Despite the ever-present assurances to the contrary from Developed Market equities over the last few weeks, there’s always a bear market somewhere. Look no further than Light Sweet Crude Oil (CL), off another -2.75% today, ostensibly due to Saudi Price Cuts intended to increase competitiveness versus US Shale. That brings Crude’s slippery slope (cliff dive?) to -27.43% since it’s June high at $107.68/bbl and to -20.61% YTD.

Crude Oil spilled out of the Descending Triangle it’s been winding through since the mid-October lows, violently snapping the $80 handle it’s been leaning against to push into the first of two 1.5-Year Bullish Butterfly Potential Reversal Zones (PRZ) near $78/bbl. The second PRZ? At $68.50/bbl.

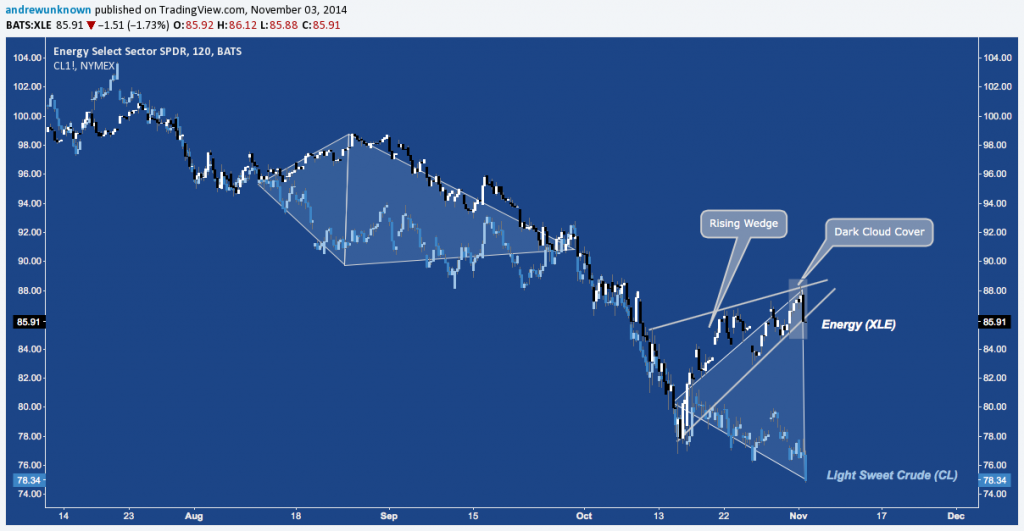

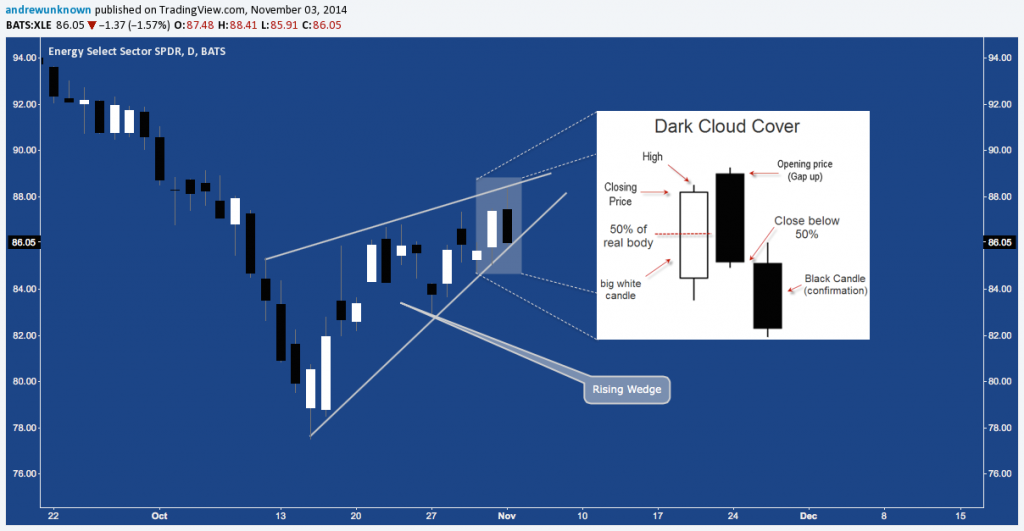

The Energy Select Sector SPDR (XLE) had a good day, by comparison, but still finished off almost -1.7% to close near $86. Here’s the ETF winding out a Rising Wedge (check out Bulkowski’s data on Rising Wedges here) posting a Dark Cloud Cover candlestick pattern (Bulkowski on DCCs here) that almost entirely negated Friday’s advance:

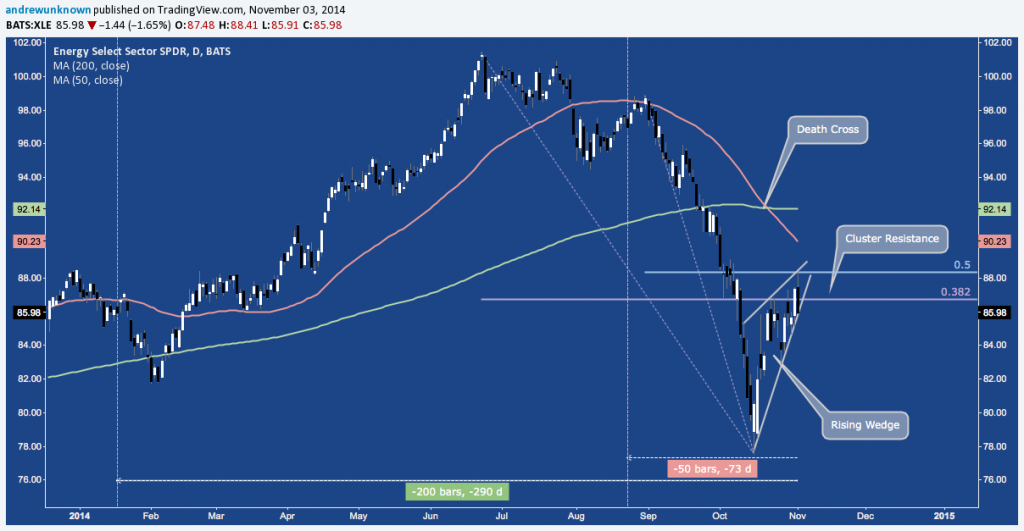

That performance comes just as XLE pushes to the Rising Wedge apex at fibonacci cluster resistance between $86.50-$88 and shortly after completing a Death Cross (which, incidentally, has been followed by a net gain). Looking at the 50-Day and 200-Day SMAs that create this technical event, we can see the 50-Day is about to shed the remainder of late August’s bear flag, while the 200-Day is about to get rid of January’s correction before it starts working off February-June’s massive run. All told, this suggests the 50-Day isn’t likely to re-cross the 200-Day to the upside in the short-term.

All of which begs the question: will XLE break higher to extend it’s divergence from CL?

Or will it break down – to close the ever-widening chasm that has developed since the 10/15 bottom, losing the convergence battle to (as it usually does) and catching down to Crude Oil? Stand by for the resolution; or just watch the documentary to see how this ends.

Twitter: @andrewunknown

Kassen holds no exposure to securities/instruments mentioned at the time of publication. Commentary provided above is for educational purposes only and in no way constitutes trading or investment advice. “There Will be Blood” copyright/distributed by Paramount, Miramax Films. “Movie Poster” image via movieforums.com.