The oversold condition of the S&P 500 Index and the Nasdaq Composite has these indices trading into support zones where we would be long for a tradable rally.

The Nasdaq has been a laggard but in a bifurcated market, getting a tech stocks oversold bounce means good things for the broader indices.

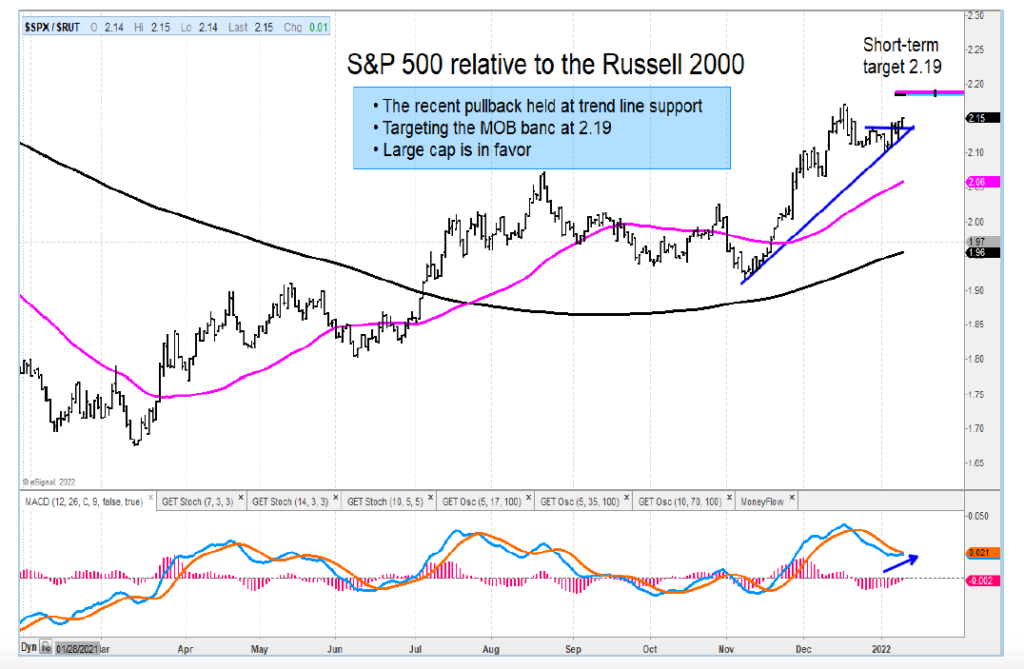

Along this line, we also have the S&P 500 Index relative to the Russell 2000 Index, which shows the strength large cap stocks vs. small caps stocks.

The structure of the ratio chart is bullish for large-caps.

The growth versus value trading ratio is turning up from trend line support at an oversold level. I believe there is a mean-reverting short-term trade higher for growth from here.

I also remail bullish the energy complex and energy equities. My next target for WTI is $88.25. The XOP is in a good spot to add to as it is consolidating at support.

The author or his firm have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.