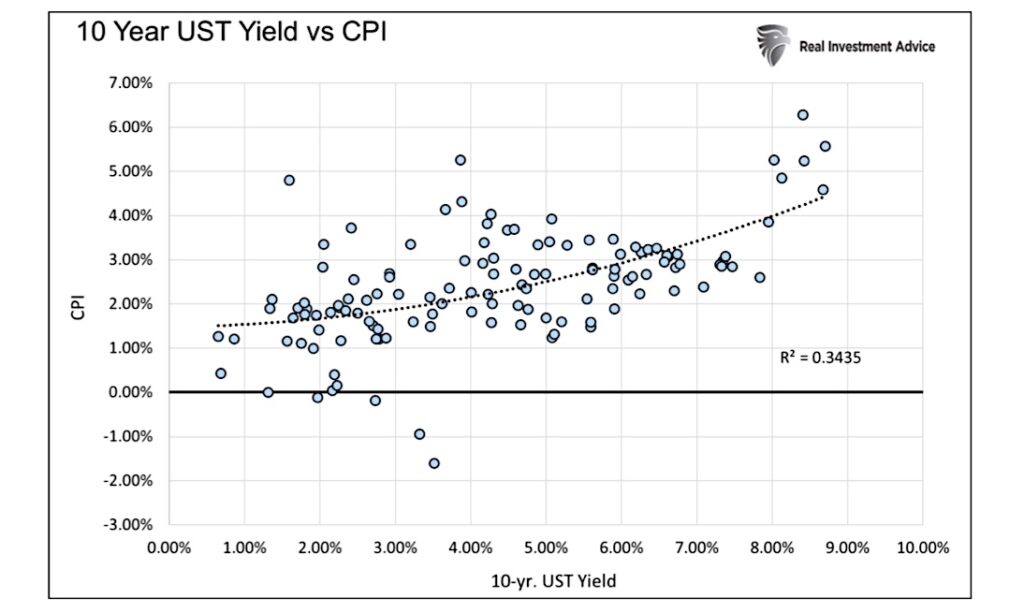

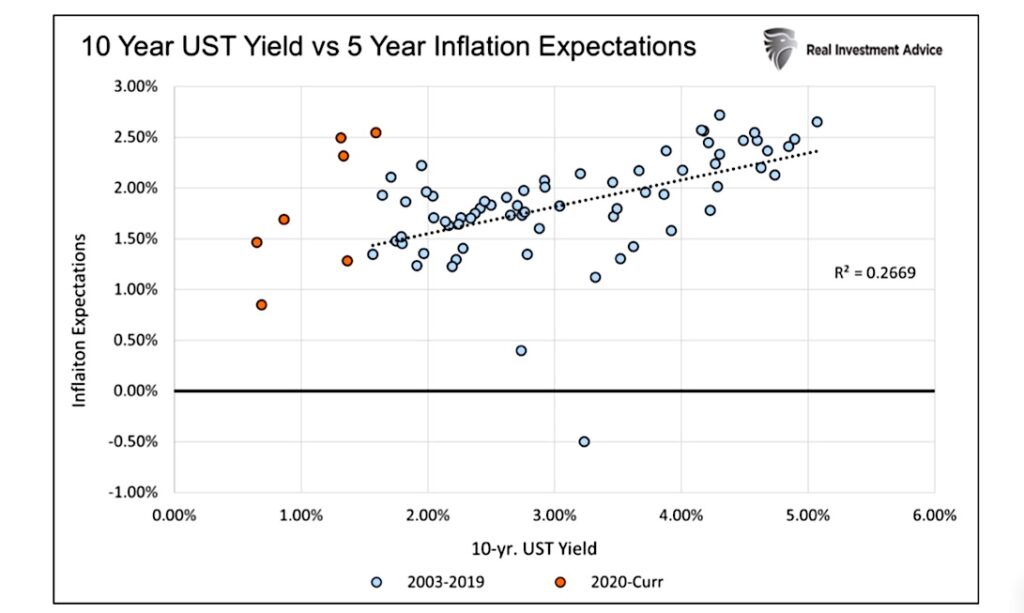

The two plots below show the relationship between yields and inflation, and inflation expectations.

While not as strong as the relationship between prior GDP and yields, there is a decent correlation between inflation and yields. If inflation rates and inflation expectations revert to pre-pandemic norms of 1.50-2.00%, we should expect yields in a range of 2.00 to 4.00%. It’s a wide range but consider the low end of the forecast is a good amount higher than current yields. Given the profile of expected future debt issuance, we suspect the Fed will do everything in its power to prevent a yield north of 2.50% or even less.

Other Forecasts

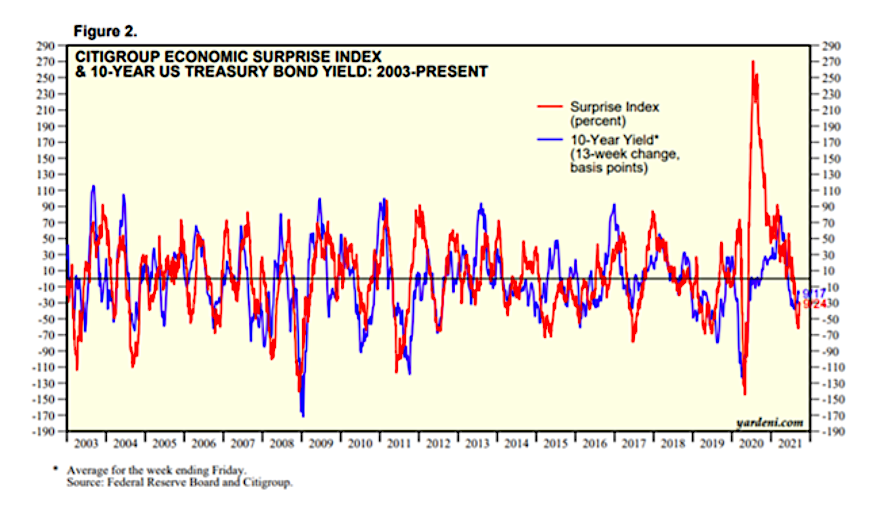

The graph below, courtesy of Ed Yardeni, shows the strong correlation between the Citi Economic Surprise Index and ten-year UST yield changes. The Citi index measures economists’ consensus economic data estimates versus actual readings.

Over time the index oscillates as economists tend to overestimate economic activity then underestimate it. As shown below in red, economists are now overly optimistic as their forecasts are recently better than actual data. The index is likely reaching a point where economists start under-forecasting economic data. If true and the correlation in the graph holds, yields are likely to rise over the coming months.

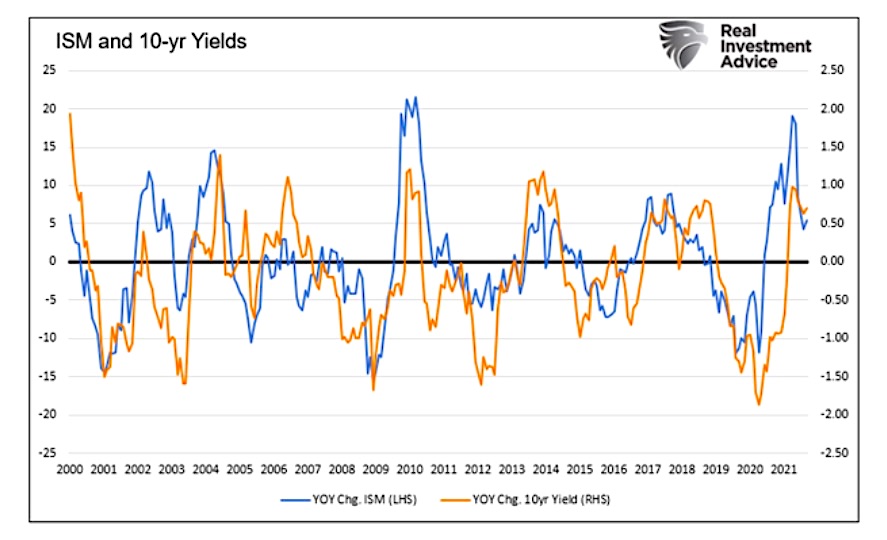

The Institute for Supply Management (ISM) publishes a closely followed survey of manufacturing conditions. The survey has a strong relationship with economic growth and, therefore, yields. Like the graph above, the survey results tend to oscillate up and down, albeit much less frequently.

The ISM Index is currently just below 35-year highs. Due to the nature of the survey questions and the range of possible answers, it is difficult for the index to rise or even stay at current levels. Even if the index defies gravity and remains near multidecade highs over the next few months, the index’s year-over change will fall to near zero. Normalization to pre-pandemic levels will result in a 5-to-15-point year-over-year decline. A similar move in yields could result in yields at or near 0.00%.

The Citi Index argues for higher yields in the next few months. Conversely, the ISM survey points to lower yields.

Summary

What would Kenny Rogers do?

As investors, we must read the table and figure out our odds of success. With yields so low, and as a result, the cushion for error minimal, this has never been so important.

Short-term traders are dealing with a period of indecision in the bond market. Some investors are nervous as inflation is running hot, and they wonder who will shoulder the heavy supply of Treasuries if the Fed tapers. Conversely, as we have seen, when the Fed steps away from bond purchases, yields tend to fall.

I believe economic growth will continue to slow, and long-standing deflationary pressures will re-exert themselves. Purely based on economic growth, bonds are reasonably priced.

Recent inflation rates and current inflation expectations argue for higher yields. The Citi Surprise Index points to a bump in yields in the coming months, while the ISM Index favors lower yields.

So, what to do? We think the answer goes beyond history and statistics. The economic threshold for higher yields is minimal. An outbreak higher is likely to result in weaker economic growth and deflation ultimately.

The Fed understands the debt trap our economy is in and will do everything in its power to avoid yields high enough to break the economy.

As my Twitter followers, I think the Fed matters most for bond yields. If they can manage inflation, we must assume they can control yields.

My advice- hold ‘em.

Twitter: @michaellebowitz

The author or his firm may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.