Bank stocks have seen better days.

Bank stocks have seen better days.

Large US money center banks (e.g. Bank of America) and bank holding companies (e.g. Goldman Sachs) with few exceptions are stamping out a very similar technical footprint. In each case, major multi-year resistance is just overhead or is currently being tested.

When so many stocks in a sector are building out such similar patterns, it’s often indicative that the sector’s directional path is about to become more binary. In this scenario, relative performance among individual stocks narrows, and directional volatility rises – often in a wider RoRo (risk-on/risk-off) market environment. Asssuming the lagging performance in Financials – bank stocks, in particularly – continues, it’s worth considering that their relative weakness may be foreshadowing an adverse period for the broader market ahead.

In each case (with one exception noted, though it is also at major resistance), the major bank stocks included here are mounting toward significant reversal zones.

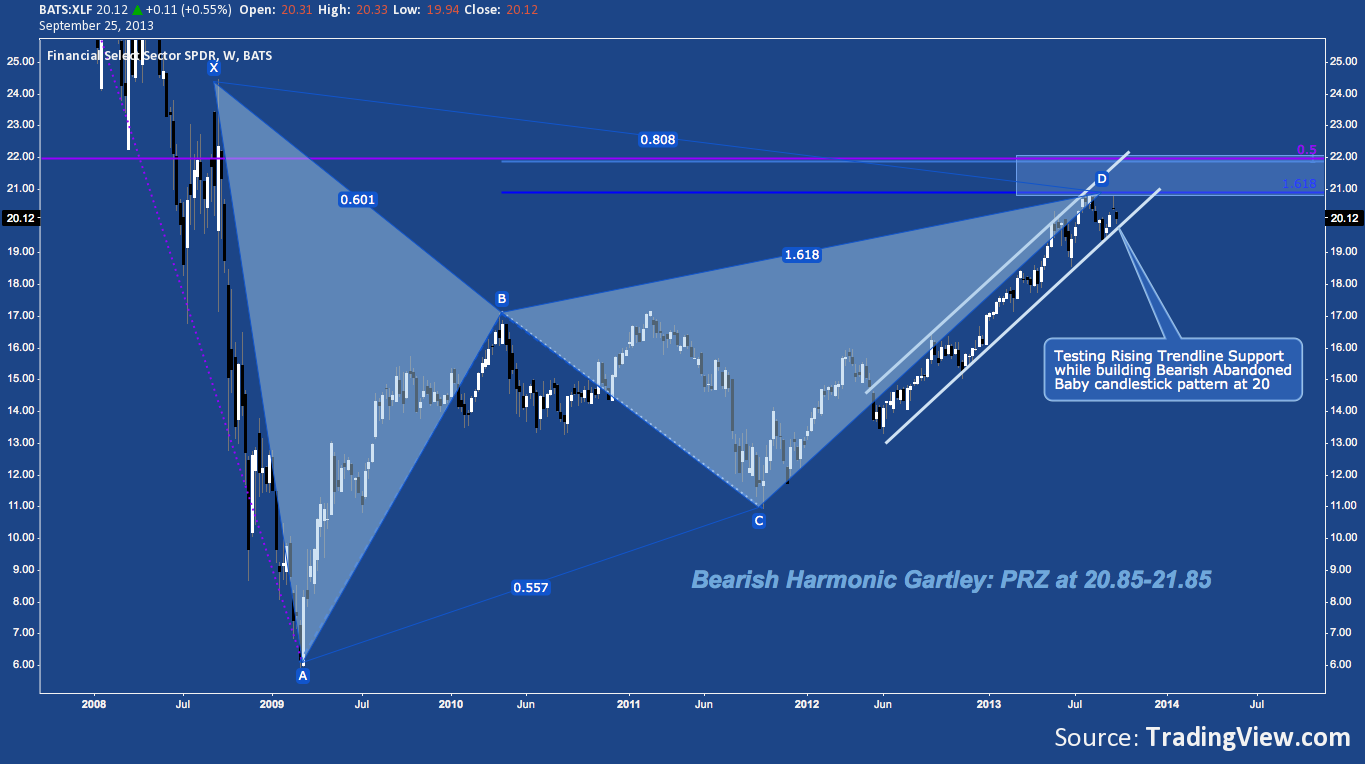

The Financial Sector SDPR (XLF) handily recaps this point as it struggles beneath 21 at the culmination of a 5-year reversal pattern:

Financial Sector SPDR (XLF) – Weekly: Bearish Gartley with 20.85-21.85 Resistance (click image to zoom)

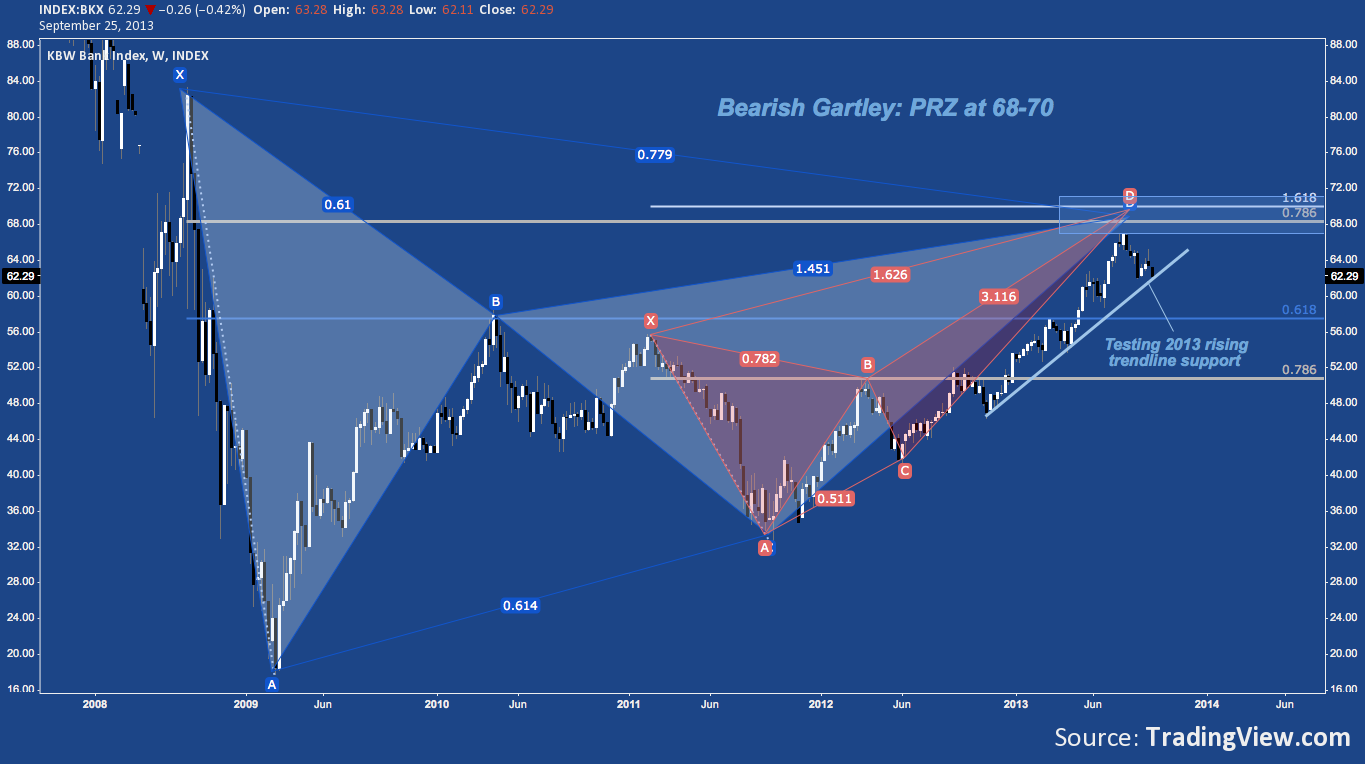

Narrowing the field just a bit, the KBW Bank Index (BKX) is posting up an almost identical pattern:

KBW Bank Index (BKX) – Weekly: Bearish Gartley with 68-70 Resistance (click image to zoom)

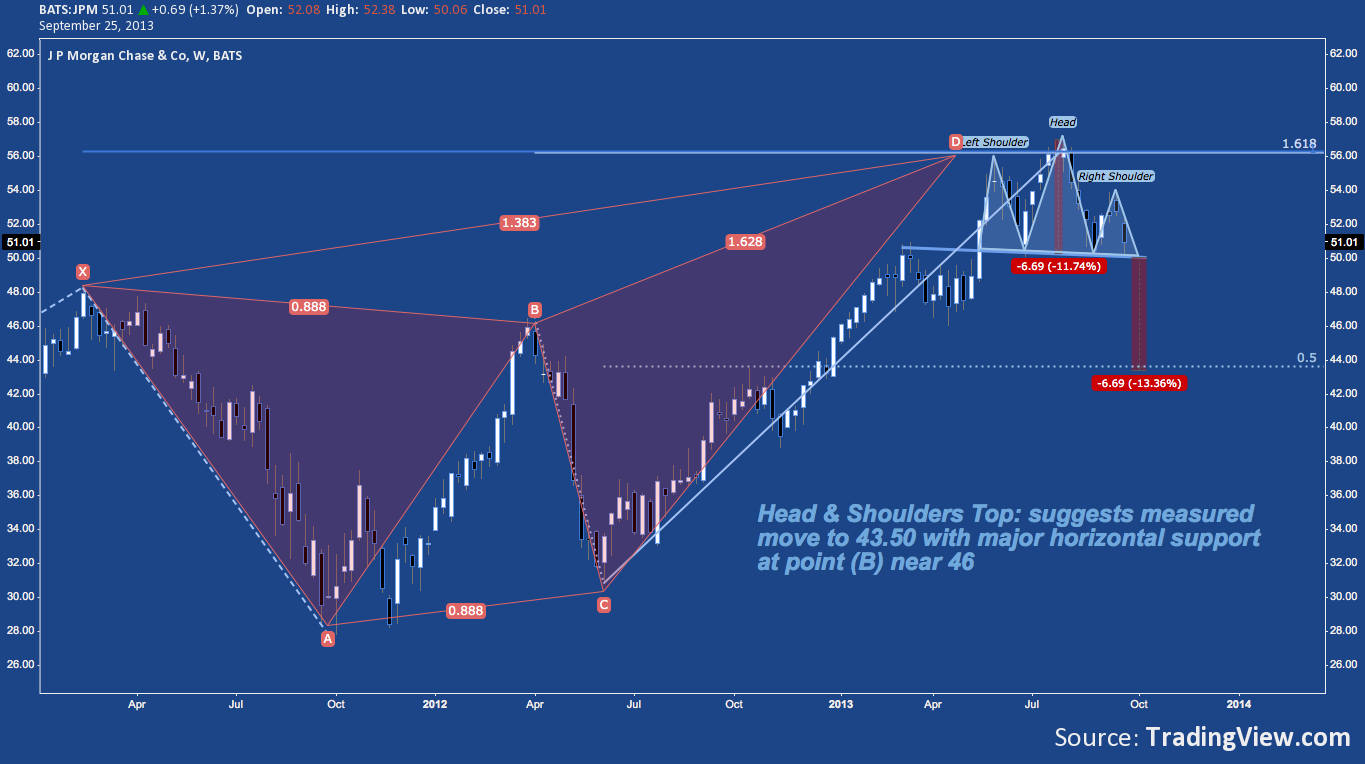

Turning to individual bank stocks that are constituents of and mostly representative of these indices, we see a very similar theme at work:

JP Morgan Chase (JPM) – Weekly: Cluster Resistance a $56; H&S Top Activates Under $50 (click image to zoom)

Bank of America (BAC) – Weekly: Bearish Bat with Potential Reversal Zone near $14.25 (click image to zoom)

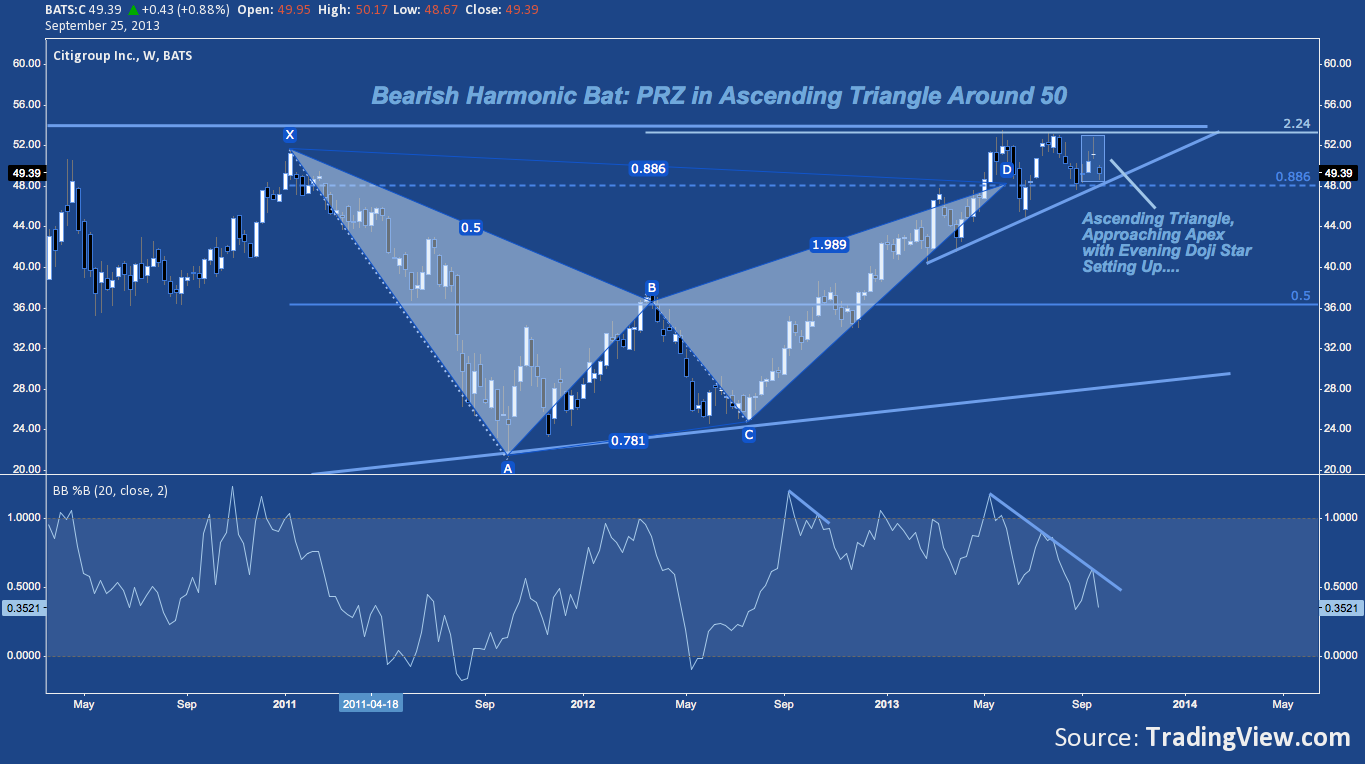

Citigroup (C) – Weekly: Bearish Bat with Potential Reversal Zone Near $50 (click image to zoom)

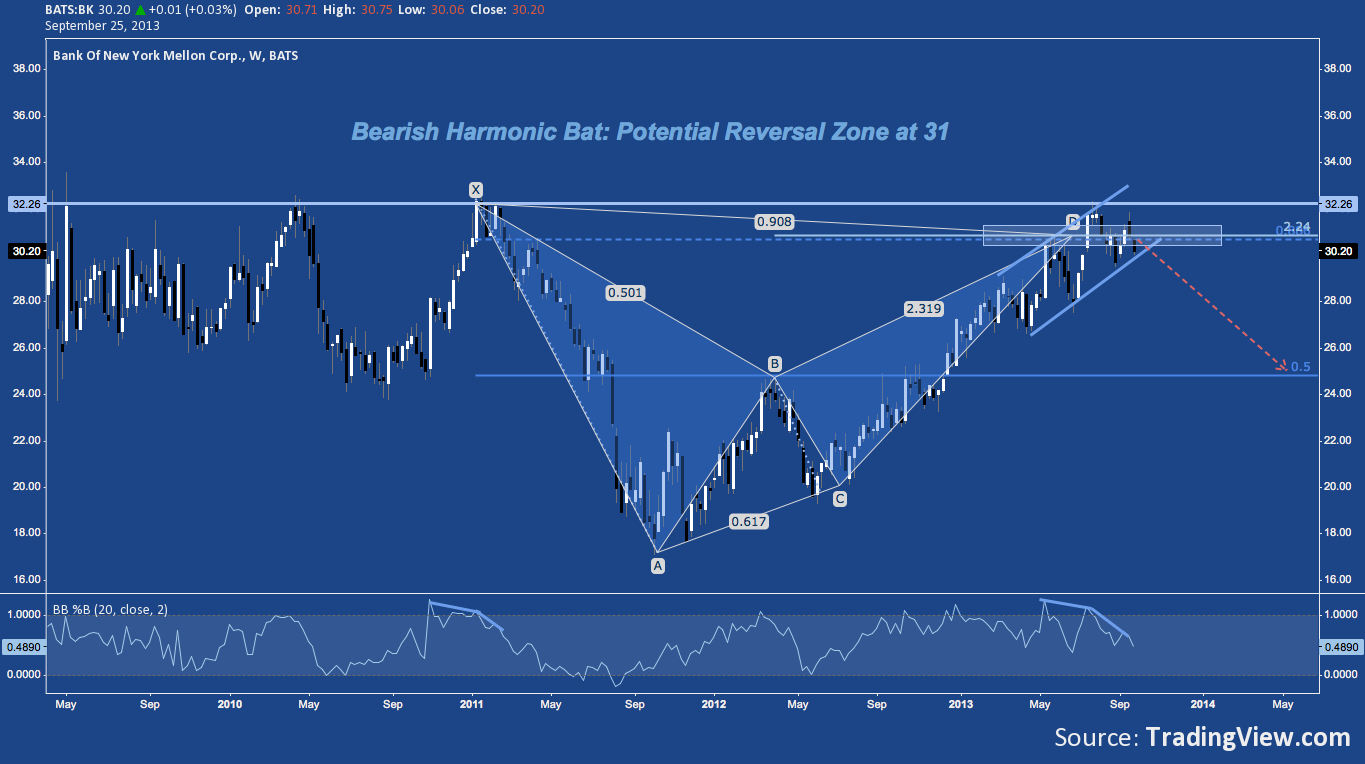

Noticing a theme? Here’s another:

Bank of New York Mellon (BK) – Weekly: Bearish Bat with Potential Reversal Zone at 31 (click image to zoom)

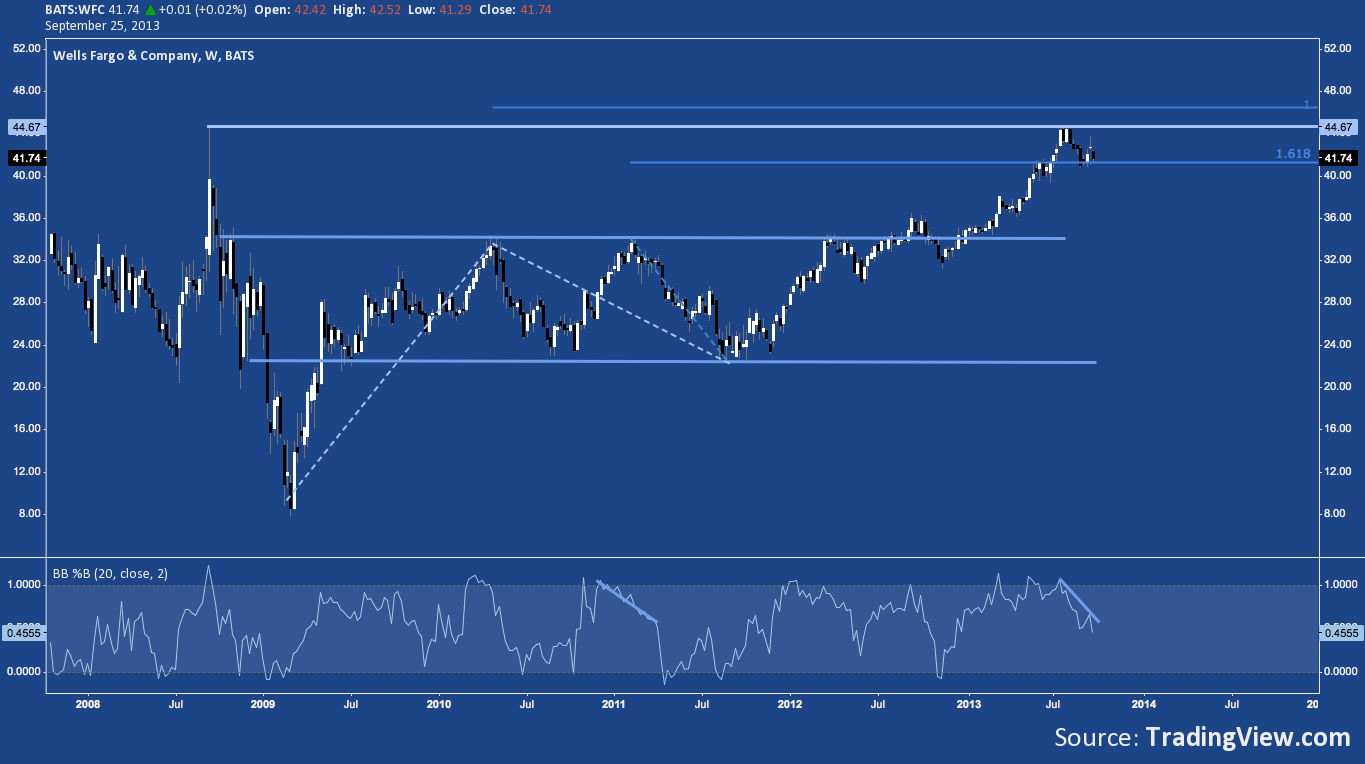

Wells Fargo (WFC) is lacking a credible harmonic pattern, but faces major resistance around it’s 2008 high near $45:

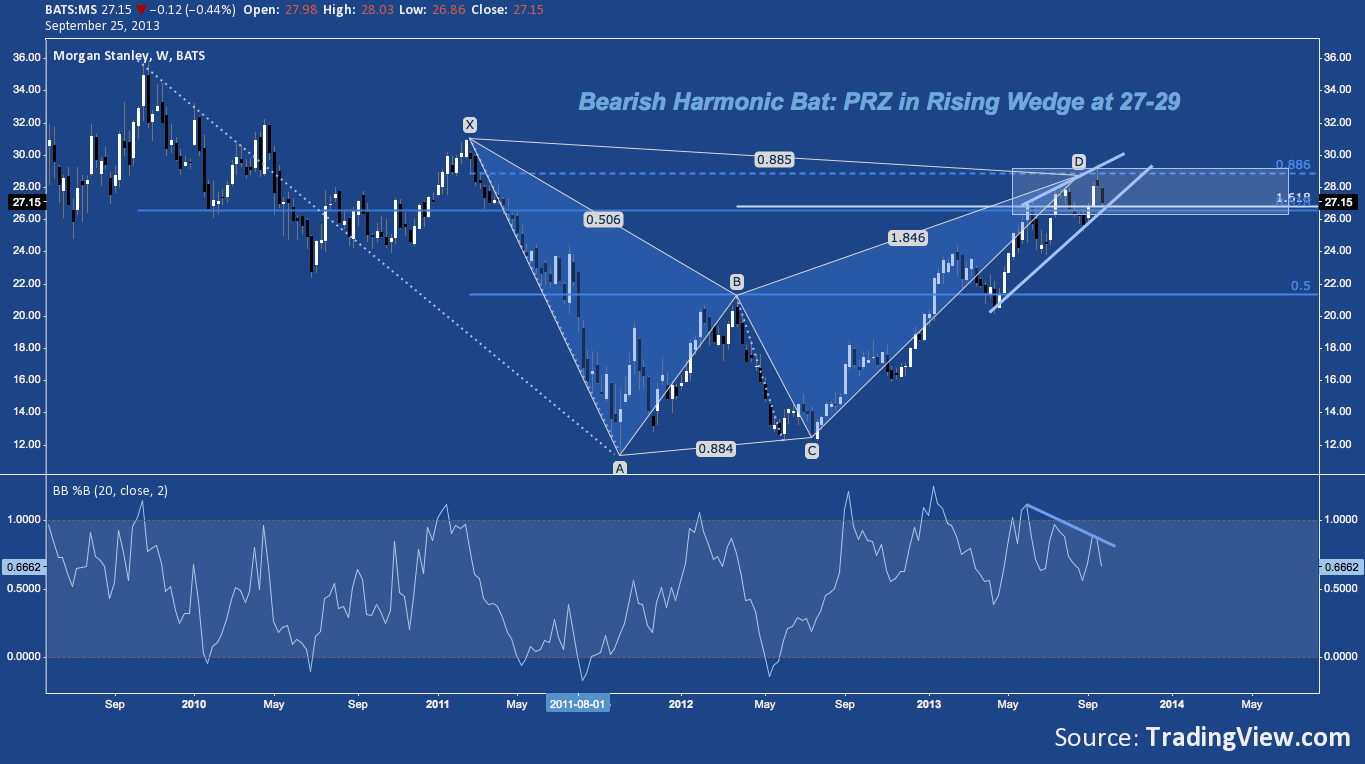

Turning to bailed out I-banks Diversified Bank Holding Companies, the Bearish Bat theme picks back up:

Morgan Stanley (MS) – Weekly: Bearish Bat with Potential Reversal ZOne at 27-29 (click image to zoom)

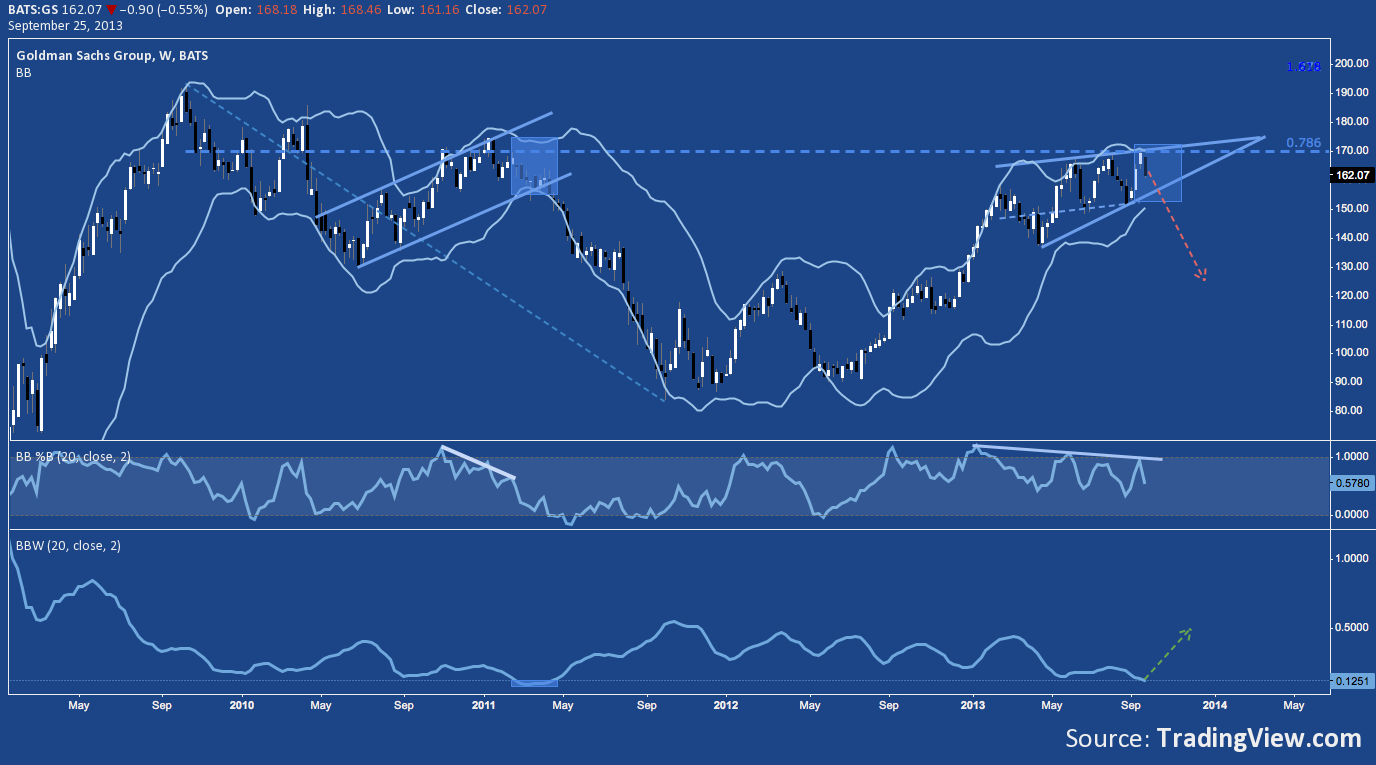

And lastly, a plausible Bat is present here as well; but technical statement made by the current Bollinger Band configuration is even more compelling:

Goldman Sachs (GS) – Weekly: Rising Wedge Inside Narrow BBands on Slackening Momentum (click image to zoom)

Twitter: @andrewunknown and @seeitmarket

Author holds no positions in instruments mentioned at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.