While in New York last week for a Yahoo Finance Contributor’s party, I dropped by the Wall Street Journal and shot a video with Paul Vigna for MoneyBeat. You can find the video at the bottom of this post, but one of the themes was August volatility and what to expect from this bull market.

While in New York last week for a Yahoo Finance Contributor’s party, I dropped by the Wall Street Journal and shot a video with Paul Vigna for MoneyBeat. You can find the video at the bottom of this post, but one of the themes was August volatility and what to expect from this bull market.

Here’s a summary of what we discussed:

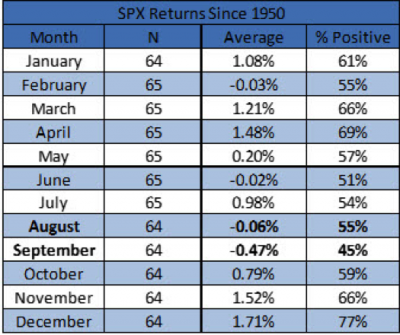

- Seasonality is a big worry here. August and September going back to 1950 are the only two months that average a negative return back-to-back.

- August volatility is pretty normal. But when August is down, it is really down. Since 1980, looking at the average negative returns for all months, August is the lowest.

- Touched on how this bull market is mature, but not nearly as old as some other bull markets we’ve seen. So don’t be bearish just because it seems like this rally has gone on for a while; it could still go on longer. I discuss this more here.

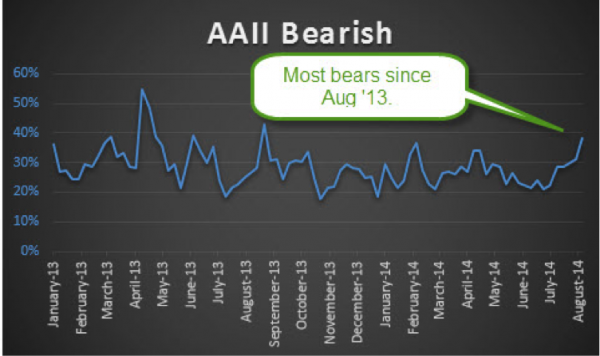

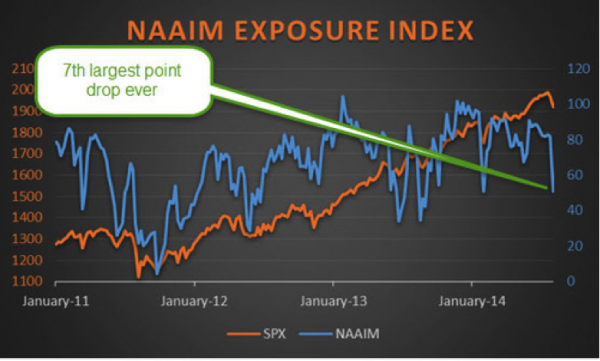

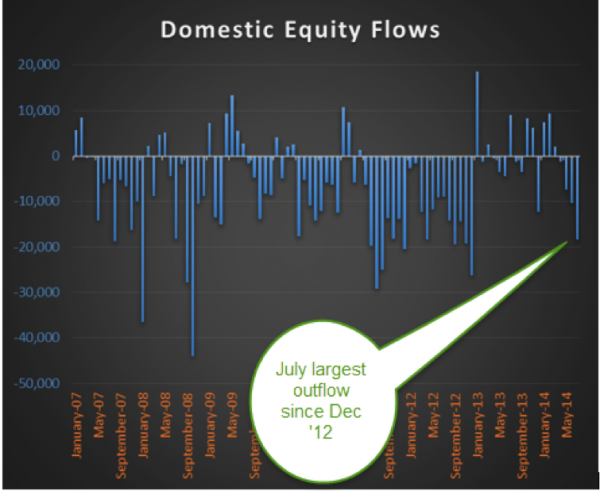

- Sentiment is still a big positive. On any little bit of weakness, everyone freaks out and thinks this is the big 10% correction. It’ll happen eventually, but as long as everyone gets super worried on any and all weakness, that should flush out the weak hands and let the bull continue. This occurred recently with the latest bout of August volatility. Here are some examples of investors’ bearish impulses.

- The AAII sentiment poll looks at average investors and that recently had the most bears in a year.

- The NAAIM exposure index looks at active money managers and they just freaked out as well.

- Lastly, mutual fund flows saw huge outflows from domestic equity mutual funds according to the ICI. Another sign of a panic?

Be sure to check out the whole video here. And yes, I am wearing makeup… they make you do that when live in the studio!

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.