The 2020 rally in the stock market accelerated last week with the S&P 500, Dow Jones Industrials and NASDAQ gaining nearly 2.00%.

The strong gains were triggered by trade optimism, strong earnings announcements from major banks and favorable economic data.

Let’s review some key stock market themes and news, while answering some important questions.

How much of the strong gains in stocks this year is due to the “January Effect?”

The January Effect is the seasonal tendency for stocks to rise in January due mainly to inflows to stocks as a result of funds from tax selling in December or corporate bonuses paid in January.

Stocks do not always rise in January, but they have risen 66% of the time since 1928. January 2019 saw the S&P 500 Index rise 7.9% and year to date the S&P 500 Index is up 3.1%.

January’s rise this year is likely caused by investor optimism due to good economic numbers (strong retail sales and home construction rose to fastest pace since 2006), a strong start to earnings season, de-escalation of Middle East tensions and positive news on trade.

Last week two historic trade deals were signed in Washington, D.C. Will the deals be enough to bring back business confidence and capital spending?

While consumer spending (70% of GDP) has been the backdrop for the rise in the stock market, business confidence (30% GDP) has lagged due mainly to trade uncertainty. Phase One of the U.S. China Trade deal commits China to a huge increase in U.S. imports, addresses intellectual property theft and forced technology transfers, and gives the U.S. strong enforcement mechanisms. In return, the U.S. will reduce some of the tariffs on Chinese goods.

On an even more important note, the United States Mexico Canada Trade Agreement (USMCA) was passed by the Senate and involves twice the volume of trade as the China deal and five times the amount of exports. According to trade executives in the White House, this will make the U.S. and North America the manufacturing hub of the world, particularly the auto industry.

The recent trade deals will likely be a major boost to the economy and the markets. However, the most recent Institute of Supply Management (ISM) survey showed expectation for capital spending is negative. We will have to wait and see if the Chinese government will hold up their end of the deal and what is next for a Phase Two Agreement. CEOs will likely feel more confident but the trade deals may not be enough to bring spending back.

The impeachment trial in the Senate is set to begin on Tuesday. What effect will impeachment have on the market?

Zero. No one in either political party believes the President will be removed from office. Since the Articles of Impeachment were approved on 12/18/19, the Dow Jones Average is up 3.03%; the NASDAQ is up 6.45% and the S&P 500 is up 4.34%.

What is the biggest risk to the stock market?

The risk is that equities have moved too far above the fundamentals. Although financial conditions remain supportive, the larger risks include weaker-than-expected earnings and geopolitical and trade uncertainty.

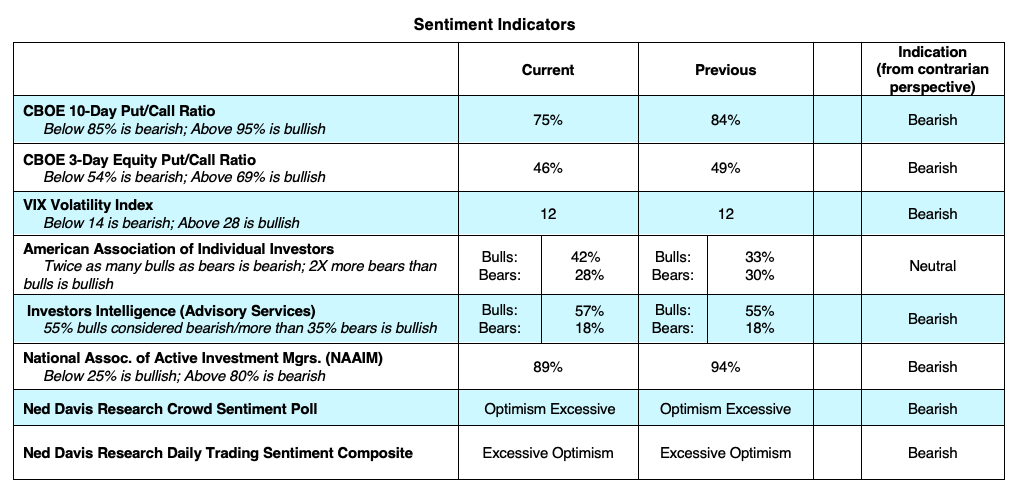

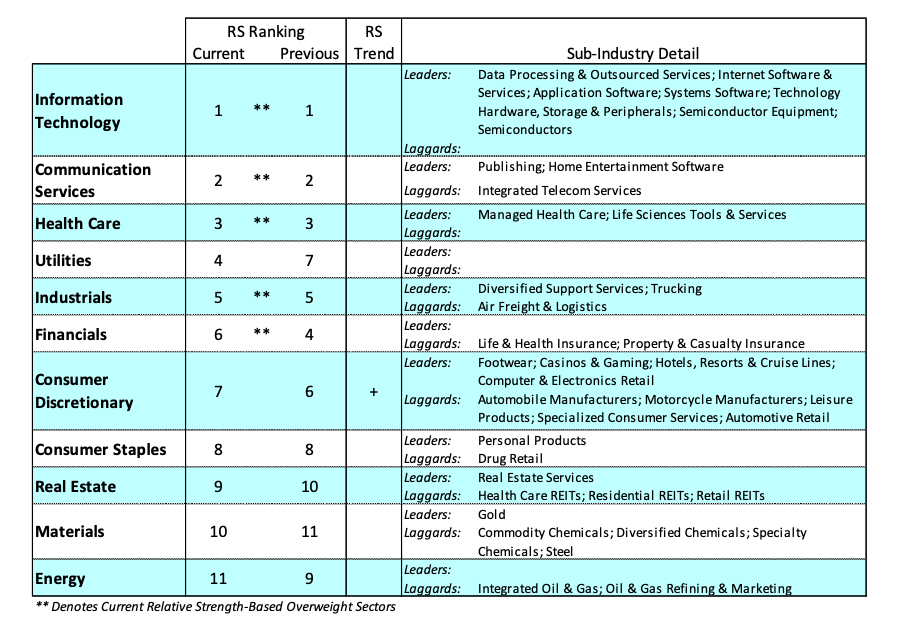

At this juncture, new highs by the S&P 500 have been supported by strong underlying breadth with 87% of S&P stocks trading above their 200-day moving average, the highest level in more than four years. However, stocks haven’t experienced a 1% down day since October and investor sentiment indicators now show the most optimism since the peak in the averages in January 2018 (Ned Davis). The demand for put options is at the lowest level in two years (put options are purchased in anticipation of a market decline).

It is within reason to expect a short-term pullback. Should we experience a correction, it would likely be limited in duration and not the end of the bull market. The factors that produced one of the best outcomes for investors in 2019 remain in place – low interest rates and a resilient consumer.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.