I recently shared my weekly sentiment snapshot, focusing on the relationship of stocks v bonds and what it may mean for the reflation trade.

You can find that post in its entirety here.

The key takeaways were:

- Equity investors are reassessing the fundamentals outlook.

- Bond investors seem to be already well ahead of them on that front.

- Bond survey trends point to a counter-trend move in bond yields, and the macro momentum seems to line up.

- Questions on bonds may lead to questions on the reflation trade.

Below are two charts from that post.

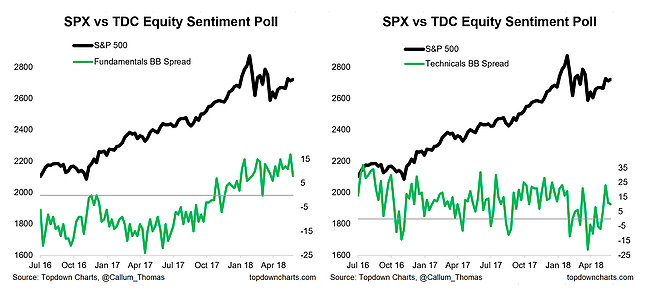

Equity Fundamentals vs Technicals

Starting as usual with a look at the weekly survey results for equity “fundamentals” vs “technicals” sentiment (the survey asks respondents whether they are bullish or bearish for primarily fundamental vs technical rationale), technical net-bulls dropped slightly, but it was the drop in fundamental net-bulls that caught my attention this week. You could say that based on the latest results investors are starting to reassess the fundamentals outlook. As I noted in the latest weekly S&P500 #ChartStorm, the fundamentals (at least earnings) have been looking pretty decent, but the outlook is by no means baked in.

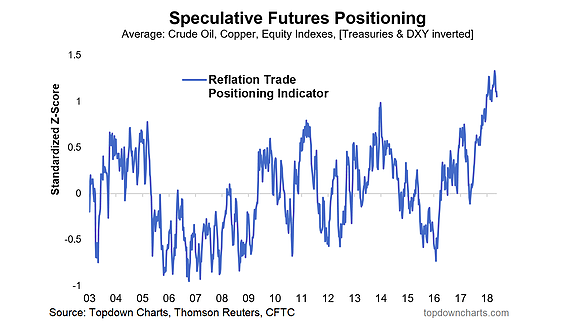

Reflation Trade at Risk

Going back to the reflation trade speculative futures positioning indicator I introduced a couple of weeks ago, it has since then rolled over from the extreme crowded net-longs. As a reminder it takes the average z-score of standardized net speculative positioning in Crude Oil, Copper, Aggregate US Equity Indexes, and Treasuries & DXY – both inverted (to align the signal). Basically I wanted to include this one because if you’re questioning the selloff in bonds you might as well be questioning the whole reflation trade. And if serious questions get raised then guess what, there’s a whole bunch of traders on one side of the boat who are going to get caught wrong-footed, and we all know how those situations usually end…

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.