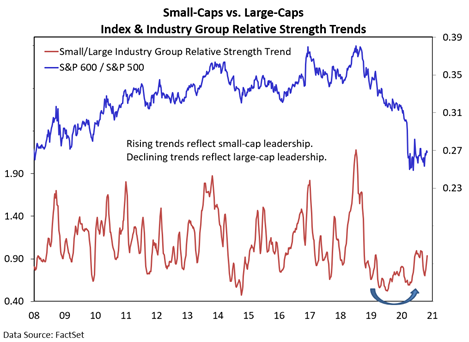

The S&P 400 mid-cap index is at its highest level since February. And even though it has lost some ground to the S&P 500 Index this week, the trend toward mid-cap (and away from large-cap) leadership remains intact.

Note that stock market indexes moving to new highs is usually a sign of strength not evidence of vulnerability.

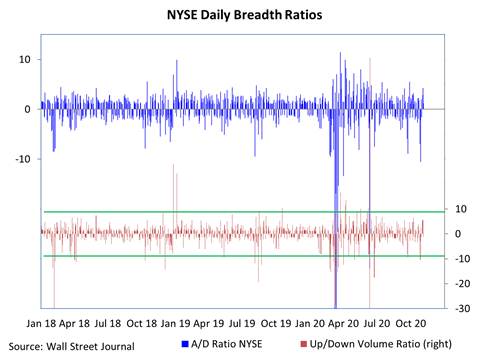

The argument for strength would be bolstered by improved rally participation (and further waning in optimism). After two days of more than 9:1 downside volume on the NYSE last week, this week’s rally has not produced a reading in excess of 6:1 to the upside (the NYSE is working on a 7:1 upside day as I write this). In fact, yesterday’s 2% gains on the S&P 500 was accompanied by more downside volume than upside volume. Sector level-trends have bounced back, but still fewer than half of the individual markets that make up the MSCI all-world index are trading above their 50-day averages.

The volatility of the past year can obscure trends that are emerging beneath the surface. The improvement in small-cap industry groups trends versus large-cap industry group trends has been ongoing for more than a year. If it persists, it would be further evidence of a sustainable shift away from large-cap leadership and could begin to be more fully reflected in relative strength at the index level. Mid-caps (and equal-weight large-cap indexes) are already hinting at this trend.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.