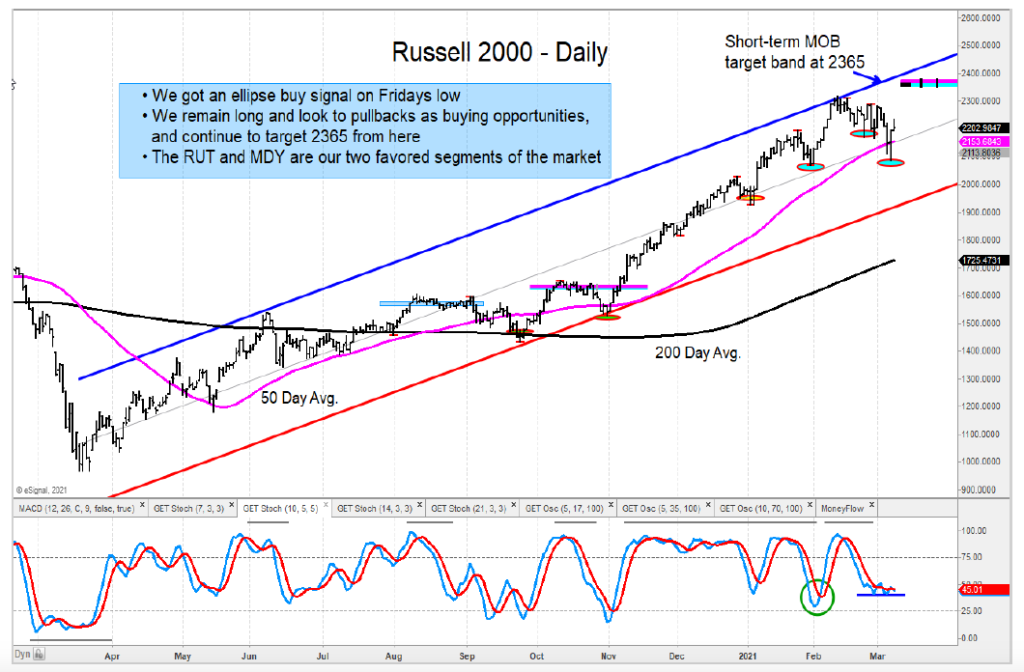

The recent pullback in equities has provided a buying opportunity in the S&P 500 Index, Russell 2000 Index, MidCap 400 Index, and select airlines stocks.

Other areas, not so much. But we will take a closer look and discuss industries and sectors we are bullish and bearish on.

The Nasdaq Composite weakness brought the index below its regression trend channel and at an important make or break (MOB) support band. If the index cannot reverse from this zone, there is risk of another leg lower.

Our relative chart of the Russell 1000 Value to Growth had a strong move higher in one week and is about 2.5% away from our initial target. A weekly close above that zone will lead to the next leg up higher from here.

The Semiconductors Sector ETF (SMH) has declined into a MOB target band that bulls need it to hold and turn up from. A close below this price support will be negative.

I continue to like the airline group, and we have the Airlines Sector (XAL) pushing above our MFU-3 price target area.

The S&P Oild & Gas Exploration & Production ETF (XOP) is getting close to my target of $93.50. I will be looking for either a pause or for the targets to morph into larger money flow units. Stay tuned on that.

I continue to favor industrials as well. The recent momentum move higher has started the next leg up in the ETF, XLI. I see another 9.3% upside to our MFU-4 price target of $103.

The author or his firm may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.