Investment advice from experts is typically designed to get you to take some sort of action. Common headlines I see every day include themes like “Buy these 3 stocks before the Fed hikes interest rates” or “Dump these 5 losers before New Year’s”. The common thread between the two is the recommendation to make an adjustment to your portfolio in order to reduce risk or capitalize on a new opportunity.

Rarely do you see an advisor telling you to do nothing with your portfolio, yet that is exactly what I am proposing at this juncture. My investment advice: Do nothing.

Why Your Best Move In December May Be To Sit On Your Hands

The overriding headline risk of the Federal Reserve tightening rates in December is the primary impetus for this strategy. Most experts seem to believe that the Fed is going to make a move in the overnight lending rate off the zero mark. Whether they pull the trigger or not, it’s likely going to create quite a stir with stocks, bonds, commodities, and even the forex markets.

The problem is that there is no way to tell exactly how these individual markets are going to react. I have heard calls to dump bonds, load up on financial stocks, short gold, buy the U.S. dollar, and a host of other eyebrow-raising antidotes to this anticipated policy change. Some of these trades may ultimately work, while others will likely fail in spectacular fashion. This isn’t the type of investment advice that’s healthy in my opinion.

My prediction is that investors who make drastic changes to their asset allocation in expectation of a certain outcome may find their strategy deficient in many aspects. The more you shift towards a specific threat, the less prepared you are for unintended consequences of the market going against you. One thing the market loves to do is confound us in as many aspects as possible.

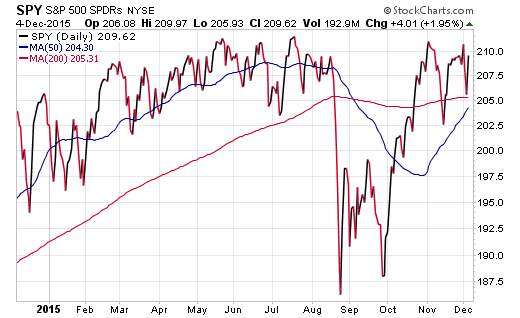

When we take a full year look back at the SPDR S&P 500 ETF (SPY), there isn’t much of a compelling story to make a significant change to your equity exposure right here. If you rode out the summer stock market correction and recovery, then you are likely sitting near the same levels you were at this time last year. The stock market has largely grinded sideways and made little net gains over the last twelve months.

The time to be a buyer was August and September. Now that we have recovered from that volatility, the risk equation has shifted to more muted upside opportunity. The flattening 200-day moving average (smooth red line) seems to underscore this point as well. I would continue to hold any existing positions that have held up well over the last several months and monitor them closely as we near the end of the year.

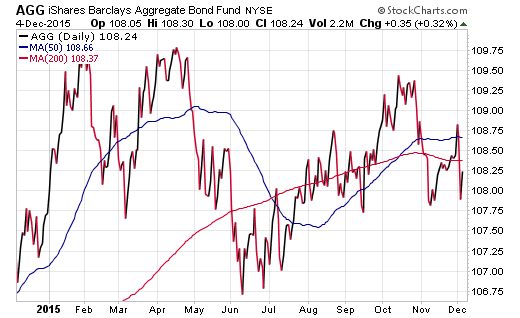

When I turn to the bond market, I am seeing a very similar story of modest volatility that has resulted in little net progress. The U.S. 10-Year Treasury yield is virtually unchanged for 2015, which has translated to flat performance in the iShares Core U.S. Aggregate Bonds ETF (AGG).

Many investors are concerned that bonds are going to get crushed over the course of a cyclical fiscal tightening cycle. The downtrend in high yield credit over the last six months is a noteworthy symptom as well. Yet in most diversified or aggregate strategies, we are continuing to see prices hold water. This sideways trend appears to be driven more by uncertainty than any real threat of rising rates on the intermediate and long end of the curve.

The Bottom Line

I’m not going to begrudge anyone who wants to move a small portion of their portfolio into a new investment or asset class that they feel will benefit from whatever the outcome is in December. However, I think that those investors who make an overwhelming shift in their investment strategy to anticipate a reaction face far greater risks than opportunities. My investment advice is to stay balanced and diversified at this juncture. Any changes should be made with careful and incremental steps to avoid trading at inopportune prices.

Thanks for reading.

Twitter: @fabiancapital

Author or his funds have positions in related securities mentioned at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.