With stocks pushing higher and the world on edge politically, there’s a lot of news / noise out there.

So it’s always a good idea for investors to “ground” themselves in some macro themes and considerations that are present in the marketplace.

Here’s a look at 5 themes I’m watching across the world financial markets:

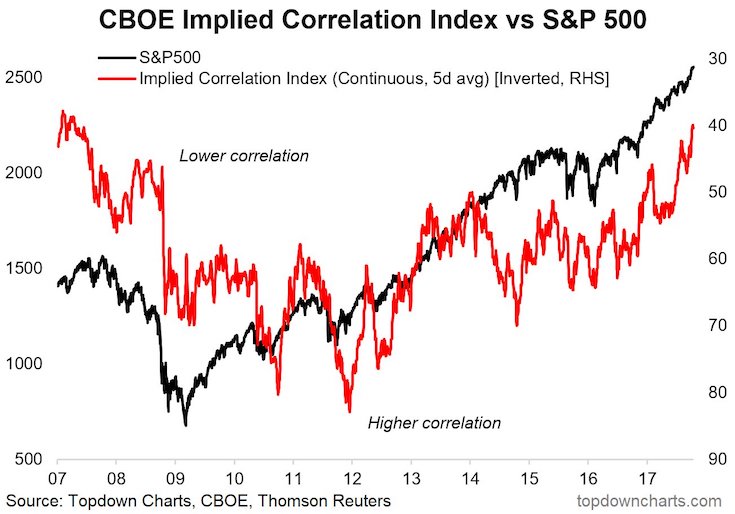

1. S&P 500 Correlations: The implied correlation index gives active investors insight into near-term market peaks and troughs. It’s currently giving off a caution signal – see the longer-term chart of correlations below.

2. S&P 500 Sectors: The increasing lopsidedness of sector representation in the S&P 500 highlights the potential risk and opportunity cost for market cap driven investors (i.e. passive/index).

3. China 2018: While Xi Jinping is talking long-term picture (20-30 years out), there are a few tailwinds and headwinds for China’s economy heading into 2018-2019. I recently shared some key charts and indicators to watch on Twitter and in our newsletter.

4. China next 6 months: Notwithstanding the previous topic, the current cyclical picture for China is good and there remains short-medium-term upside risk to inflation by our charts.

5. China FX view: Despite some capitulation and complacency Renminbi devaluation risk remains relevant.

You can get a more in-depth look at these themes by subscribing to my “Macro Themes” newsletter. Have a great week.

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.