- Banks such as JPM, C and GS started the earnings season off on a positive note when all beat expectations on the top and bottom-line

- The pre-peak Late Earnings Report Index fell to its lowest level in a year, signaling corporations are feeling more certain about growth prospects as they start 2025

- Q4 S&P 500 EPS growth expected to come in at 12.5%, the highest growth rate in three years

- Peak weeks for the Q4 season run from February 3 – 28

Banks Send a Bullish Signal to Markets

Big US banks marked the beginning of the Q4 earnings season when they released results last week, and overall they were positive. Because of their position opening up the earnings season they tend to set the tone for things to come. Commentary from bank CEOs was very optimistic about what the New Year could bring, with bullish sentiment around the US economy, the incoming Trump administration, trading and investment banking activity.

All six big banks (JPM, C, WFC, GS, BAC, MS) reported better-than-expected results on the bottom-line, and only Wells Fargo missed slightly on the top-line. Some interesting results included those from JPMorgan which saw net income catapulting 50% in the final quarter of 2024.1 Goldman Sachs saw net income double.2 Bank of America noted strength in investment banking fees and interest income.3 Wells Fargo saw net income that was also up nearly 50% YoY, and investment banking fees up 59%.4 Across the board, banks seem to be firing on all cylinders.

That bodes well for the Financials sector as a whole which according to FactSet is anticipated to lead profit growth this season. Currently EPS growth is estimated to come in at 47.5%, more than double that of the next leading sector (Communication Services at 20.7%), with expected revenue growth of 6.5%.5

As far as other sectors are concerned, Information Technology and Communication Services both remain amongst the leaders on the top and bottom-line, while Energy, Materials, and Industrials are all expected to post YoY declines on both metrics.6

For the Q4 season, S&P 500 EPS growth is expected to hit 12.5%, which would be the best profit growth in three years, and a big improvement over Q3’s 4.6% result.7 Note that 12.5% is a blended growth rate that includes results for those companies that reported as of Friday, January 17 and estimates for those that have yet to report. Revenues are expected to come in at 4.7% YoY growth.8

LERI Update – Did CEO Confidence Get a Boost?

After rising to its highest level in four years during the last quarter of 2024, the Late Earnings Report Index, our proprietary measure of CEO uncertainty, has fallen back below the historical benchmark as companies prepare to report their Q4 results.

The LERI tracks outlier earnings date changes among publicly traded companies with market capitalizations of $250M and higher. The LERI has a baseline reading of 100, and anything above that indicates that companies are feeling uncertain about their current and short-term prospects. A LERI reading under 100 suggests that companies feel they have a pretty good handle on the near-term.

The official pre-peak season LERI reading for Q4 (data collected in Q1) stands at 65, well below the baseline reading, suggesting companies are feeling more certain about economic conditions than they were for the last three quarters. As of January 15, there were 61 late outliers and 85 early outliers.

Some of that certainty was evident in banking commentary, with Goldman Sachs CEO David Solomon saying “There has been a meaningful shift in CEO confidence, particularly following the results of the U.S. election,” on the earnings call.9 But there is also a high incidence of Q1 continually having a low LERI reading. For the past three years we’ve seen a Q1 reading of 64 in 2024, 66 in 2023 and 75 in 2022. This is well below the benchmark of 100 and could have something to do with how elongated the reporting season is for the first quarter. The Q4 reporting season tends to see peak weeks stretch to four rather than the typical three. There is also the presence of three US Federal holidays during the reporting season (New Years, MLK Jr. Day and Presidents Day), with the addition of January 9 this year to commemorate the death of former US president, Jimmy Carter.

We’ll be on the lookout for other measures of CEO sentiment, especially The Conference Board Measure of CEO Confidence which should be released in the next week or two and usually moves similarly to the LERI.

On Deck This Week

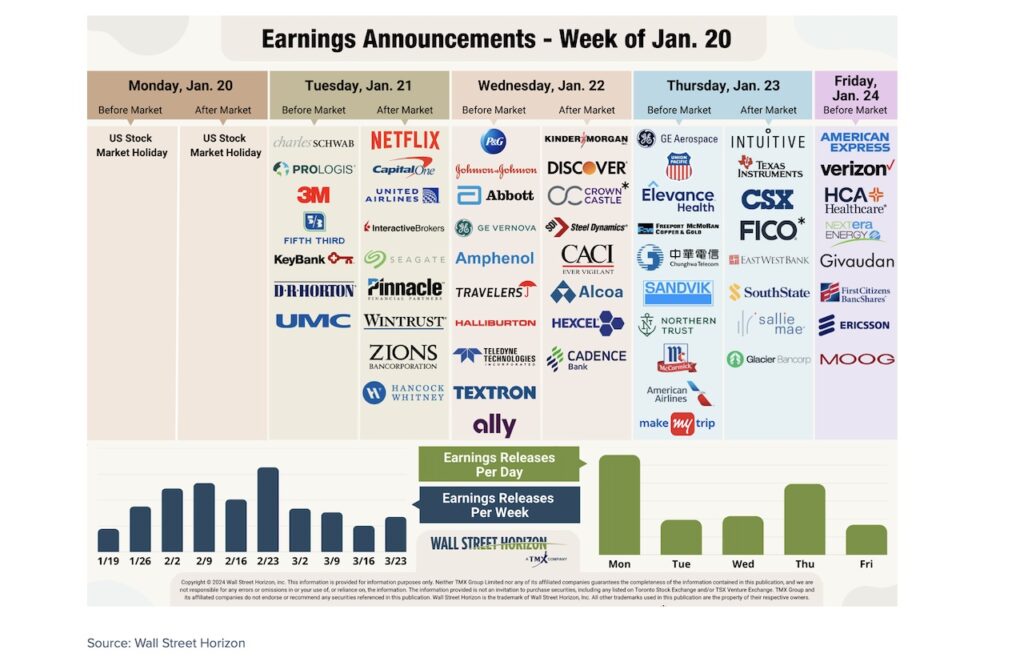

The Q4 season has gotten off to a slow start as it usually does, and peak season is still two weeks away, but this week there is no lack of interesting results to tune in for. We’ll continue to get results from the Financials sector when names like Charles Schwab, Capital One and Discover report, as well as results from Industrials such as 3M and Texas Instruments, and specifically the airlines sub-sector when United Airlines, Alaska Air and American Airlines all report. In total 43 S&P 500 companies are expected to release results this week.

Q4 Earnings Wave

With the Q4 season getting started a little later this year, the peak weeks are expected to fall between February 3 – 28, with each week expected to see over 1,200 reports. Currently, February 27 is predicted to be the most active day with 877 companies anticipated to report. Thus far, only 46% of companies have confirmed their earnings date (out of our universe of 11,000+ global names), so this is subject to change. The remaining dates are estimated based on historical reporting data.

Sources:

1 JPMORGANCHASE REPORTS FOURTH-QUARTER 2024, JPMorgan Chase & co, January 15, 2025, https://www.jpmorganchase.com

2 Goldman Sachs Reports 2024 Full Year and Fourth Quarter Earnings Results, Goldman Sachs, January 15, 2025, https://www.goldmansachs.com

3 Bank of America Reports 4Q24 Net Income of $6.7 Billion, EPS of $0.82 , Bank of America,January 16, 2025, https://d1io3yog0oux5.cloudfront.ne

4 Wells Fargo Reports Fourth Quarter 2024 Net Income of $5.1 billion, or $1.43 per Diluted Share, Wells Fargo, January 15, 2025, https://www.wellsfargo.com

5 Earnings Insight, FactSet, John Butters, January 10, 2025, https://advantage.factset.com

6 Earnings Insight, FactSet, John Butters, January 10, 2025, https://advantage.factset.comf

7 Earnings Insight, FactSet, John Butters, January 10, 2025, https://advantage.factset.com

8 Earnings Insight, FactSet, John Butters, January 10, 2025, https://advantage.factset.com

9 Goldman Sachs Conference Call on 2024 Full Year and Fourth Quarter Earnings Results, Goldman Sachs, January 15, 2025, https://www.goldmansachs.com

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.