In October, we wrote that the S&P Biotech Sector ETF (symbol XBI) might become a good value buy some months in the future. After that writing, the fund rose higher and for longer than we expected, causing us to revise our Elliott wave count.

However, the basic theme remains the same, and price is now approaching the areas where longer-term traders might consider shopping for entries in this Biotech Sector ETF.

It is important to note that our forecast and price targets for the biotech sector ETF does not match our general expectation of declining stock indices during the early part of 2016. While our charts for the major stock indices favor the possibility of stronger declines in coming months, XBI offers the possibility of a sizeable corrective rally.

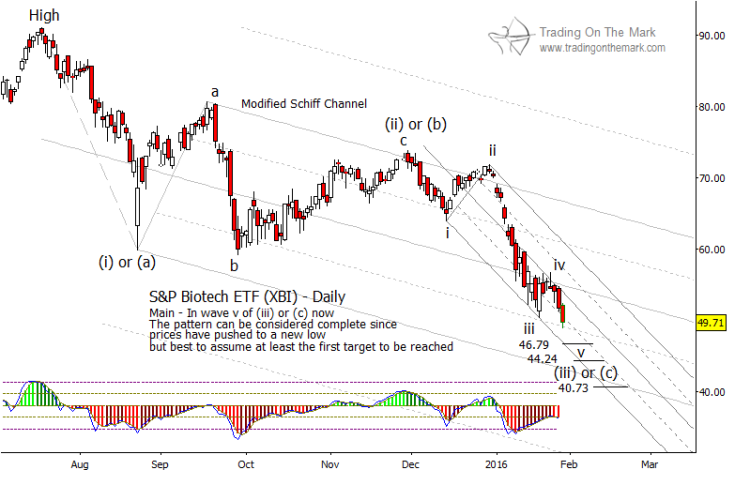

The Biotech Sector ETF (XBI) Daily Chart

If XBI is heading downward in a major impulsive (i)-(ii)-(iii)-(iv)-(v) move from its July 2015 high, as the internal structures of the swings indicate, then we would expect to see a fourth-wave correction appear soon. There are several areas to watch for support to develop, and that suggests that a useful strategy for seeking a long trade might be to scale into a position in small increments – either buying at the levels or (more safely) buying small pullbacks that create higher lows after a support level has been tested.

Fibonacci-related support areas and price targets for XBI include approximately 46.79, 44.24 and 40.73, and the lower edge of the large Schiff channel on the chart could also become a price support area.

The uncertainty about which level will hold also means that traders seeking new long positions might need to allow price to go against them for a bit (again, another reason for using scale). Meanwhile any traders who are already in short positions should consider scaling out of trades or lowering stops as price approaches the support areas.

A fourth-wave upward/sideways corrective move could take price back to the channel’s center line or even higher, and thus could represent a relative increase of 15% or more. If that type of pattern begins forming on the Biotech Sector ETF, we will be able to estimate upward targets based on where wave (iii) ends.

If our main scenario is correct, with the Biotech Sector ETF in the process of making a large five-wave move downward, then a fourth-wave correction should not exceed the August low, which represented wave (i) of the five-wave sequence. On the other hand, if price exceeds that level of 59.86 on a bounce, it would imply that a larger upward pattern might be forming. In that alternate scenario, we would label the low as wave (c) instead of wave (iii), and we would begin looking for a way to count a developing upward impulsive move that could potentially reach new highs.

Keep in mind, we believe the more bullish alternate scenario is less likely than the fourth-wave correction scenario, but both scenarios imply a bullish trading opportunity.

Keep up with this and other markets by following us on Twitter and subscribing to our newsletter. Thanks for reading.

Continued Reading: Russell 2000 Index: Following The Bear Market Roadmap

Twitter: @TradingOnMark

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.