In this post, I’ll take a closer look at Biogen (BIIB) and share some thoughts on its price chart, along with some options ideas I’m looking at.

I have a daily and weekly chart attached.

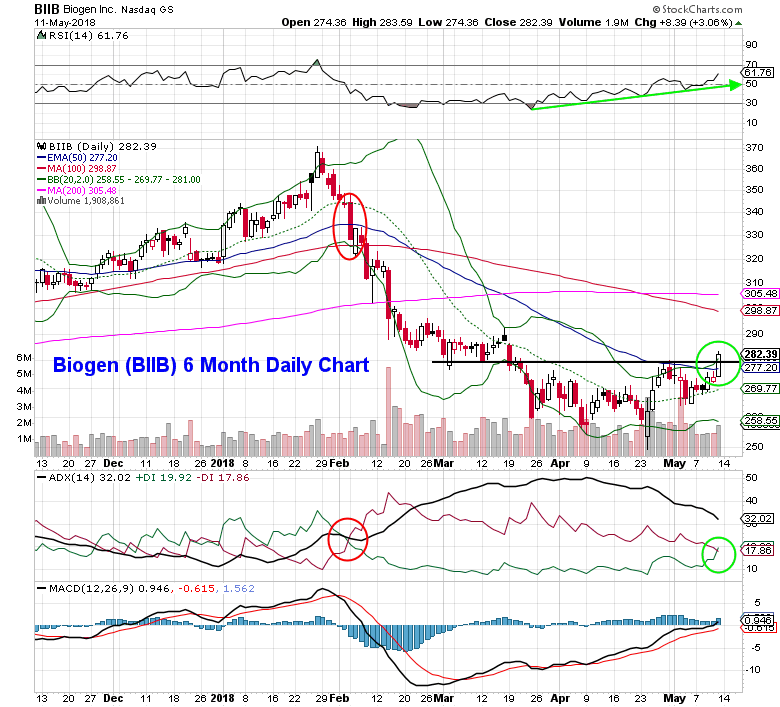

$BIIB Daily chart

1. Shares closed above $280 for the first time in two months

2. The RSI has been trending higher since late March.

3. Now the average directional index (ADX) is confirming the reversal. It is important to note that the indicator was a confirmation signal for the previous downtrend (decline of more than 20%).

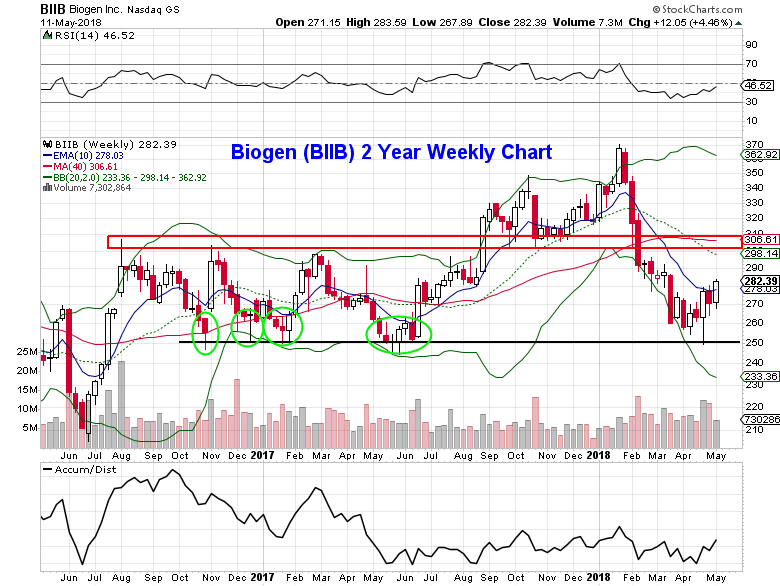

$BIIB Weekly chart

1. The weekly chart shows the stock found long-term support at the $250 level

2. Major resistance isn’t until the $300-$310 area.

Biogen (BIIB) Options Trade Ideas

Idea #1 I’m looking at the June 18 $285/$310 bull call spreads for $7.00 debit or better.

Stop loss: $3.50

If the biotech stock continues to climb higher, I would look to take a majority of my position off in the $295-$300 range. A move to the top of the resistance area highlighted on the weekly chart ($310) would be an opportunity to close out the rest of the trade.

Idea #2 I’m looking at the June 18 $255/$265 bull put spreads for $1.60 credit or better

Stop loss reference: close below $265 in the stock

For credit spreads you are positioning for where the stock won’t go as opposed to a directional trade. As long as the stock doesn’t drop and close below the May low by the June options expiration, the put spreads will expire worthless. However, as a function of risk management, look to close out the trade for a $0.25 debit or less.

Disclosure: I plan on opening the BIIB June 18 $255/$265 bull put spreads.

Twitter: @MitchellKWarren

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.