Civil unrest is not impacting the market right now, as much as one might think it should.

Someone said today that the market has no conscience.

Yet, the market is behavioral.

Currently, the market sees the riots as a one-off event, unlikely to persist for any length of time.

However, if we look at the last time in the US history we had similar unrest, we must look at the 1960’s.

The 60’s were laced with protests against the Vietnam War, racism, women’s rights and marijuana use.

The Chicago Seven, a group of political activists, were arrested for their antiwar activities in August 1968.

The Black Panthers, a political organization founded in 1966 by Huey Newton and Bobby Seale, challenged police brutality against the African American community. Hoover, at the time, declared them the worst threat to society.

Martin Luther King was assassinated in 1968.

More protests and riots ensued.

Afterwards, an expansion of the landmark Civil Rights Act of 1964, the Civil Rights Act of 1968, was passed to prohibit discrimination concerning the sale, rental, or financing of housing based on race, religion, national origin, and sex.

Furthermore, the legality of marijuana drug use entered politics.

Pres. Richard Nixon replaced President Johnson in 1968.

The Tax Act’s mode of federal cannabis prohibition became illegal in 1969 with the case Leary v. United States, which found that purchasing a marijuana tax stamp amounted to self-incrimination.

Nixon saw pot prohibition as a way to destroy the antiwar left, and target minorities.

Although The Shafer Commission found in 1972 that cannabis was as safe as alcohol, Nixon squelched that report.

We also saw Women’s rights and ERA bring another avenue of protests.

But many would say that the apex of the era came in 1970 when 13 unarmed Kent state students were shot by the National Guard, resulting in the deaths of four white students.

How do the 1960’s compare to today?

As far as social unrest, we began with protests to end social distancing due to COVID-19.

The recent peaceful protests and violent riots were sparked by the murder of George Floyd.

If this is only the beginning, as many fear, then social unrest can easily expand into protests over the substantial financial inequality on every level from salaries, to education, to healthcare.

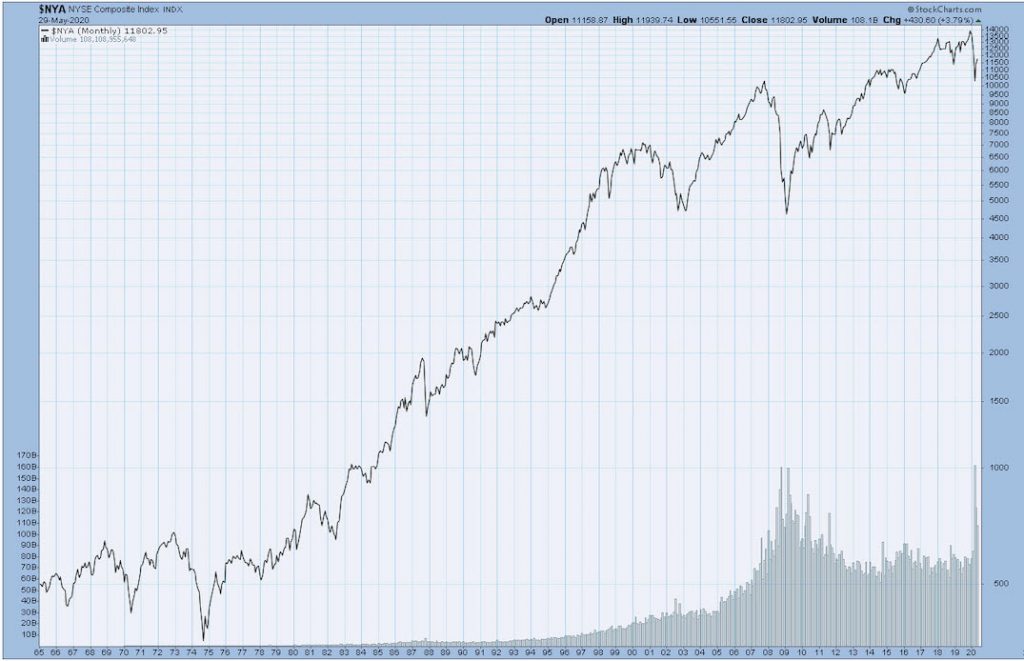

Looking at the charts, the market peaked in 1968.

The composite fell nearly 60% by 1970.

In 1972, right before the Yom Kippur War sent oil prices flying, the market ran to another peak, overtaking the 1968 price peak.

Then, as the OPEC oil embargo, more Vietnam War protests and Watergate took hold, the market fell hard, or by nearly 90% in 1974.

The late 1970’s to early 1980’s saw stagflation.

Finally, after one more run, followed by another drop in 1982, the market began to recover in 1983.

How is today different?

Thus far, the market is not feeling threatened.

We are in a presidential election year.

And on top of the social unrest, we have the chance of a second wave of the pandemic.

What we did not have back then was zero interest rates and unlimited stimulus promised by the Central Banks.

So, who is pulling the market strings?

The bankers rule.

But one must wonder, at what point does the puppet cut the strings from the puppeteer and take on a more sardonic appearance?

Check out my short commentary on the market in Trader Rundown Biz First AM TV-with Angela Miles.

Key ETF price levels to watch:

S&P 500 (SPY) 300 support 313 resistance

Russell 2000 (IWM) 140 is pivotal. 147.25 big resistance

Dow (DIA) 263 resistance with 255 support

Nasdaq (QQQ) Looks like all-time highs are in the cards (237.47)

KRE (Regional Banks) 40 pivotal 35 key support

SMH (Semiconductors) 137.50 support-still has gap to 144.96

IYT (Transportation) 156 support 163 next resistance

IBB (Biotechnology) Until it takes out 136 noise

XRT (Retail) 43.50 resistance. 60.70 support

Junk Bonds (JNK) 100 support 105 resistance

LQD (iShs iBoxx High yield Bonds) 132 pivotal

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.