Stocks of major U.S. banks and brokers are behaving in a way that shorts are probably not very happy with. Question is: Should they treat this as a signal or just noise surrounding the major bank stocks?

The top six U.S. banks have reported September quarter-end earnings results, and it is a mixed bag on the bottom line, and a disappointment on the top.

JPMorgan Chase (JPM), Goldman Sachs (GS), and Morgan Stanley (MS) missed on the bottom line. Wells Fargo (WFC), Bank of America (BAC) and Citibank (C) beat… but they all struggled on top-line growth.

In fact, of the four major bank stocks, WFC was the only one to have grown revenue year-over-year, though ever so slightly – from $21.2 billion last year to $21.9 billion. JPM reported $22.8 billion (versus $24.5 billion last year), C $18.7 billion (versus $19.7 billion), and BAC $20.7 billion (versus $21.2 billion).

Post-earnings, five of these bank stocks are higher. Investors/traders reacted positively to the results of BAC, C, and WFC right from the get go. GS staged an intra-day reversal shaking off early weakness, while JPM dropped in the session that earnings were reported, but rallied in subsequent sessions. MS is still down.

Bad earnings results from the big banks and brokers are not keeping these bank stocks down, even as the good ones are being embraced. Bulls could not ask for much more.

One probable reason for this behavior is the perception in the market place that higher interest rates are good for the banks (and bank stock prices). Jamie Dimon, JPM CEO, was on Bloomberg TV the other day essentially urging the Federal Reserve to raise interest rates. In ordinary circumstances, a higher rate would help. The Fed begins to tighten as it is convinced that the economy is on a self-sustaining path. The yield curve steepens. Spreads – banks’ bread and butter – widen. And bank stocks react – positively.

Here is a counterargument to that line of thinking.

This is not any Tom, Dick, and Harry cycle. The Fed acts like it seriously wants to begin to tighten, but economic data continue to come in mixed at best. Interest rates are still zero-bound. It is entirely possible when the first rate hike finally happens – whenever that is – the long end of the curve does not cooperate. So rather than steepening, the yield curve tightens. Not an ideal scenario for entities that borrow short and lend long.

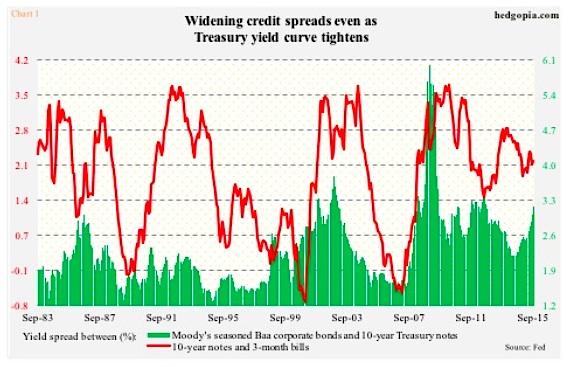

In chart 1 above, the spread between 10- and three-year Treasury yields has been making lower highs for nearly five years now. Year-to-date, the spread is essentially unchanged at 2.15 percent. On the other hand, the spread between yields on 10-year Treasury notes and Moody’s Baa corporate bonds has been rising – from 2.53 percent last December to 3.17 percent in September. In December, these corporate bonds were yielding 4.74 percent, rising to 5.34 percent by September. This is not a confidence-booster. The long end of the Treasury yield curve continues to act worried.

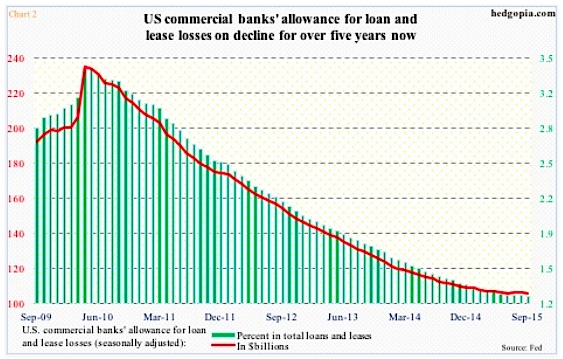

This view is totally contradicted if we focus on what banks are setting aside in reserves. U.S. commercials banks’ allowance for loan and lease losses was $106.1 billion in September, which not surprisingly has persistently dropped as the economic recovery matured. In April 2010, these allowances totaled $235.3 billion (see chart 2 above). At the time, this equaled 3.4 percent of total loans and leases ($6.9 trillion), dropping to 1.26 percent this September (loans and leases of $8.4 trillion).

This becomes a moot issue if macro data begins to improve enough that the Federal Reserve feels comfortable raising the fed funds rate, followed by a steepening in the yield curve.

Does the bond market believe in this scenario currently? Probably not. The way the long end of the curve is behaving speaks volumes.

In this respect, how financials act in the very near future has potential to be another big tell. So keep an eye on the bank stocks.

Now let’s review a couple of charts that are representative of the bank stocks and financials sector: XLF and KBE (both are ETFs).

continue reading on the next page…