The stock market correction has several key stocks and sectors teetering on important support levels.

One such sector is the banking sector. Bank stocks are equally important to the broader stock market as they are to the economy.

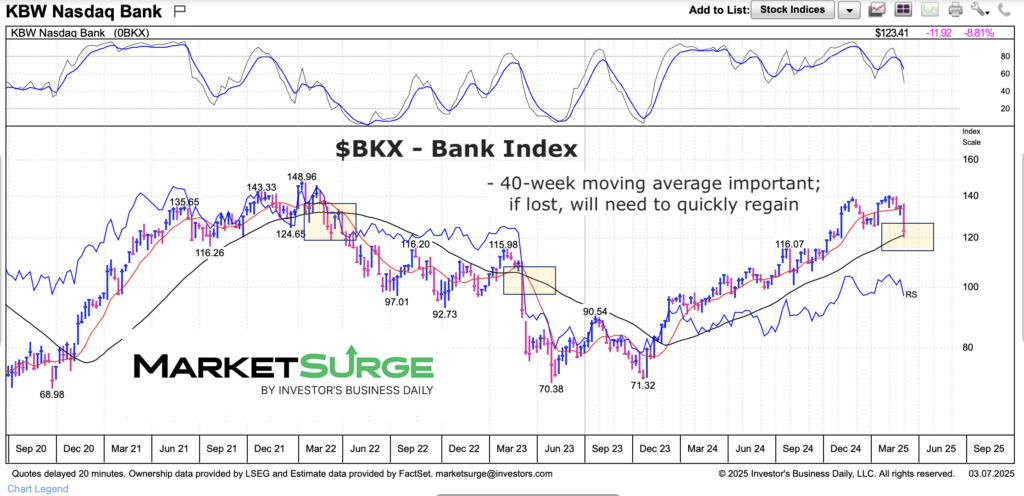

Today, we look at a “weekly” chart of the Nasdaq Bank Index (BKX) and highlight why active investors need to be watching this index right now.

What BKX does in the coming week or two may be an indicator for the broader market.

Note that the following MarketSurge charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of tools, education, and technical and fundamental data.

$BKX Bank Index “weekly” Chart

As you can see, BKX is testing its 40-week moving average. If recent history is any guide, bulls want/need to defend this level right now. Any dip below this level must be bought and the 40-week MA quickly recovered… or it could indicate a deeper selloff.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.