After a steep decline across the commodities sector, the recent rally has breathed life into the sector. To be clear, the rally has been sharp and persistent. But those types of rallies can be hallmarks of a bear market rally. And, additionally, it’s fair to note that a bottom can take time to form. One indicator to watch in the commodities space is the Aussie Dollar strength (AUD/USD).

The AUD/USD may be able to help us answer the question: Is the rally in commodities the start of something new or nothing more than a rally in a bear market?

Aussie Dollar strength often accompanies a commodities rally (or provides a tailwind for it). That’s why it’s one of my fave currencies to monitor when watching commodities.

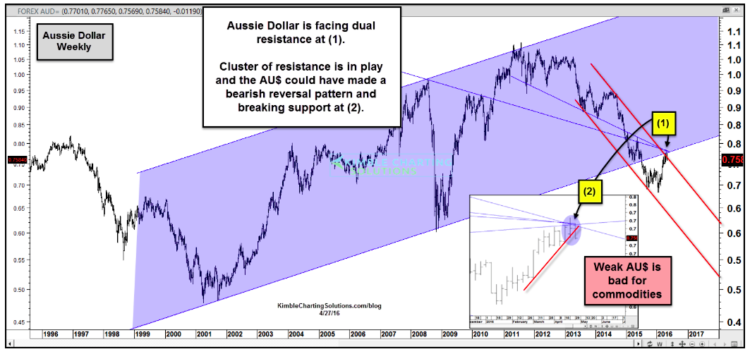

As you can see in the chart below, Aussie Dollar (AUD/USD) strength has accompanied the latest rally in commodities. But it is facing a stiff test right now. As you can see, it is at dual resistance (point 1). A cluster of resistance is in play here and the AUD/USD may have made a reversal pattern, poking up through resistance and reversing below it – watch for a break of that support at point 2.

What the Aussie Dollar does from here could well go a LONG way to determining if commodities like Crude Oil and Gold are topping out or ready to breakout.

Thanks for reading and have a great week.

More from Chris: Are Health Care Stocks Ready To Lead Again?

Twitter: @KimbleCharting

The author does not have a position in related securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.