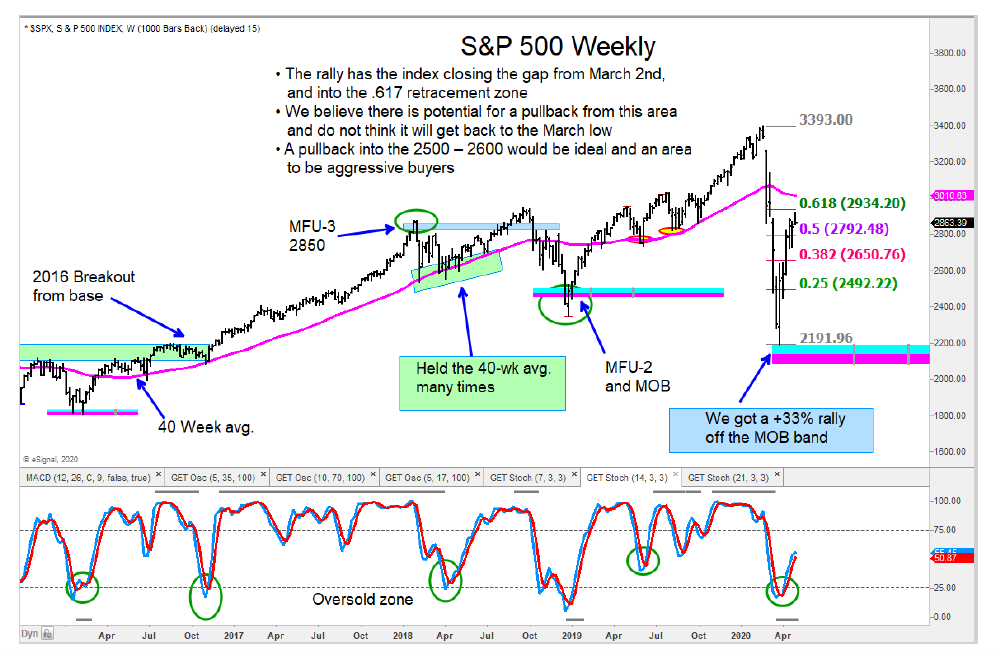

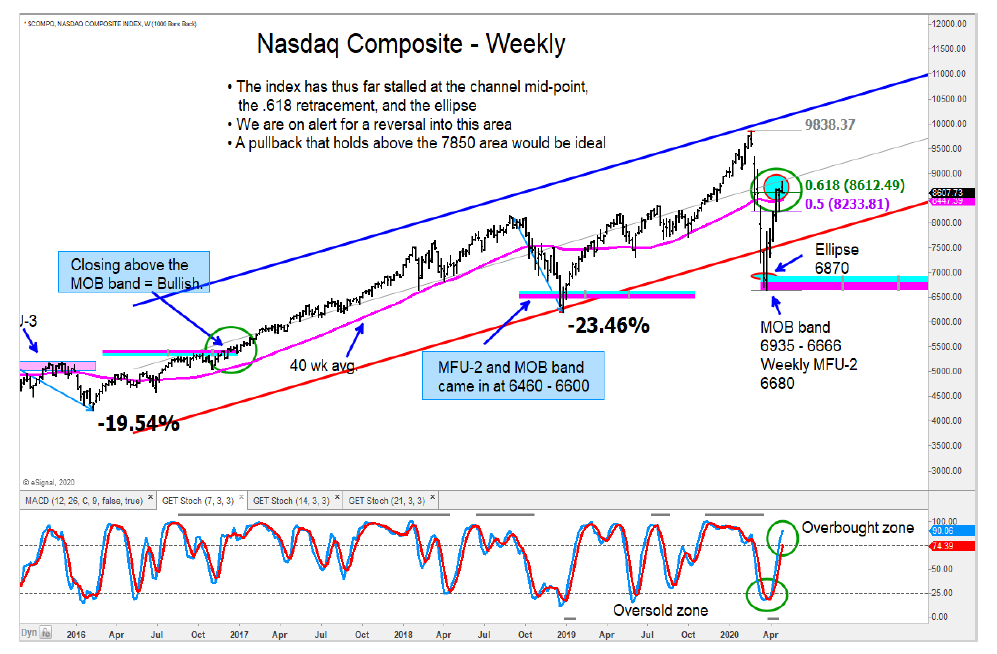

I have reviewed many of the key U.S. stock market indices, and many are hitting their ellipse turning point indicators.

And several are forming a bearish wedge pattern.

Will the stock market get a pullback from all this or just another pause that refreshes.

I don’t know, but I prefer to be a buyer of a pullback than to chase in here.

The ellipse turning point indicators highlight zones to look for resistance. The last time the ellipse caught the high, we had about a –5% pullback.

There are a few things to consider.

Let’s review:

• Many of these indices have a rising wedge on a daily time frame along with momentum divergence.

• We don’t know the magnitude of a pullback, but we do want to add to longs when it does occur.

• What we don’t believe will happen is a pullback that will take out the March low.

• The momentum factor ETF (MTUM) has reversed sharply off the upper end of its regression trend channel, and we believe there is more to go.

The author may have position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.