The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- With 95% of S&P 500 companies having reported, Q1 2023 earnings season closes with a final growth rate of -2.2%, officially indicating an earnings recession

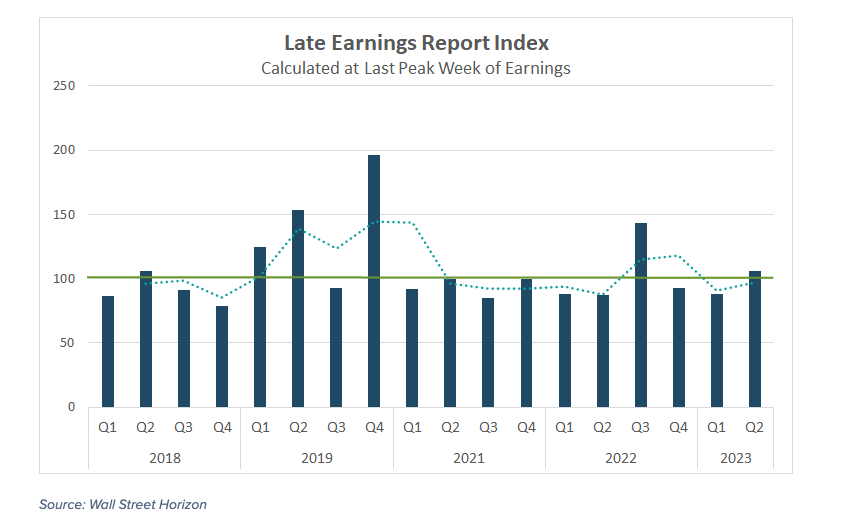

- The post-peak LERI shows corporate uncertainty rose to the highest level in 3 quarters

- Potential earnings surprise this week: New Relic (NEWR)

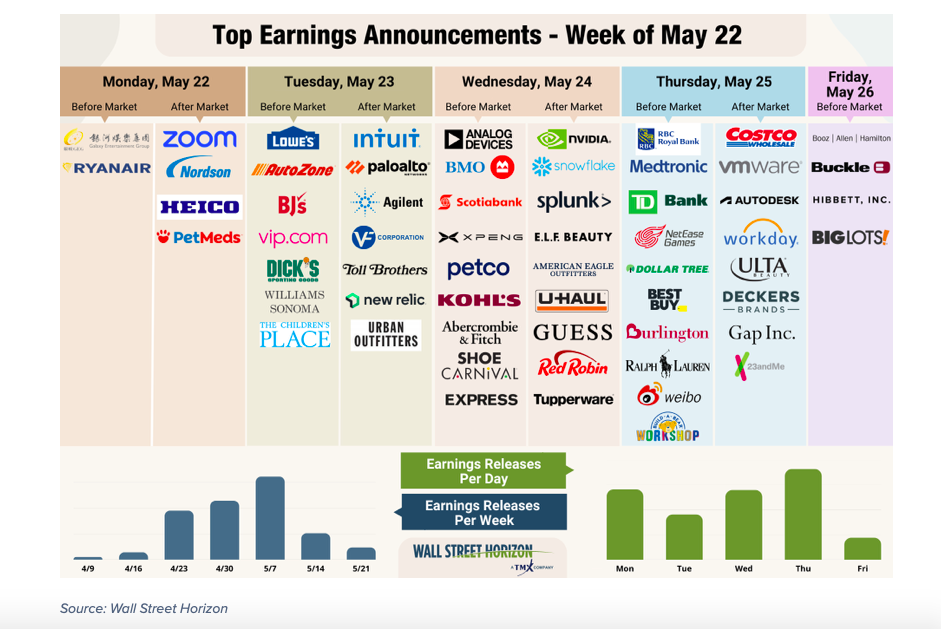

- Retailers and tech names take us out this week: LOW, NVDA, KSS, ULTA, PANW

- Earnings season winds down, 583 companies expected to report this week

In one of the last heavy weeks for Q1 2023 earnings season, retailers gave investors a better read on the state of the US consumer. Results were a mixed bag, with Walmart emerging as a clear winner last week and Home Depot as a laggard. With 95% of companies having reported at this point, the S&P 500 EPS growth rate for the season ends at -2.2%, officially marking an earnings recession as there have been two consecutive quarters of negative growth.¹

Even with all the action around retail stocks, it was clear investors were more interested in the debt ceiling debate. Stocks marched higher mid-week when the likelihood of resolve was echoed by both President Joe Biden and House Speaker Kevin McCarthy. The three major indexes all closed the week higher on that optimism.

LERI Shows CEO Uncertainty Is at Its Highest Level in 3 Quarters

The uncertainty index which suggested CEOs were feeling more comfortable with how their businesses were performing in the second half of 2022 and first quarter 2023 showed that confidence beginning to waver in Q2 as companies reported their Q1 results.

The Late Earnings Report Index (LERI) tracks outlier earnings date changes among publicly traded companies with market capitalizations of $250M and higher. The LERI has a baseline reading of 100, anything above that indicates companies are feeling uncertain about their current and short-term prospects. A LERI reading under 100 suggests companies feel they have a pretty good crystal ball for the near-term.

The first quarter earnings season (reported in Q2 2023) closed with a LERI of 106, suggesting that companies are more worried than they have been in three quarters. A reading of 106 is the highest since Q2 2022 (Q2 2022 reporting season) came in at 143. The two quarters in between saw below baseline readings of 93 for Q4 2022 and 88 for Q1 2023.

Similarly, The Conference Board released their Measure of CEO Confidence for Q2 on May 4 with much of the same findings. The second quarter reading ticked down 1 point to 42, a reading below 50 suggests “CEO’s remain largely pessimistic about what’s ahead in the economy.”²

Potential Earnings Surprise this Week? Or Just Acquisition News for New Relic?

New Relic, Inc (NEWR)

Company Confirmed Report Date: Tuesday, May 23, AMC

Projected Report Date (based on historical data): Thursday, May 11

DateBreaks Factor: -3*

For the past eight years, New Relic has reported their fiscal Q4 results between May 8 – 14, on a Tuesday or Thursday. This year they are bucking the trend by releasing results nearly two weeks later on May 23, their latest earnings report date in the 18 years we’ve tracked them. Typically we would point out that academic research shows that companies which delay earnings dates tend to report bad news on their calls, but given recent news on New Relic, this delay could be due to something else.

On Wednesday the Wall Street Journal revealed the enterprise tech company is in talks with private-equity firms Francisco Partners and TPG for a $5B+ acquisition.³ Oftentimes M&A activity causes companies to delay the timing of their earnings reports, as they look to gain more clarity on the potential deal before taking questions from analysts.

So far investors seem keen on the news with the stock closing up 11% on Wednesday.

Last Trickle of Meaningful Q1 2023 Earnings

This more or less concludes the first quarter earnings season with 89% of companies in our universe of ~10k having reported. This week 583 companies are anticipated to release results, 13 of those coming from the S&P 500. Attention will remain on the retail sector with reports expected from: V.F. Corporation (VFC), Lowe’s (LOW), Williams-Sonoma Inc. (WSM), Dick’s Sporting Goods (DKS), Kohl’s (KSS), Ulta (ULTA), Best Buy (BBY), and more. We’ll also get results from a handful of tech names including: Zoom Technologies (ZM), Palo Alto Networks (PANW), New Relic (NEWR), NVIDIA (NVDA), Snowflake (SNOW), Workday (WDAY), and Splunk (SPLK).

The Q2 earnings season will begin on Friday, July 14 with reports from JPMorgan (JPM), Citigroup (C) and Wells Fargo (WFC).

Sources:

¹ FactSet

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.