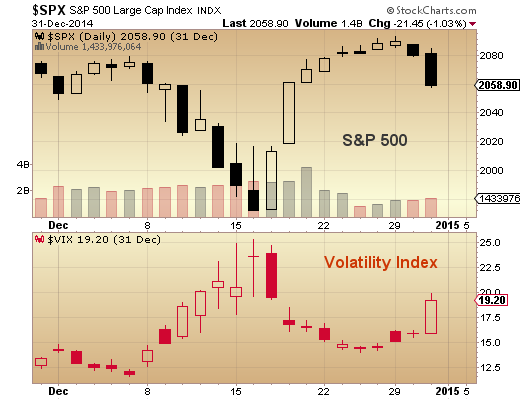

The month of December saw on-time seasonal moves that dug a bit further both up and down during the month. But you wouldn’t know that if you simply looked at the return of the S&P 500 (SPX) for the month: -0.4%. Seems harmless enough, but stocks were struggling under the surface and the Volatility Index (VIX) made a comeback.

To recap, the SPX slipped early in the month, falling 5 percent by mid-month, before bottoming just in time for the “Santa” rally (which included a trip to new highs before tapering off into month end). These swings have continued into the New Year and it appears that investors will have to wrestle with a more volatile market in January.

S&P 500 / Volatility Index (VIX) – December 2014

Throughout December, our cast of extremely talented contributors offered up several short and intermediate-term research posts. I hope you will take a few moments to review some of our best posts from the month of December in our latest installment of The Best of See It Market. This is your chance to check up on our work – please feel free to provide feedback/comments any time. We greatly appreciate your readership.

Equities:

- Why Equities Aren’t Taking Cues From The US Economy by ANDREW NYQUIST

- GoPro Nearing Important Price Support by JAMES BARTELLONI

- Using A Broken Wing Butterfly To Play Potential RUT Breakout by GAVIN MCMASTER

- Why The Stocks To Bonds Ratio Is Important Into 2015 by AARON JACKSON

- Gauging The Stock Market Into 2015: A Look At The Technicals by DAVID BUSICK

- S&P 500: Near-Term Distribution Patterns Emerging by JONATHAN BECK

- Stock Market Trends Still Up But Risk Increasing by JEFF VOUDRIE

- S&P 500 Defensive Sectors Trouncing Cyclical Peers by ANDREW KASSEN

- ETF Investing: A Look At Where To Invest In 2015 by DAN NEAGOY

- 2015 US Equity Outlook by JONATHAN BECK

- 4 Reasons Utilities Deserve A Place In Your Portfolio by CHRIS BURBA

- Are Stocks Ready To Break Away From The VIX Fear Index by CHRIS CIOVACCO

- Is The Utilities Sector Sending A Broad Market Signal? by AARON JACKSON

- India ETF Breaking Free From Emerging Market Mess by MIKE ZACCARDI

- Why IBM May Reverse Higher In 2015 by JAMES BARTELLONI

- Sustainable Investing In Real Estate En Vogue by JOSHUA SCHROEDER

Currencies & Commodities:

- Could Crude Oil Prices Fall To $45 Per Barrel? by DAVID BUSICK

- Decline In Crude Oil Prices Stirs Deflation Debate by KARL SNYDER

- Corn Over $4: Can The Rally Continue? by ANDREW NYQUIST

- Will Russia’s Market Woes Cause Decoupled US Stocks To Crater? by ANDREW KASSEN

- USDJPY: Will This Reversal Pattern Trigger A Pullback by CHRIS KIMBLE

- US Dollar Pairs In Focus by DAVE FLOYD

Bonds:

- How Much Future GDP Has Been Stolen By Fed ZIRP? by ROSS HEART

- Interest Rates: Flattening: Yield Curve Signals Short-Term Shift by DAVID FABIAN

- The Bond Market Blues: In 3 Charts by AARON JACKSON

Must-Read Education:

- Market Masters: The Trader’s Journey, The Hero’s Journey by ADAM GRIMES

- Trading Methods, Systems, and Plans: What’s The Difference? by STEVE BURNS

- Identifying Tight Trading Setups by DOUGLAS BUSCH

Look for another installment of “The Best of See It Market” next month. Thanks for reading.

Twitter: @seeitmarket