Within the last 6 months, 22 Biotech IPOs have occurred in the US. Though that may seem modest in a market populated by thousands of stocks, the figure represents a deluge of companies dashing for cash inside the violent IPO current sweeping through the broader market. “The Biotech window is open” is the phrase de rigueur; and Life Science firms are wasting no time filing amidst investors’ fervid enthusiasm for new offerings in the space.

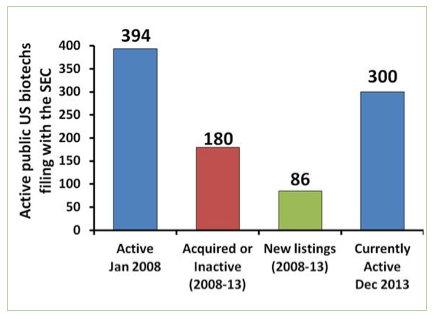

In context, these 22 filings come at the end of a 6-year period (as of 12/31/2013) that saw only 86 total initial public offerings in the Biotech space.

By market cap, this subset of the 76 Healthcare sector IPOs that have occurred over the last year breaks down as follows:

- 3 small cap (<$2B)

- 14 micro-cap <$50M-$300M)

- 5 nano-cap (<$50M)

This is roughly in-line with the market cap distribution in the industry: Biotech has always carried a majority concentration of smaller companies. But strikingly, though they’ve all been publicly traded for less than half a year (and half of them for less than a quarter), this constituency makes up 8% of all Biotech companies with a <$1B market cap.

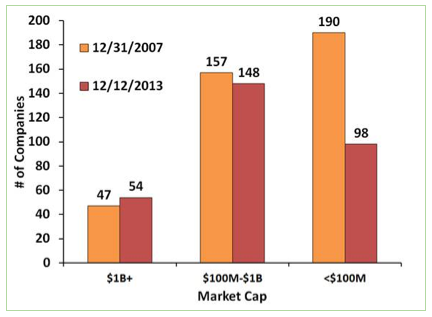

These companies – and their established peers who are raking in new cash with follow-on offerings – come to market in an exciting environment of research advances, a recent track record of successful clinical trials and an FDA eager to fast-track approvals. Some of them will become highly successful; but whatever their individual potential, all of these companies are highly vulnerable to broader market forces. Check out these stats on Biotech market cap distribution (through 12/31/13) and how each segment has been impacted since the last time IPOs were running at a cyclical peak.

How have these 22 companies performed? As a baseline, the popular cap-weighted NASDAQ iShares Biotech ETF (IBB) is up 12.51% year-to-date (YTD), +18.43% in the last quarter and +26.12% over the last 6 months. By comparison, our list of Biotech IPOs boasts an average YTD performance of +28.34%; and since inception (i.e. 3-6 months out for 11; within 90 days for the other 11), they average +90.34%. Only 3 of the 22 are in the red v. their IPO price; and only 1 those is down more than 3%.

As I noted over the weekend (in Biotech Bubble? A Nervous Speculator’s Field Guide), there is an emergent trend in which the smallest and newest Biotech issues are steadily out performing:

Of the Top 100 performing Biotechs YTD…44 are micro-cap (<$300M)

and:

[I]n the past few weeks, smaller issues have entered a season of relative strength. To wit, the equal-weight S&P Biotech ETF (XBI) is radically outperforming the cap-weighted iShares Biotech ETF (IBB) These ETFs don’t have identical constituents, true; and mid-cap Intercept Pharmaceutical’s (ICPT) 577% YTD performance is largely responsible for XBI‘s decoupling pop in early January. But with XBI up nearly 2-to-1 versus IBB over the last 9 weeks, it’s clear the lower-priced and just-issued are capturing a lot of notice.

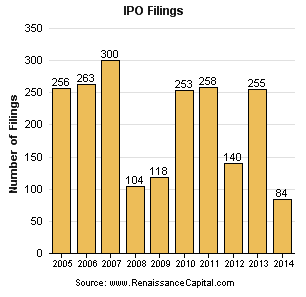

Lest this seems localized, it’s important to remember the renewed allure of IPOs isn’t exclusive to Biotech. Ceteris paribus, US IPOs are on track to break 2000’s record of 406 companies at $97 Billion. According to Renaissance Capital, 84 US companies have already filed to come to market thus far in 2014:

As Ernst & Young IPO analyst Jacqueline Kelley puts it regarding Healthcare (italics mine):

In 2013, health care saw 49 IPOs in the US, the largest number by sector, raising US$8.8b in total proceeds. Pharmaceutical development and, in particular, biotechnology firms were active, with listings for the latter reaching the highest level since 2007. Looking forward, we expect the pace of health care IPO activity to continue in 2014 as long as market volatility remains low.

Those with a vested interest in the general IPO parade are much too concerned with the season of plenty to consider the next famine: the rosy evaluation by some (like this one) of Castlight’s (CSLT) absurd IPO (here’s a balanced appraisal) are proof enough of that. But away from partisan views: is there anything to worry about here? Among the questions to consider:

- Does Biotech’s susceptibility (remember, nearly 50% of Biotechs <$100 market cap winked out of existence in 2008-2013) in virtue of its concentration of small (and new) companies to major cyclical downturns matter?

- Can the growing mania evident Biotech companies small (and large) continue indefinitely amidst a supportive policy environment, low borrowing rates and ravenous investor demand?

- Are the amazing things (and there are many) happening in Biotech right now sufficient to add up to a “permanently high plateau” vindicating all this? Is investor sentiment simply rendering justly optimistic and price-efficient verdict of the industry’s present and (plausible) future breakthroughs?

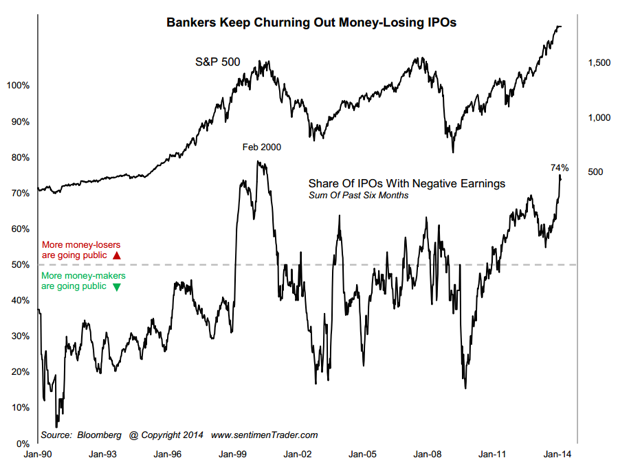

- Or is it immaterial that IPOs for money-losing companies are nearing their peak in 2000 as Jason Goepfert of Sentimentrader points out in the chart below; and that nearly half of all Biotech companies have negative earnings?

As you ruminate on that, here they are to scan through in no certain order: the 22 Biotech IPOs of the last 6 months, complete with filing date, pricing and performance since inception:

Ultragenyx (RARE)

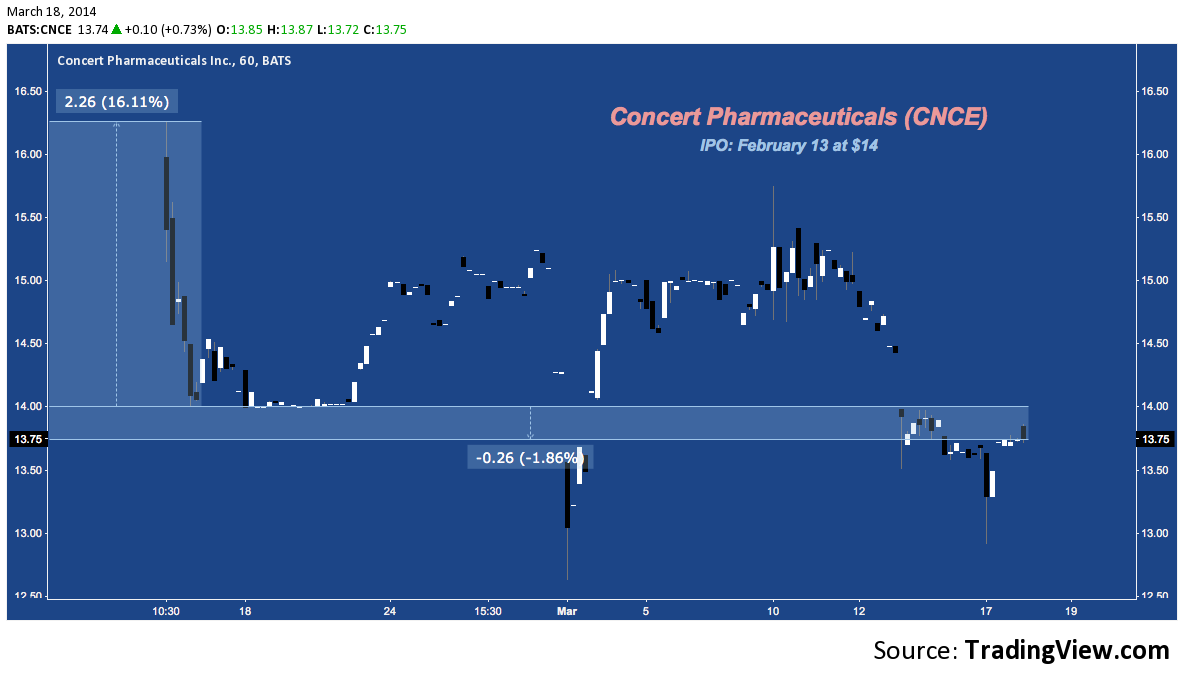

Concert Pharmaceuticals (CNCE)

Fate Therapeutics (FATE)

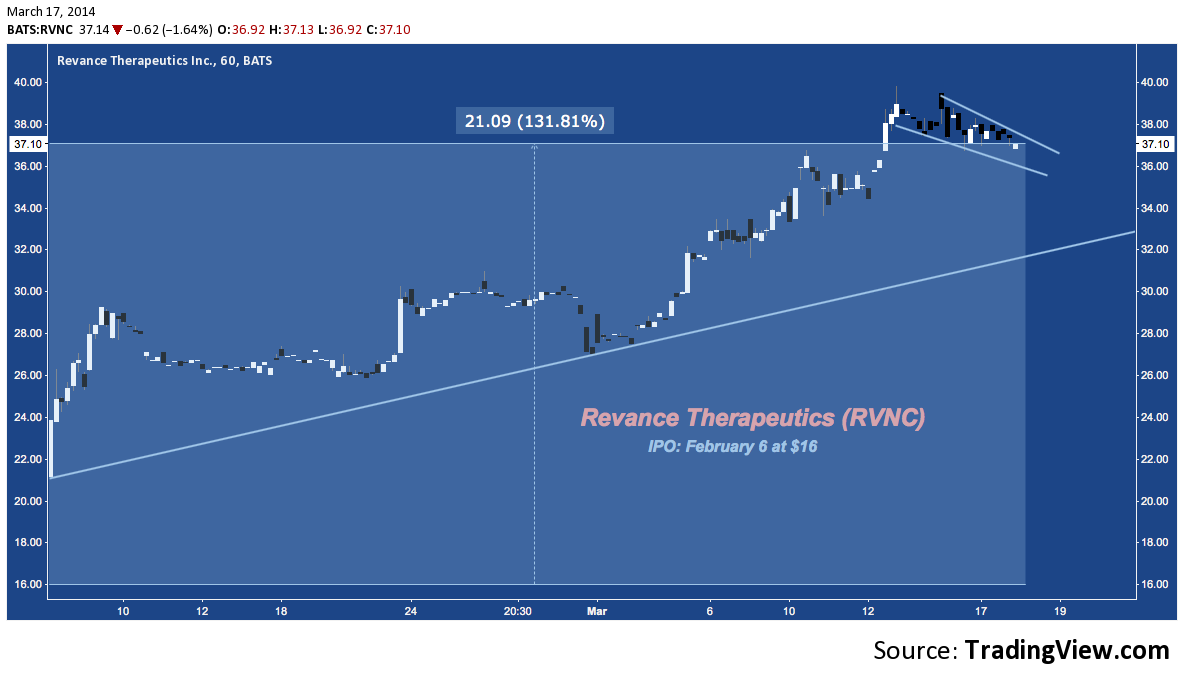

Revance Therapeutics (RVNC)

Relypsa (RLYP)

Five Prime Therapeutics (FPRX)

Tetralogic Pharmaceuticals (TLOG)

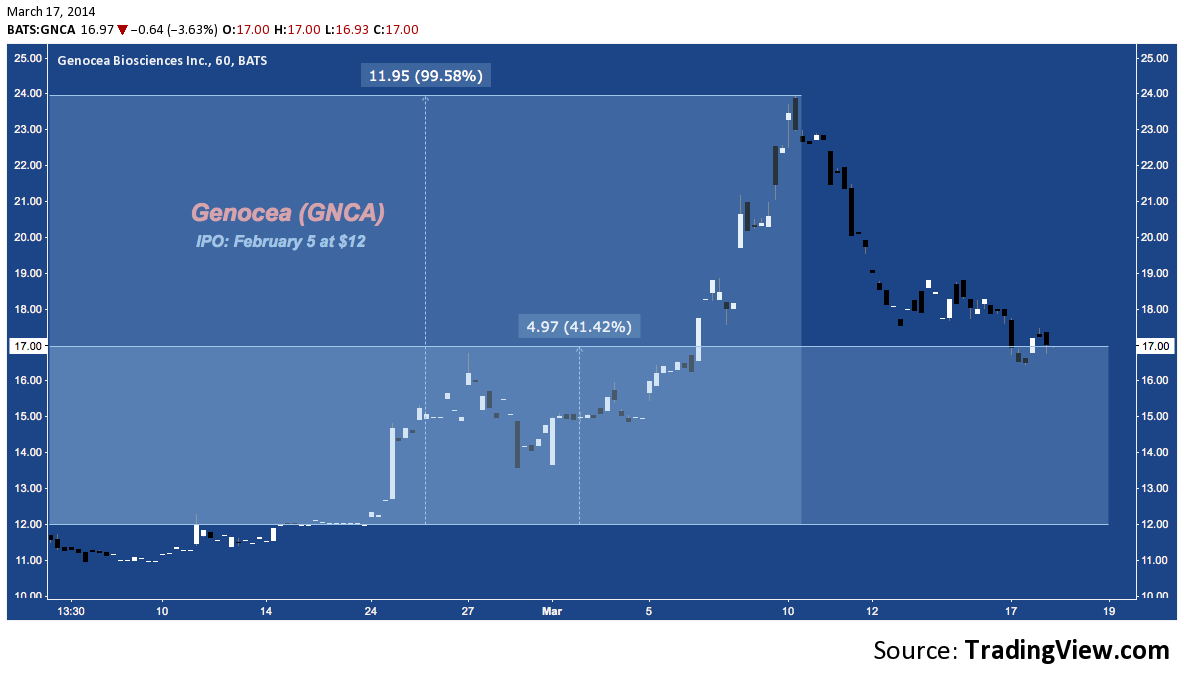

Genocea Biosciences (GNCA)

Macrogenics (MGNX)

Cara Therapeutics (CARA)

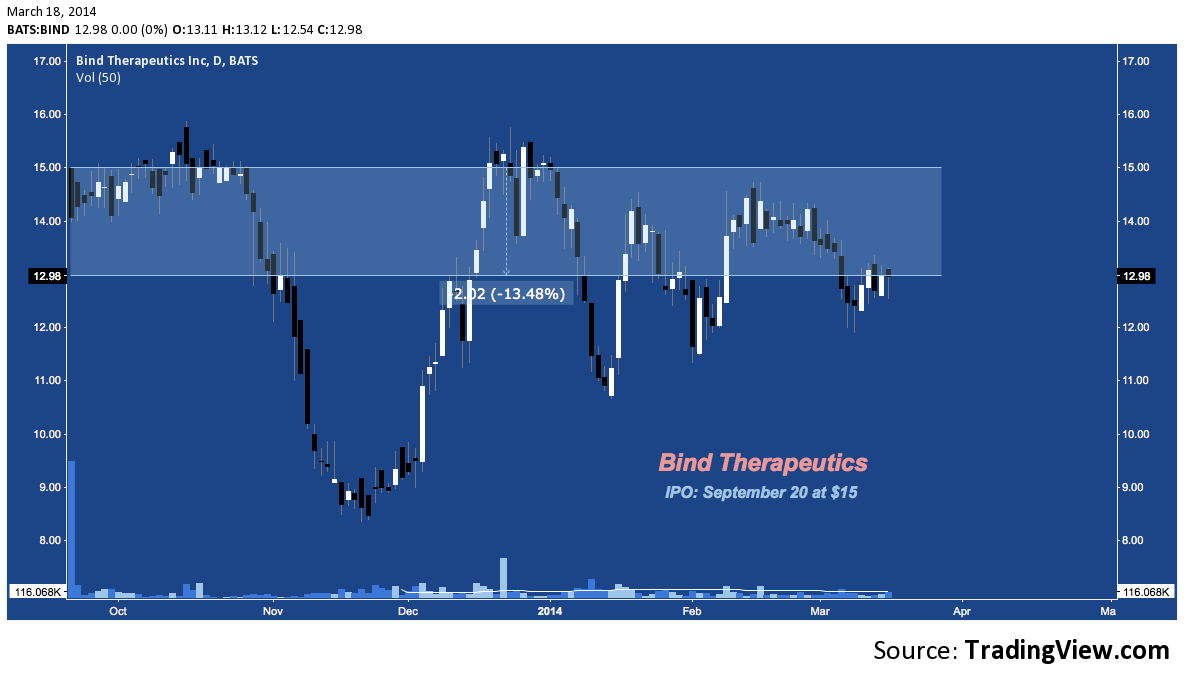

Bind Therapeutics (BIND)

Trevena (TRVN)

Kindred Biosciences (KIN)

Xencor (XNCR)

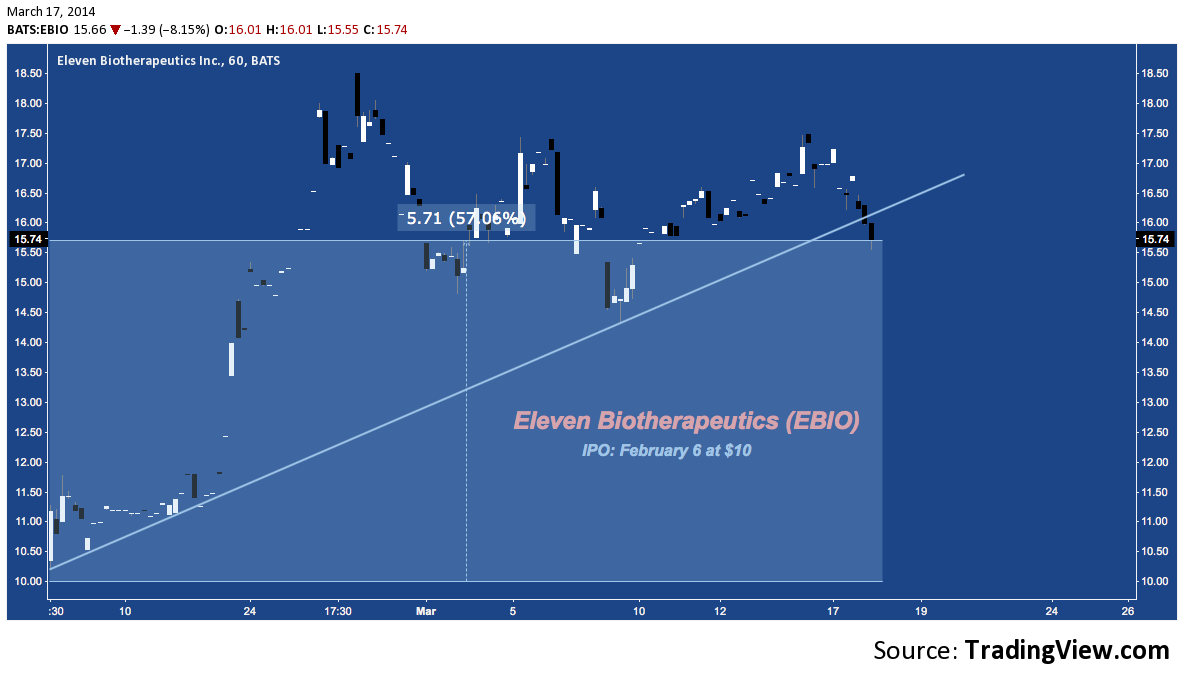

Eleven Biotherapeutics (EBIO)

Acceleron Pharma (XLRN)

Veracyte (VCYT)

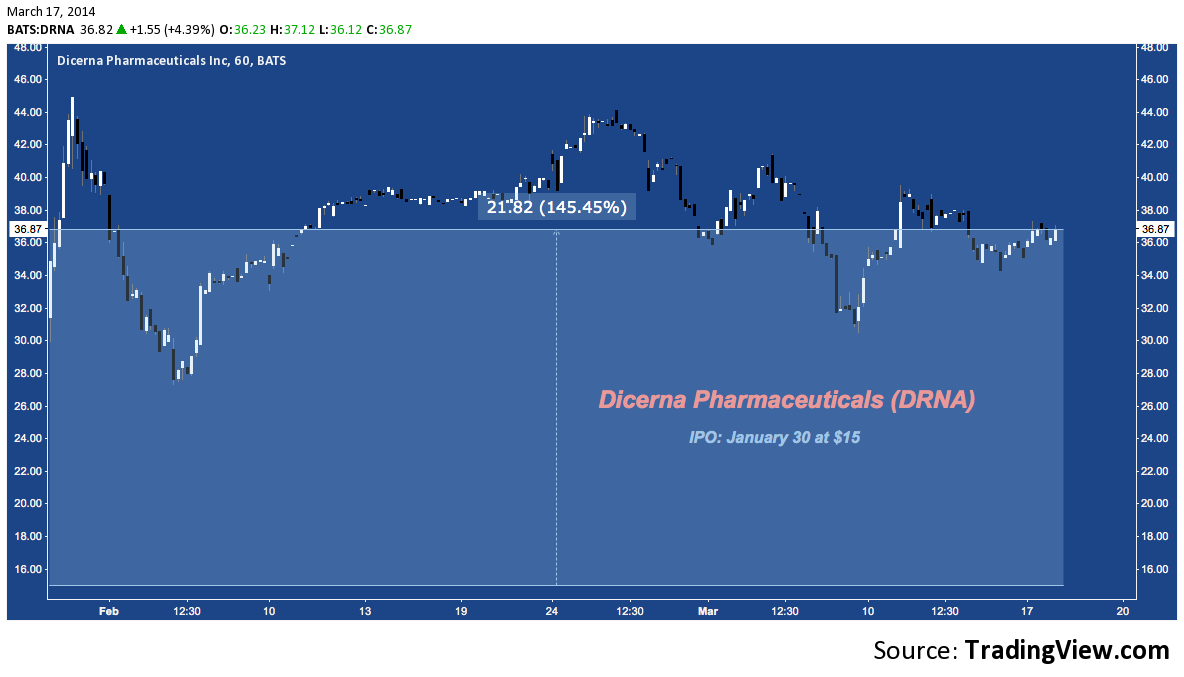

Dicerna Pharmaceuticals (DRNA)

Celladon (CLDN)

Ophthotech (OPHT)

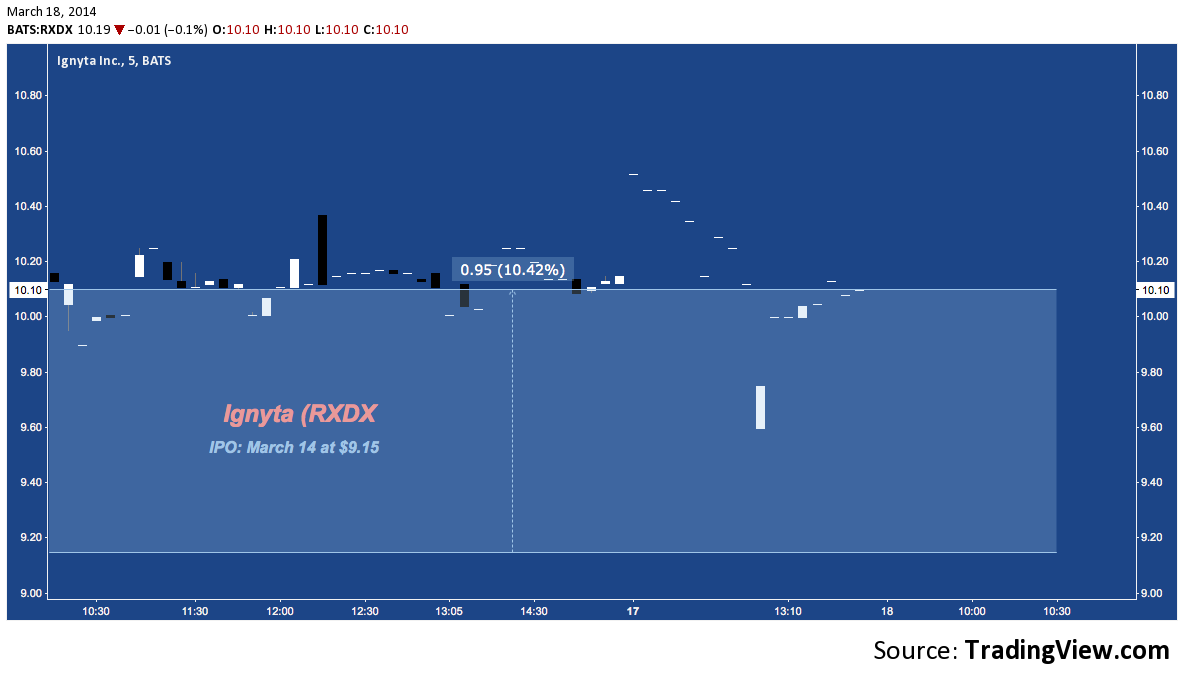

Ignyta (RXDX)

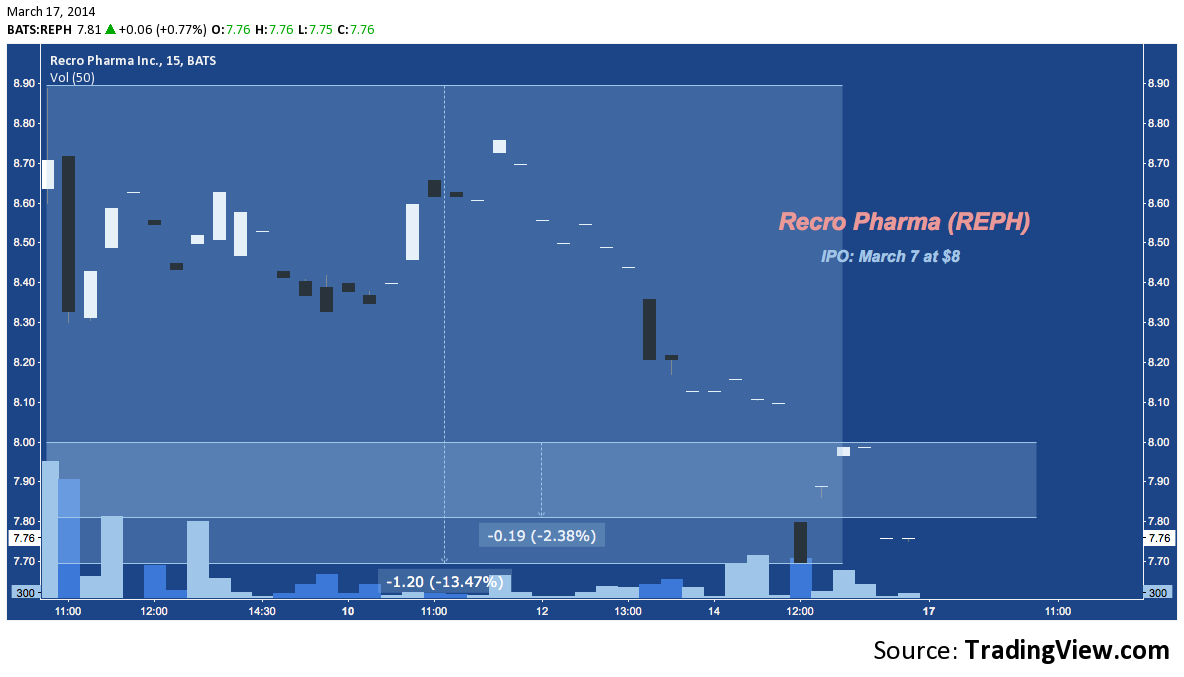

Recro Pharma (REPH)

Twitter: @andrewunknown and @seeitmarket

Author holds no exposure to instruments mentioned at the time of publication. Commentary provided is for educational purposes only and in no way constitutes trading or investment advice.

Active IPO and IPO 2007/2013 Market Cap Comparison images courtesy of BIO Industry Analysis. “Helix” image courtesy of worldipreview.com

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.